DERIVATIVE Market: Multi-Trillion Dollar Global Casino

Derivatives Market Species Origins – Abuse, Props and Risks

By Jim Wille

The topic of financial derivatives is a huge can of worms. The subject has arisen in the financial press much more in the last few years since the global financial crisis turned critical and became a clear case of grand struggle to prevent a veritable collapse. In a loose sense, the derivatives are the scotch tape, bailing wire, band-aids, and chewing gum holding the system together, the glue and adhesive, with rose colored glasses used with a large amount of deception. Another analogy preferred for usage by the Jackass is the floating fabricated foundation laden with vaporous illicit toxic fabric, the phony platform on which insolvent structures lie. That the big banks do not serve well as credit engines or investment crucibles is no surprise. They are insolvent, and their derivative foundation is fractured. It is very difficult to explain how the derivatives serve as foundation. Imagine a spinning wheel, spinning very fast, except that the flat disk has almost zero mass. It spins so fast that it appears to serve as a platform which can support weight. Its floor is mentioned more than seen. It is fake, an illusion.

ORIGIN OF DERIVATIVE SPECIES

The origins of derivatives really came onto the scene in the early 1990 decade following the Black Monday 1987 crash. Most people believe the nation overcame the crisis. It did not. Actually the weight shifted, so that the Asian Meltdown occurred ten years later in a grand echo. The firm Jackass belief was that after a decade of adjustment to significantly higher crude oil prices (following 1973 Arab Oil Embargo) and a massive slice of US manufacturing having been outsourced to the Pacific Rim and to Japan, the — USEconomy suffered a severe air pocket of insolvency. It lost its income and endured higher costs. Economists overlook the challenges with jutted chests like peacocks. The 1987 stock slam that occurred was a wake-up call. The response was the creation of a derivative banking foundation of vaporous substance. It was a shoddy attempt to compensate for the gross insolvency of the US Banking system. It operates like a constantly moving Round Robin of self-dealing fraud designed to maintain the value of the foundation itself. The US lost industry, lost income, relied upon debt security trading, lost solid foundation, and set itself up for grotesque dependence upon asset bubbles for income and wealth generation, instead of from industry and tangible work. The US created a Ponzi Economy that is fracturing finally, here and now.

TYPES OF DERIVATIVE DEVICES

Main types of derivatives litter the contrived banking landscape, all highly risky. Credit Default Swaps are insurance contracts to protect against default of corporate bonds. The most popularly traded are the CDSwaps from bank bonds, linked to the big financial firms. They tend to be traded hundreds of times over, a true absurdity. Imagine 20 neighbors have fire insurance on your home, and then some go out and borrow money on the fire insurance policy to manage their household. Chaos would come if and when a fire actually destroyed the house. Well, chaos did come to the House of Lehman, mentioned later. The Interest Rate Swap contracts are short-term versus long-term trades, then leveraged further within the contracts that link the bonds on inner workings. They are clever devices used to create massive artificial USTreasury Bond demand. The architects can even create a vacuum in which the big US and London banks must go out and secure more bonds, and to purchase them unwillingly. Evidence of such atrocity is the infamous Failures to Deliver of USTreasurys, the backwash which the Wall Street conmen prefer never to explain. They are evidence of too much reliance upon the IRSwap to create phony bond demand.

The 2011 USTreasury Bond rally was all artificially contrived, from a cool $8.5 trillion in Int Rate Swaps put on by Morgan Stanley over several months late in 2010. The financial news chose to ignore the phenomenon, and instead focus on a bond rally. They wish never to look at data from the Office of Comptroller to Currency. The intrepid Rob Kirby and the Jackass do. There was no rally in reality. In fact, there was no US loose wealth lying around from which to purchase bonds. At the same time as the hefty dose of IRSwaps dispensed by Morgan Stanley, the USFed made available between $5-10 trillion in Dollar Swaps to rescue an insolvent European banking. Their banks were in dire straits in 2011 in the aftermath of the PIIGS sovereign debt implosion. They should have collapsed, just like the Wall Street banks.

