Why did the California’s arsonists go after PG&E infrastructure? Cui bono?

PG&E Reportedly Planning Bankruptcy Announcement To Workers As Soon As Monday

ZeroHedge.com

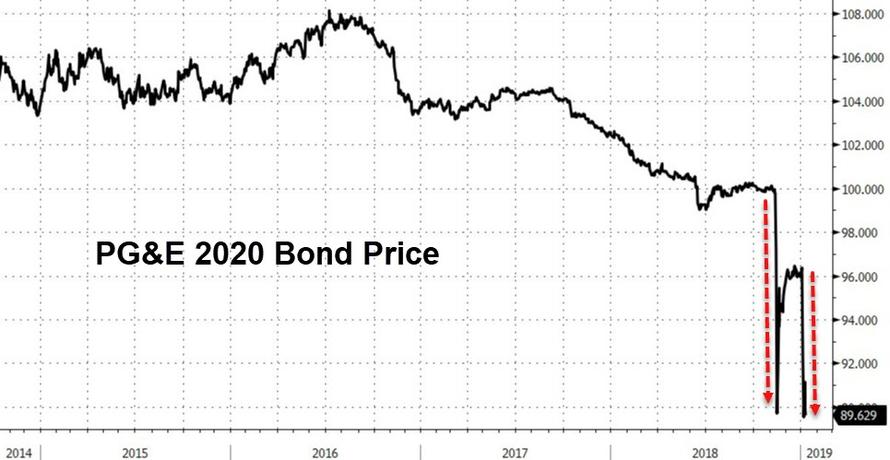

18 years after becoming one of America’s largest bankruptcies, the writing is on the wall for California’s utility giant after its cash-collateral-call triggering second downgrade to junk has led to reports that PG&E may notify employees as soon as Monday that it’s preparing a potential bankruptcy filing, according to people familiar with the situation.

California passed legislation last year in the aftermath of the deadly Wine Country fires requiring utilities to post public notices for employees at least 15 days before a change of control, including a bankruptcy filing.

This potential bankruptcy announcement comes after PG&E’s AIG moment hit late on Thursday, when Moody’s did precisely what S&P did two days earlier, and cut the utility’s credit rating to junk citing the electric company’s potential wildfire liabilities.

“We see a much more challenging environment for PG&E,” Moody’s analyst Jeff Cassella said in a statement. “The company is increasingly reliant on extraordinary intervention by legislators and regulators, which may not occur soon enough or be of sufficient magnitude to address these adverse developments.”

As Bloomberg reports, a notice may signal that the company has accelerated plans to make a Chapter 11 filing as way of dealing with crippling liabilities from wildfires that tore through California in 2017 and 2018, killing over 100 people and destroying hundreds of thousands of acres.

And, as we detailed previously, with two junk ratings, PG&E will now be required to use cash as collateral to guarantee power contracts, according to the company’s latest quarterly filing, which estimates the utility will have to fully collateralize as much as $800 million of positions.

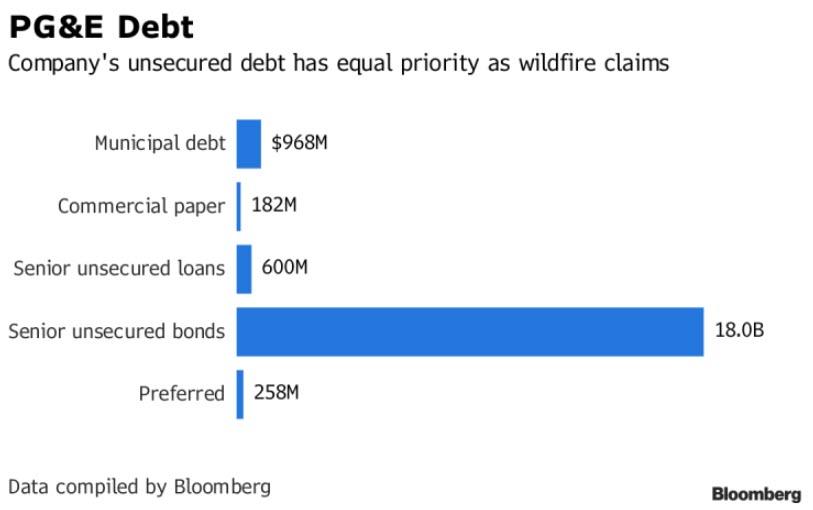

That… is a problem because PG&E had only $430 million of cash on its books in September, precipitating what now appears to be an imminent liquidity crisis, one which as a result of some $30 billion in wildfire legal liabilities will quickly escalate into a solvency inferno, to use a term closely associated with California utility companies.

PG&E declined to provide a statement, saying the company doesn’t comment on rumor or speculation.

During its 2001, bankruptcy, California governor Gray Davis used the state’s treasury to bail out the utility, provoking a controversy that eventually contributed to his ouster. PG&E emerged from bankruptcy in April 2004 after returning $10.2 billion to creditors.

Newly appointed California Governor Gavin Newsom said during a press conference Thursday that his office would be making an announcement related to PG&E within the next few days and that the issue was at the top of his agenda. He said in a later interview that the announcement would involve appointments to the California Public Utilities Commission, the state’s grid operator and to a commission established by legislature to explore wildfire issues.

Newsom’s office didn’t immediately respond to a request for comment on Saturday.

Citigroup Inc. called it a “a crisis of confidence.” Guggenheim Securities analysts likened the dilemma PG&E poses to investors and lawmakers as “a falling knife.”

As we pointed out previously, with relation to the last financial crisis, while Lehman was the spark, its was the bailout of AIG that really precipitated the most violent part of the 2008 crisis. While most analysts see PG&E as an isolated case, now that the biggest California utility is on the verge of bankruptcy, and is about to have its own AIG moment, one wonders just how “contained” this particular shock to the system will be.

One thing is clear, however: the shock to California residents, or rather their wallets, will be most unpleasant, as their rates are about to surge one way or another.

Think it couldn’t happen? Think again, as Bloomberg reports, PG&E’s deepening financial crisis has already spread to the companies that supply its natural gas and generate electricity for its customers. At least two small gas suppliers have restricted sales to PG&E out of concern that the company won’t be able to pay, people with direct knowledge of the situation said earlier this week.

Some banks are taking a long look at a potential $2 billion debt financing for the Geysers, the world’s largest geothermal complex, because it supplies the utility, people familiar with the matter also said this week.