The World’s Most Dangerous Systemic Risks for the Week Ending October 14, 2016

A Weekly Intelligence Briefing Integrating the Risks Presented on the Prevailing Gray Swans List

by Jim Autio

DEEP CONNECTIONS

The purpose of this intelligence briefing is to consolidate and integrate into a single document on a weekly basis an assessment of the world’s most dangerous systemic risks that can impact your quality of life. The assessment is grounded by the Prevailing Gray Swans List and its in-depth, intelligence briefings. This document provides a succinct synthesis for those readers desiring only a 10-minute executive summary of “a current big picture of the clear and present dangers in the world” but without sacrificing the Deep Connections philosophy. The approach is designed to minimize noise and error while avoiding speculative over-reach. The references and details are readily accessible as follows:

[this document → deep background/threat forensics/logic path → original source material]

What are the most dangerous real — not merely theoretically possible — threats we face right now that can blindside us?

Cutting through the noise, what truly matters?

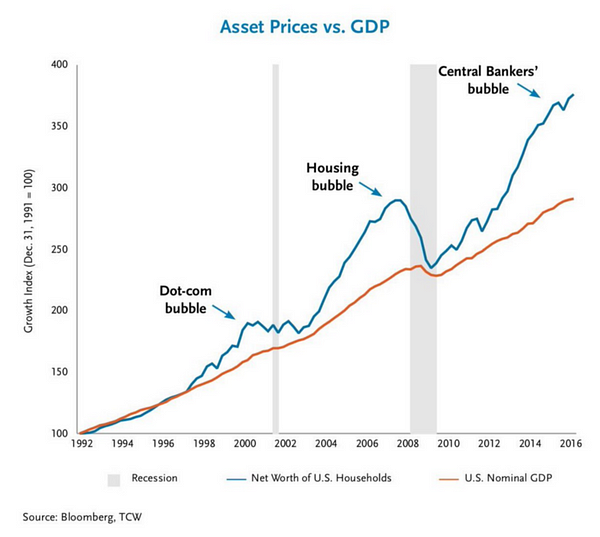

There are presently two paramount foreground dangers and a third that is moving closer to the foreground. We are currently experiencing the biggest, global-scale, financial bubble in history (the “mother of all bubbles” or MOB) and this is not a one-dimensional bubble like the “Crash of 1929”, the 2000 dot com bubble or the 2008 housing bubble: the MOB is simultaneously present in all asset classes: stocks, bonds, and real estate. Because of these properties, the MOB is both quantitatively and qualitatively in a different category than any previous bubble. The driver behind this enormous bubble is central bank intervention that has been sustained since 2008 on an unprecedented scale when viewed by the aggregate activity of the world’s central banks: the US Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BOJ), the Bank of England (BOE) and the Swiss National Bank (SNB). What also makes the MOB categorically different, besides its size and ubiquity, is its vulnerability to a massive implosion due to inherent structural defects:

The MOB’s network architecture is the three-tiered hierarchy and dense interconnectedness of {currencies ⇋ bonds ⇋ derivatives} and this network is embedded in every global systemically important bank (GSIB) node, not just a single node failure like Deutsche Bank (or Lehman Brothers in 2008) in the GSIB network architecture. Simply, it is a network nested inside a network. A bond selloff has high network centrality in every node, not just one, and then radiates outwardly simultaneously from each and every node — it is like every major star in a galaxy exploding at the same time. The MOB’s gargantuan size is highly appreciated but this architectural vulnerability and its detonation is an unrecognized hazard — a black swan hereby is now a gray one.

Throughout history all financial bubbles have the same fate — they all collapse, sooner or later. Due to sociological phenomena, they never deflate in an orderly manner; greed and fear dominate as actors in a zero-sum mindset exit simultaneously in an attempt to maximize personal gain or mitigate losses.