The US financial system desperately required the ZIRP to remain in place. Notice 0% is stuck, which enables long-term bonds to be bought with free short-term cash via the swap. The Int Rate Swap is used to push the demand into long-term bond instruments, and poof, a rally. The practice is very risky since it constitutes self-dealing fraud, much like structural Flash Algorithm Trading operating on a vast vapor platform. The risk is to blow away the vaporous platform and its illusory mass. The JPMorgan Chief Investment Office and USDept Treasury use the powerful Exchange Stabilization Fund to do much hidden dirty work. The ESFund is dangerous to discuss, since it controls almost every world market. Foreign nations do not wish to learn of the control of their markets from a Wall Street control room. Best to describe in rough cuts. The entire USTreasury Bond complex of 0% short-term and 3% long-term is carefully managed by derivatives. Despite the nearly complete absence of foreign USTBond buyers, and the huge uncontrollable USGovt debt to finance, the sovereign bond from the financially crippled United States remains in safe calm controlled secure ground. How so? By Interest Rate Swap contracts and fabricated demand.

The other leveraged asset backed securities use leverage squared. See the incredibly crazy Collateralized Debt Obligations whose wreckage still has not been entirely cleaned up. The mortgage bonds have a higher structure with another 25:1 or 30:1 leverage put on the already leveraged mortgage bonds. With just a 7% to 13% decline in the basis of the CDO bond, the entire bond goes worthless, and did go worthless. Much of QE bond monetization is done to offer effective cloud cover to redeem a massive amount of financial derivatives. The chairman talks about $40 billion per month, but never is coverage of derivatives mentioned. Thus the estimation of $100 to $150 billion in QE volume per month. The Jackass lives in the world of reality, not in the US propaganda shadow or fecal downwind draft.

The entire — USEconomy remains totally dependent upon ZIRP and QE, thus better described as a Ponzi Scheme economy. Draghi at the Euro Central Bank devised phony super senior bonds as patches, declared illegal by the German high court. The Long-Term Refinance Operation (LTRO) attempted to create a super senior bond that lorded over the sovereign bond. In this way, a banking collapse would allow the elite owning the LTRO bonds to be paid first, not lose any money, and impose the losses on the unwashed masses for the standard fare sovereign bonds that attract all the attention. More derivative hanky panky mumbo jumbo, pure shenanigans.

DECEPTIVE LEGAL UNDERPINNING

The 2005 Bankruptcy Reform Law was a douzey, rarely ever explained for its details or consequences. The private citizen side is often discussed. If John Doe declared bankruptcy, he could no longer exercise a Chapter 7 BK. No more was permitted the lineup of all assets, placed against all debts, with a cleansing operation and single sweep. Ch-7 used to allow for the debtor to walk away with no more debts, the creditors dealt with fairly, using whatever assets existed. Imagine the debts being 5 times larger than the assets, which would mean the creditors would receive 20 cents per dollar in debt held. Clean, nice, done! It was eliminated, in favor of Chapter 13 BK. It instead stipulated a restructure of debts, often with reductions on amounts owed, along with a revised timetable for repayment, seemingly forever in many cases. Imagine a rework of a car loan or home mortgage, when more time is given, interest rate possibly reduced, with end result being more years to pay off but more manageable. The social impact was to eliminate fresh starts, and to make systemic the debt dependence, kind of a debt slavery with legion of debt vassals working in servitude. Also, a key element to the Reformed BK Law was that income taxes were never reduced or forgiven. In many cases, the repayment would take 20 to 30 years, a clear cut display of tax slavery.

