“What is revealing here is that the Administration seems to think that the public buys this sort of enforcement theater… They know the banks got away with murder and pacts that are cost-of-doing business level fines don’t get their attention. They want to see managers and executives prosecuted, or at least pay hefty fines… and see the bad acts exposed too. Of course, the reason this can never be allowed to happen is that that course of action would facilitate private litigation, and that might lead to uncontrolled outcomes, like exposure of really bad conduct (embarrassing the Administration for not going after it themselves) and hefty damages… the dirty secret here is the Administration is not just protecting the banks. It now also needs to hide how cronyistic its behavior has been.“

~ Kent Welton

NYT’s William Cohan Blasts “Holder Doctrine” of Headfake Bank “Settlements” With No Prosecutions

by Yves Smith

Even though there is tacit acceptance, or perhaps more accurately, sullen resignation, about regulators’ failure to make serious investigations into financial firm misconduct (probes on specific issues don’t cut it), occasionally a pundit steps up to remind the public of the farce that passes for bank enforcement.

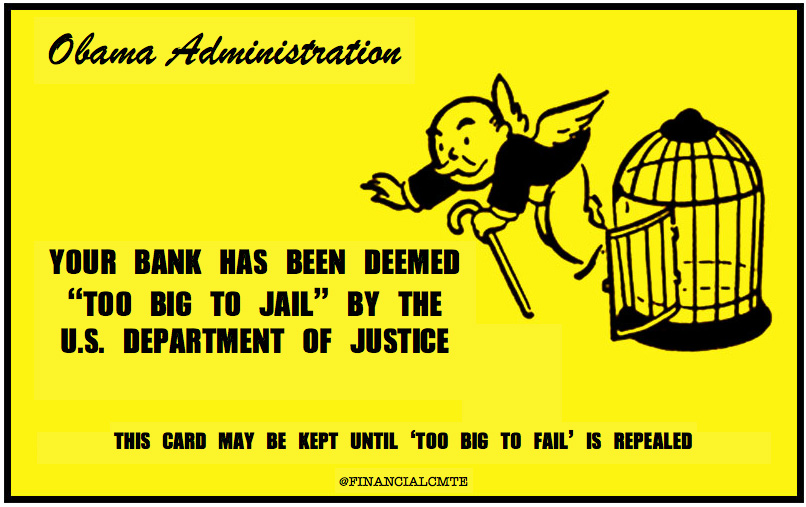

Today William Cohan tore into Attorney General Eric Holder, and by implication the Administration, for its raft of bank “settlements” which have come is a sudden spurt, no doubt intended to boost the Democrat’s flagging standing in the runup to the Congressional midterms. We’ve pointed out that the comparatively few commentators who have looked past the overhyped Department of Justice press releases into the details of the agreements have been appalled at the embarrassing lack of detail, meaning the almost total absence of any admission of wrongdoing. It’s critical to understand why this silence is important. It means that regulators have accepted as a condition of the settlement that they are to protect the bank from private suits by remaining as silent as possible about precisely what horrible things were done. The absurd part is that regulators and prosecutors could easily call the banks’ bluff by threatening to go a few rounds in court: “Would you rather have us start discovery and see what we can get in the record, or would you rather make some admissions right now?”

But of course, the dirty secret here is the Administration is not just protecting the banks. It now also needs to hide how cronyistic its behavior has been. As we wrote last month:

What is revealing here is that the Administration seems to think that the public buys this sort of enforcement theater. The public has lost interest in these deals. They know the banks got away with murder and pacts that are cost-of-doing business level fines don’t get their attention. They want to see managers and executives prosecuted, or at least pay hefty fines (enough to inflict financial pain) and they’d like to see the bad acts exposed too. Of course, the reason this can never be allowed to happen is that that course of action would facilitate private litigation, and that might lead to uncontrolled outcomes, like exposure of really bad conduct (embarrassing the Administration for not going after it themselves) and hefty damages.

Cohan in his article focuses on the deep internalization by Holder and the DoJ generally of the “protect the banks” mentality, which he calls the “Holder Doctrine”. That mindset was also reflected in a widely-criticized interview of assistant attorney general Lanny Breuer by Frontline, in which he stated that he lay awake some nights worrying about whether pending investigations might hurt financial firms. From his article:

That Mr. Holder prefers large settlements to prosecutions is no surprise to anyone familiar with the so-called Holder Doctrine, which stems from his now-famous June 1999 memorandum — when he was deputy attorney general — that included the thought that big financial settlements may be preferable to criminal convictions because a criminal conviction often carries severe unintended consequences, like loss of jobs and the inability to continue as a going concern. (See Andersen, Arthur, for instance.)

That Mr. Holder, as attorney general, is following through on an idea that he proposed as a subordinate 15 years ago does not make his behavior any less infuriating. The fact is that by settling with the big Wall Street banks for billions of dollars — money that comes out of their shareholders’ pockets — Mr. Holder is allowing them to avoid the sunshine that Louis Brandeis wrote 100 years ago was the best disinfectant. Instead of shining the bright light on wrongdoing that took place at the Wall Street banks, Mr. Holder’s settlements allow them to cover it up permanently.

And that helps no one. The American people are deprived of knowing precisely how bad things got inside these banks in the years leading up to the financial crisis, and the banks, knowing they will be saved the humiliation caused by the public airing of a trove of emails and documents, will no doubt soon be repeating their callous and indifferent behavior.

Instead of the truth, we get from the Justice Department a heavily negotiated and sanitized “statement of facts” about what supposedly went wrong. In the case of JPMorgan, the statement of facts was 21 pages but contained little of substance beyond the fact that an unidentified whistle-blower at the bank tried to alert her superiors to her belief that shoddy mortgages were being packaged and sold as securities. Her warnings went unheeded and the mortgages were packaged and sold all the same.

As solid as Cohan’s piece is, let’s highlight some offensive features of Administration enforcement theater that he could have hit harder. One was the shift, starting with the “no admission, so what was Citi paying for” $4.5 billion in cash mortgage settlement by Citigroup, which of course was presented as a much bigger number ($7 billion), since the convention is to let the banks throw in all sorts of stuff they intended to do anyhow and pretend they had to have those big bad meanie regulators force them to take profitable actions. The reason this is even more putrid than past settlements is that regulators used to want to get the extra headlines and cheap brownie points of regulatory injunctions (promises to shape up, which in fact are rarely enforced) which requires court approval. After Judge Jed Rakoff had the temerity to give these pacts real scrutiny, rather than just rubber stamping them, the officialdom appears to have decided to go the path of least resistance and just cut deals with the miscreants directly.

And in the headlined “$13 billion” JP Morgan settlement (actually roughly $9 billion in cash), Cohan attributes the large amount to a criminal case the DoJ was threatening to file, the details of which remain secret as a result of the deal. In fact, this settle consisted of a bundle of pending actions all heaped together to increase the total amount and thus make it sound more impressive. The biggest single item was in fact not the DoJ action, but a FHFA suit on mortgage putbacks launched by Ed DeMarco. Readers of this site may recall that the Administration demonized him for well over a year before finally replacing him with Mel Watt. So it was perverse to see the Administration take a victory lap for a settlement where their Mortgage Enemy No. 1 deserved a good bit of credit.

So Cohan has provided an important service in trying to penetrate the official echo chamber and remind the powers that be that the public has not been fooled by these settlements. Unfortunately, Washington DC looks more and more like Versailles circa 1788, and our elites ,like the Bourbons, seem incapable of learning anything.