Because the sovereign bond market is the underlying reference asset for much of the world’s total derivative exposure (particularly US Treasury bonds which benchmark everything) while composing what is considered high-quality collateral for maintenance of margin in leveraged positions throughout the structure, a bond collapse (i.e. a rapid increase in interest rates) is both functionally and structurally the detonator for the entire derivatives network which notionally exceeds USD 1Q (one quadrillion US dollars).

http://twitter.com/JanusCapital/status/740907764046659584?ref_src=twsrc%5Etfw

Bill Gross on negative interest rate bonds (NIRP).

In other words, the Achilles heel of the global financial system is a sustained, high-volume, sovereign bond selloff. The timing and precise trigger event for the bursting of the MOB are unknown but there are several known possible triggers, many of which are mentioned below. The collapse of the MOB is inevitable and is already on borrowed time; even though the consequences are dire the event itself will be an iconic anti-surprise — there is absolutely no reason that any rational person can’t see this coming. Because of the all-encompassing, unprecedented nature of this mega-bubble, the conditions in its aftermath are purely speculative, even defiantly unpredictable due to the number of moving parts on many levels from political quandaries to legal entanglements to impact of societal blindside. Quite possibly, this will burst a multi-century, fiat-currency based “trust bubble.” But for now, tragic complacency reigns.

[Deep Background:Financial Bubble (Understanding the MOB: evolution, historical perspective, structure, vulnerabilities, aftermath psychology)]

Russia ships new anti-aircraft system to Syria and promptly warns the U.S. not to target the Assad regime. https://t.co/1TJbNkKd6s pic.twitter.com/rSlSL21ONd

— Foreign Policy (@ForeignPolicy) October 7, 2016

The second dominant foreground danger is also a trigger for the MOB’s collapse: a military escalation in the Syrian Conflict between the US and Russia. Americans are unaware of the dangers brewing in Syria because Western major media has not been forthcoming of the mounting perils. Understand: The Syrian Conflict is not just “another war against terror” like Iraq or Afghanistan. The primary danger is a US-Russian war, not a war against ISIS. Given recent events and decisions made by both alpha belligerents, we are moving rapidly in the direction of increased risk of direct conflict between nuclear superpowers for the first time since the Cuban Missile Crisis:

- Russia’s foreign policy on the use of a tactical nuclear response includes attack by foreign powers on strategic assets such as those at the Syrian airbase in Latakia and the naval base at Tartus, both of which have Russian air and missile defense systems, personnel, facilities and naval ships or military aircraft;

- an attempt to prosecute a no-fly zone by US/NATO air forces will result in losses of aircraft caused by Russia’s state-of-the-art air defense systems with immanent escalation and retaliation by the US/NATO that will invoke Russian foreign policy measures;

- Russia has used major media to advise the Russian population of a risk of war with the West including possible nuclear engagement;

- Russia has repeatedly warned the US of the grave consequences of attacking Syrian or Russian assets;

- Russia conducted over a four-day span in early October a civil defense exercise involving 40 million citizens, 200,000 rescue professionals and nearly 50,000 vehicles and has done so annually since 2012; and

- Negotiation bandwidth and mutual trust is at a multi-decade low between the world’s two greatest nuclear powers; ex-President of the Soviet Union Mikhail Gorbachev said, “We are at a dangerous point.”

Discussions between the US and Russia on Syria at the G20 Meeting in China in 2016. (Photo credit: Alexei Druzhinin/TASS | Source page: The Sun (UK))

—

It is unlikely that a major escalation will occur during the remainder of the Obama administration because there has been no overt threat of attempting a no-fly zone in Syrian airspace or conducting any major attacks on Syrian or Russian assets. This stance will most likely change with a new US Commander in Chief and Russia is preparing for exactly that scenario. Russia has performed actions commensurate with a war footing between superpowers — Russia has taken actions tantamount to vigilant readiness on a large scale, not just saber rattling or empty rhetoric. It is important for Americans to not be dismissive of these events, it is not posturing and — given major media’s dearth of coverage of these events and their gravity — perhaps you are just becoming aware of the alarming stature of this flashpoint this second.