The far more onerous and deceptive side of the Reformed BK Law is seen in provisions for the financial institutions. The failure of big banks or other large financial institutions would never again be a simple failure, with liquidation, with trustee management, with a hierarchy of losers. The entire hierarchy was quietly altered, but with almost zero publicity. It took many alert analysts a few years to discover the fine points of the revised law. The new law dictated the derivatives would be first in seniority for satisfaction during any bankruptcy proceeding. The truly sadistic element of the new law was the accounting classifications, whereby depositors are called “unsecured lenders” to the bank, while derivative owners are called “secured lenders” to the bank. Hence, the depositors like with CD or passbook savings accounts no longer own their accounts. They technically lend their deposits to the bank and are permitted to withdraw them with interest, provided the bank is sound. The depositors found themselves to be last in line during a failure, the disadvantaged class from the Reformed BK Law. Individuals stand behind the derivative owners. The US public had no idea what happened on the financial firm pecking order, and still largely does not. If a big bank fails, or a major mortgage firm fails, then the derivatives are handled first, and then depositors are given crumbs left on the floor. Most analysts believe the depositors will be wiped out, as the derivatives will find some salvage. It is accurate to say that the Bankruptcy Reform Act ushered in the Bail-in concept long before Cyprus hit the scene in 2013.

LEHMAN FAILURE KILLJOB & SHAM

Derivatives played a key role in the Lehman investment bank failure. In reality, it was more a planned financial murder event, orchestrated by JPMorgan and Goldman Sachs. Much has been written about the carefully crafted event of denying Lehman Brothers their due payouts from certain investment instruments, in order to force them into a dangerously poor liquidity position. The vultures JPM & GSax exploited the situation to the max. The true background was that Goldman Sachs was vulnerable to failure, as a result of its heavily leveraged position in mortgage bonds, even CDO bonds (leverage squared). The biggest victim to the Subprime Mortgage Crisis was Goldman Sachs, the venerable firm of superstars who only knew near perfection. Their strong performance is maintained through graft, collusion, insider trading, and government control. So the Wall Street kings killed Lehman in order to pick its bones and to feed Goldman Sax, in plain terms. It bears repeating. The most at risk firm on mortgage bonds during the Lehman collapse chapter was GSax (not Lehman) since more leveraged. In the aftermath, the USGovt chose to nationalize AIG for a few reasons. Among them were the desire to cover up how duplicate Credit Default Swap contracts were owned against the failed firms, even the preferential treatment. The financial derivative impact crater was large, to be kept quiet with AIG movement under the USGovt aegis. Recall several owners of fire insurance against your house, where payouts are complicated.

The Lehman CDSwap contracts had to be managed in payouts. GSax then received 100 cents per dollar on their Credit Default Swaps, incredibly, first in line, since they managed the desk. It can be said that AIG was nationalized, in order to control the derivative implosion, and to redeem GSax fully in secrecy, without AIG executives offering obstacles. Other payouts occurred at 30 cents or 60 cents per dollar insured. The Lehman event was a derivative implosion event very well disguised. When it was killed, it caused a derivative crisis and the immediate need to alter the rules, conjure up new rules, and to favor the JPM/GS tagteam of white collar crime. The derivative implosion forced the USFed into ZIRP Forever and QE to Infinity, in order to continually manage the wrecked derivative landscape. The USFed monetary policy of ZIRP/QE is stuck permanently, which continually has created a backdoor bailout to Wall Street bank portfolios, since they must manage the long-term USTreasury Bond breakdown. The USTreasury complex required free money from which to create steady ongoing never ending bond demand. The derivative foundation evaporated. The end result was the US financial system stuck with hyper monetary inflation to finance debt and to sustain the vaporous derivative foundation, that spinning whirling dirvish that still gives the impression of mass for a foundation.

