Fed Raises Rates, Eyes Three 2018 Hikes as Yellen Era Nears End

By Christopher Condon and Craig Torres

Bloomberg.com

Federal Reserve officials followed through on an expected interest-rate increase and raised their forecast for economic growth in 2018, even as they stuck with a projection for three hikes in the coming year.

“This change highlights that the committee expects the labor market to remain strong, with sustained job creation, ample opportunities for workers and rising wages,” Chair Janet Yellen told reporters Wednesday in Washington following the decision. In her final scheduled press conference, Yellen noted that her nominated successor, Jerome Powell, has been part of the consensus shaping the Fed’s gradual rate-hike strategy.

In a key change to its statement announcing the decision, the Federal Open Market Committee omitted prior language saying it expected the labor market would strengthen further. Instead, Wednesday’s missive said monetary policy would help the labor market “remain strong.” That suggests Fed officials expect improvement in the job market to slow.

The yield on 10-year U.S. Treasury notes fell after the Fed announcement, as did the Bloomberg Dollar Spot Index. Trading at record highs recently, stocks jumped after the Fed’s announcement before paring gains. Asked during a press conference about rising asset prices, Yellen said the high valuations don’t necessarily mean that they’re overvalued and that she’s not seeing a worrisome buildup of leverage or credit.

The 7-2 vote for the rate move, the Fed’s third this year, raises the benchmark lending rate by a quarter percentage point to a target range of 1.25 percent to 1.5 percent. In another move that could tighten monetary conditions, the Fed confirmed that it would step up the monthly pace of shrinking its balance sheet, as scheduled, to $20 billion beginning in January from $10 billion.

Through the policy adjustments and the statement, the Fed continued to seek a delicate balance between responding to positive news on growth and unemployment that encouraged gradual tightening, while signaling caution due to persistently weak inflation readings that have befuddled policy makers.

That puzzle continued earlier Wednesday when Labor Department data showed consumer inflation, excluding food and energy, was lower than expected at 1.7 percent in the 12 months through November.

Inflation Developments

“Hurricane-related disruptions and rebuilding have affected economic activity, employment and inflation in recent months but have not materially altered the outlook for the national economy,” the Fed said. Repeating language used since June, the FOMC said that “near-term risks to the economic outlook appear roughly balanced, but the committee is monitoring inflation developments closely.”

In the latest set of quarterly forecasts released Wednesday, the median estimate for economic growth next year jumped to 2.5 percent from 2.1 percent. It wasn’t immediately clear how much of the change reflected confidence that the tax-cut legislation moving through Congress will boost growth, or other factors such as pickups in business spending and global growth.

At the same time, the committee’s median forecast for long-run expansion was unchanged at 1.8 percent, suggesting officials aren’t yet convinced the tax package will significantly affect the economy’s capacity for growth.

Minneapolis Fed President Neel Kashkari and the Chicago Fed’s Charles Evans both dissented against the interest-rate decision, preferring to leave them unchanged. It was the first meeting with more than one dissent since November 2016; Kashkari’s dissent was his third this year. Evans dissented for the first time since 2011.

| WHAT OUR ECONOMISTS SAY: |

|---|

| “The most important takeaway from the December FOMC meeting is that even though policy makers are becoming more bullish on economic prospects, they are not shifting to a more hawkish policy stance. An extended inflation soft patch is giving the Powell-Fed a free pass to continue along Janet Yellen’s gradualist path toward policy normalization.”

— Carl Riccadonna and Yelena Shulyatyeva, Bloomberg Economics. |

That follows a solid rebound for the expansion since a disappointing start to 2017. Gross domestic product grew at more than a 3 percent annualized pace in both the second and third quarters, and is on track to expand in the fourth quarter by 2.9 percent, according to the Atlanta Fed’s GDPNow tracking estimate.

Rate Path

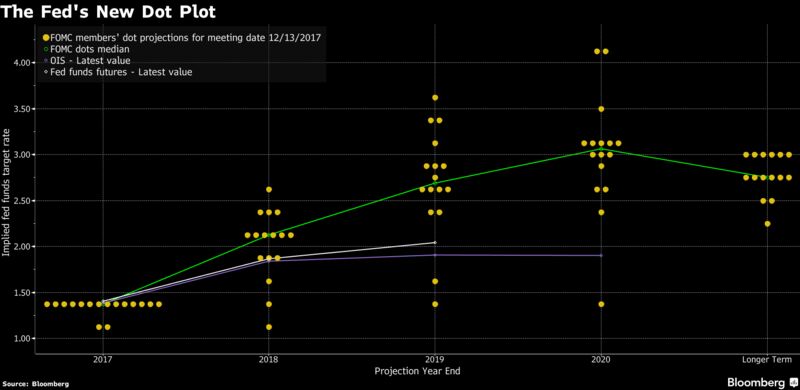

Despite the upgrade in near-term growth expectations, policy makers left the number of hikes projected for 2018 effectively unchanged. The median forecast pegged the federal funds rate at 2.1 percent at the end of next year.

That could, in part, reflect lingering concerns over sluggish wage and price gains. The Fed’s preferred gauge of inflation, based on consumer spending, gained just 1.6 percent in the year through October.

Weighed against unemployment, which has dropped to a 16-year low at 4.1 percent, that weakness has puzzled economists and made some policy makers declare the Fed should hold off on additional rate increases until prices respond more briskly.

The committee lowered its median estimate for the unemployment rate, expecting it to hit 3.9 percent by the end of 2018, compared with a September projection of 4.1 percent.

The committee left its median estimate for the lowest sustainable level of long-run unemployment at 4.6 percent, suggesting that officials still expect the drop in joblessness to eventually boost inflation. Forecasts showed little change in the inflation outlook over the next three years.

Yellen is expected to chair the committee’s next meeting on Jan. 30-31 for what will be her last FOMC gathering of her time on the committee spanning three decades as chair, vice chair, San Francisco Fed president and governor.

Other Details of Projections

- Median estimate for 2019 federal funds rate held at 2.7 percent; 2020 projection rose to 3.1 percent from 2.9 percent, while long-run rate remained at 2.8 percent

- Median inflation forecasts all unchanged except for 2017 headline PCE forecast, which rose to 1.7 percent from 1.6 percent

- 2019 median economic-growth forecast rose to 2.1 percent from 2 percent; 2020 projection moved to 2 percent from 1.8 percent

- Median 2019 unemployment-rate projection fell to 3.9 percent from 4.1 percent; 2020 estimate declined to 4 percent from 4.2 percent

— With assistance by Matthew Boesler, Jeanna Smialek, and Steve Matthews

___

http://www.bloomberg.com/view/articles/2018-02-07/are-banks-worthless