Russia has held large-scale civil defense drills since 2012. (Photo credit: mchs.gov.ru | Source page: Russian Times)

It is vital to know the difference between tactical and strategic nuclear weapons and the conditions for their use by both sides, not just one: the foreign policy positions of the US and Russia are very different for the use of these very different weapons systems (tactical has a much lower bar than strategic nuclear weapons and are not only not considered “Doomsday” weapons but tools of de-escalation or even being the “humane” option in some contexts).

At this time, military escalation in Syria or the Balkans poses only a small risk. However, that changes instantly if the US/NATO takes aggressive military action by targeting Syrian or Russian assets in the air or ground. Should that happen, we will be in uncharted territory and events will unfold rapidly whilst history proffers no guidance.

[Deep Background: Syrian Conflict (What is the Syrian Conflict really about? Also addresses weapon systems, escalation, and foreign policy vis-à-vis Syria, the Balkans and Ukraine)]

[Deep Background: Understanding military-grade cyberwarfare (a possible alternative response or a stepping stone to tactical nuclear weapon use)]

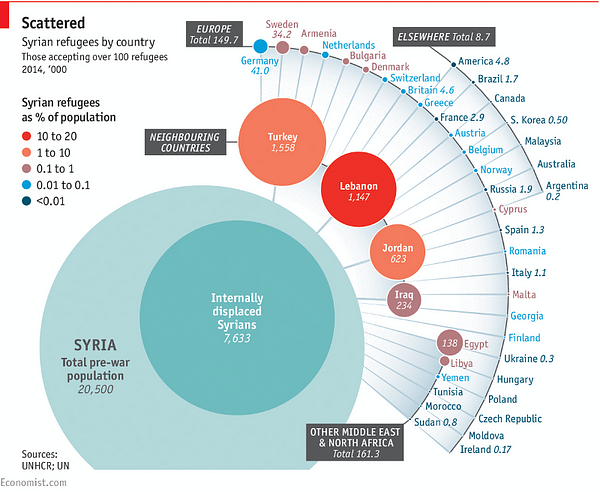

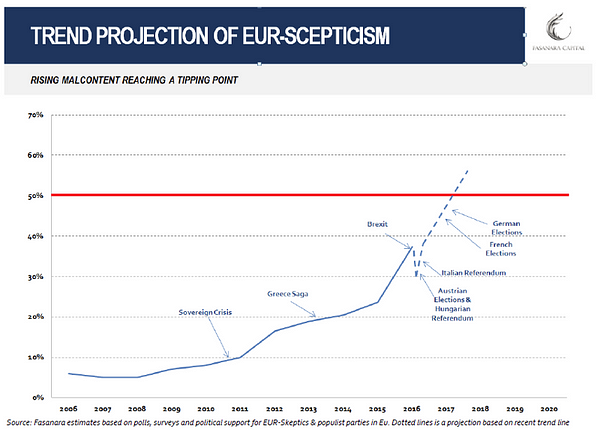

The third dominant danger is not yet in the foreground but is now within a 18 to 24 month event horizon and gaining momentum so must be addressed. Given the political atmosphere in the European Union (EU), there is a high likelihood of a disintegration of the eurozone(the 19 countries in the EU that use the euro as a common currency). There are two fundamental forces undermining the stability of the EU: globalization (Italy and elsewhere have lost competitiveness while being hamstrung by the euro, a strong currency) and immigration policy (France and elsewhere). There is a particularly strong likelihood given present trends that either France or Italy will vote by national referendum to leave the EU and these are not the only countries bearing that proclivity. What is vital to understand is that if either Italy orFrance execute a similar action to the United Kingdom’s Brexit referendum, the eurozone will most assuredly fail.