LONDON WHALE DAMAGE & LIES

From the Lehman failure in late 2008, to the Zero Interest Rate Policy installed in 2009, to the Quantitative Easing put in place in 2011, it only took another year for the big accident to occur. The crash site was the so-called London Whale incident. It was well covered up, as per usual with Wall Street. It was another derivative disaster story. At first, JPMorgan spokesmen told a fantasy fairy tale about losses due to European sovereign bonds for the previous quarter. Divert the blame to Europe, keeping attention off the United States. Upon easy quick examination, one could see (reported in Hat Trick Letter at the time) that the PIGS sovereign bonds all improved in value during the cited quarter. The only damage done was to the USTreasury Bonds, which lost ground in a sudden bout of volatility. It is well known to experts that volatility in either direction is the bane, the key enemy, of all such derivatives like the powerful Interest Rate Swap. The JPMorgan told lie was that the London Whale, with its Chief Investment Office and London outpost, has lost $800 million. They soon changed the amount of stated loss to $1.9 billion, when in reality it is in the neighborhood of $100 billion. As of now, JPM admits its loss from the London Whale incident has amounted to $8.9 billion.

The entire story is full of lies, an absolutely fabrication of lies. In fact, Bruno Iksel has been made into something of a scapegoat. The JPM bank executives have tried consistently to put distance from themselves to Iksel himself. They gave him all the marching orders, in a closely coordinated operation, with some leeway to be sure. The Whale was managing a boatload of Interest Rate Swaps. He and JPM played serious accounting games, like not marking to market, like pushing through a late day trade to alter the final price. The truth has never come out. The full extent of losses cannot be revealed without admitting that the entire USTreasury Bond complex being from an artificially defended fortress, bound by the corrosive derivative anchors. The false story is kept alive by means of the many London banker murders, of mid-level officers who carried out the dirty details. The other JPMorgan large holes of bankruptcy are kept quiet by Swiss insurance murders.

SYSTEMIC RISK FROM CONTAGION

Apart from numerous background pressures, the system limps along deeply wounded and probably fatally so. When China wanted to exit the long-term USTreasurys, the USFed accommodated them. They launched Operation Twist without much clear explanation of its provisions. We are always led to trust the magic of their machinations. China actually transferred their long-term bond holdings to short-term holdings, in order to make possible their redemption at maturity, and soon, like before the implosion. The USFed accomplished the task by putting on an enormous swath of cleverly devised Int Rate Swaps, which in effect switched from LT bond to ST bond. There are a great many other types of derivatives, such as exotic swaps, and customized contracts.

The entire Euro Monetary Union has its foundation created upon swapped hidden debt into FOREX currencies, an illicit deed that to this day has not been resolved. The Maastricht Treaty was circumvented by means of heavy swap contracts, shifting debt onto currency obligations in the form of these derivative swaps. Many were the big investment banks eager to assist in the deception and illicit qualification process, and thus earn big fees. The nations of Italy and Spain, for instance, were able to qualify for the European Monetary Union by hiding their debt with the FOREX swaps. Prosecutions are laced all through the Deutsche Bank chambers here and now, the legal wheels of justice grinding slowly. Therefore, the Euro Currency has a phony fraudulent foundation, an illicit basis enabled by derivative abuse. The victim of the ongoing prosecution, if the USGovt chooses to impose yet more heavy fines, could be the German alliance. The Germans are ready to jump ship, away from the sinking USS Dollar.

Perhaps the ugliest derivative story is the IRS Tax secure stream contract very likely used by China as collateral, which is suspected by the Jackass to be the backend deal to secure a Gold Lease from China. It is related to the 1999 Most Favored Nation granted by US to China. The Chinese would receive gigantic direct foreign investment, and thus build an industrial base. The Wall Street criminal bankers would receive a vast hoard of gold bullion, leased from the Chinese Mao Era gold reserves. The Chinese distrusted the US bankers, after many past experiences, which might include several rafts of fake gold bars sent to Hong Kong banks by the Clinton-Rubin Admin. In the outcome, the Wall Street masters reneged on the gold lease, while the — USEconomy entered a downward spiral of recession which accelerates downward. The Jackass suspects that the powerful recession made impossible the honoring of the IRS secure stream derivative contract held as collateral, forcing a national default. In the last few months, we see China busy securing US commercial property. The Chinese have taken control of the JPMorgan Chase headquarters in South Manhattan, the famed One Chase Plaza. In it is contained the largest private gold vault facility in the world. It has underground tunnels connected to the US Federal Reserve. Many are the rumors and suspicions that with the end of the Federal Reserve Act operational contract, following 100 years of hidden financial tyranny, that the Chinese might have taken over a strong interest in the Fed, maybe a controlling interest.

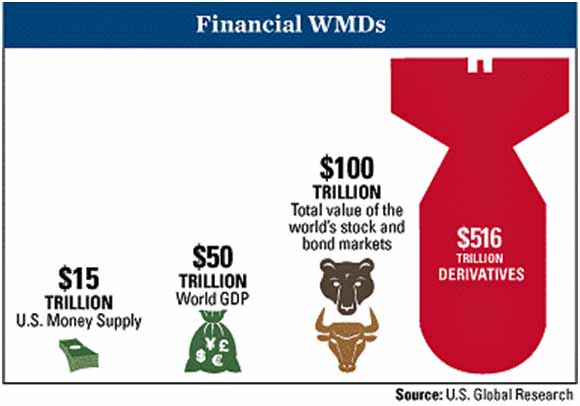

GOLD ON WHITE HORSE

The Western financial system is operating on fragile tenterhooks, on shaky pylons, on that same vaporous floating spinning illusory foundation. A few big banks have entered failure, like Banco Espirito Santo in Portugal. When big banks begin to fail, the belief has been, the risk of contagion will be the main focus. Since Lehman, the major Western banks have lashed themselves together for safety and security. They have done so with financial derivatives, the rope to connect them together. Thus no repeat of Lehman failure, a big financial firm failure to put the entire system at risk of breakdown. So the next failures will put the entire system at risk of collapse. This is the oft-described nuclear outcome, which has been brought upon by the overusage of derivatives. Their total in usage is somewhere between $700 trillion and $1.4 quadrillion, depending on the definition and the team doing the calculation. Claims of big reductions in derivative overall usage are a lie, since new derivatives are put on quickly. They offer short-term security but long-term systemic risk. The world faces a guaranteed systemic implosion caused by derivatives. Bank failures and contagion will lead to the widespread connected failures, and lost control by both governments and central banks to manage them. Gold will be the secure port during the stormy outcomes.

The derivative cost will be revealed as obscene, in high multiple $trillion suddenly. The public will ask questions like how we could have permitted the situation to go out of control. To be sure, derivatives assure the equivalent of a financial nuclear explosion. The answer to the question posed is that the Rubin Doctrine has been used after the Rubin thefts of the USGovt gold reserves at Fort Knox. The doctrine dictates the sacrifice of tomorrow for a few more todays. Well, tomorrow has arrived. The return to the Gold Standard is the answer, but the clean-up crews will be busy for a long time. The Gold Price will reach incredibly high levels when the derivative implosion occurs, which should occur when the East introduces a legitimate gold-backed new BRICS currency for trade settlement. The fallout will be tremendous, as the USDollar is rejected on the global stage.

A solution must also come for the ancillary devious devices like secret weapons on weather, virus, espionage, and more. Gold will continue to draw capital away from the dying corrupted sinking system. Then finally the Gold Standard will be installed, but by the Eastern nations. It will be led by Russia, China, and Germany. The United States will be indescribably isolated. The US Fascist leaders have attempted to isolate Iran, but Tehran will be integrated into the Eurasian Trade Zone. The US Fascist leaders have attempted to isolate Russia, but Moscow will be integrated into the Eurasian Trade Zone. The US Fascist leaders have attempted to coerce Europe to join a deadend insane war with an absurd basis, but the core powers of the NATO will move away and be integrated into the Eurasian Trade Zone. The United States is a hair away from losing both Germany and France to the Eastern Alliance. They will embrace gold, and walk away from the USDollar, with a certain absorbed cost. Great changes are coming like a fierce new storm.