Stated differently, there are multiple disparate vulnerabilities that lead to the EU’s collapse which — concomitantly — greatly increase the probability that other countries will opt for the exits. As an analogy, the EU is a battleship that can absorb the damage of one large torpedo but not two. Say the battleship survives a large torpedo (such as the UK’s exit) but then there is another large torpedo in the water as well as two smaller torpedoes… That’s the predicament, precisely. Obviously, this serves as an independent trigger event to burst the MOB. The collapse of the EU is presently not a risk but it is on a collision course with much greater than Russian roulette odds of dissolution. The deteriorating Syrian refugee crisis and its Siamese-twin relationship to EU survival is one of the greatest disconnects in the world today while — paradoxically — complacency and finger pointing run rampant.

[Deep Background: Threats to EU Integrity | Contributing factors: The Syrian Refugee Crisis | Italian banking system collapse | Deutsche Bank risks]

Threat Matrix

The other global threats at the present time are neither in the foreground or of major consequence by themselves but they contribute to systemic fragility and cascading effects because their outputs are materially damaging to larger, vulnerable networked systems that are already labored and/or redlined. They are Kryptonite to the MOB. Consider the seemingly bottomless woes of Deutsche Bank and the status of numerous banks in Italy that are heavily burdened with non-performing loans: at present these are well-defined and manageable problems — the EU has much greater problems at hand like the ballooning ramifications of the Syrian Conflict and immigration issues at large. Japan has been spiraling out of financial control for years and is now showing societal cracks reflecting doubt but appears to be stable for the time being. However, all three of these lower-grade threats would collapse in the wake of the MOB’s collapse, or, going the other way, could become triggers for the MOB’s collapse if they suddenly go awry — havoc strikes bi-directionally (A ⇋ B). Clearly, the entire MOB network is a textbook minefield:

- Syria (an escalating war or refugee blowback),

- Deutsche Bank,

- referendums in the EU,

- Japan’s deteriorating financial condition and incipient societal distrust in its direction and stewardship, and

- the weak Italian banking sector including many other banks within the EU.

These threats are contributory pathways to detonating the MOB.

Other Concerns

- China’s slowing economy in the face of rapidly growing debt is becoming a bigger problem and could spread from a regional to a global danger due to impacts on global trade and rapid currency fluctuations which impacts the MOB.

- Acts of cyberterrorism are happening 24/7 and their economic costs are mounting but manageable. These are not foreground threats but there needs to be much greater public and corporate awareness given their nonlinear rate of proliferation due to knowledge pooling, low-cost (Moore’s Law + cloud computing) and easy access (open source) to powerful and flexible cyberweapons and software toolsets tuned for their construction and deployment. Well-funded non-state actors, because of these synergistic technological windfalls, are now capable of producing sizable damage to vital national infrastructure/function and should not be underestimated. A cyberattack by such an organization or an ad hoc confederation would not be a black swan 911 — only the last dot is not connected.

[Deep Background: Understanding military-grade cyberwarfare]

Conclusions

“Three Dangers” | (Source: National Geographic)

The two primary clear and present dangers in the world are the biggest financial bubble in history and the rapidly increasing risk of an armed conflict between the US/NATO and Russia. Of note, there are many secondary threats that can trigger the collapse of the financial bubble. On deck there is a third major danger on the horizon — the disintegration of the EU by political means stemming from multiple threats of different classes of waxing risk. The failure of the EU would independently burst the financial bubble, that is, if the bubble remains intact that long.

Bottom line: Existential risk from gray swans — rest assured — are in the pipeline and coming to roost. And, of course, black swans always remain unknown unknowns a heartbeat away. Prepare accordingly.

If you thought this intelligence briefing useful, please use social media or email to reach others of like mind. Twitter and Facebook icons are below. Thanks for your help.

Want to build an intelligence (“smart news”) site focused on what matters that has: extreme integrity, unbiased and wired for social? Email me.

/ja