Why would any country ever store their gold at the Bank of England again?

Store Your Gold At The Bank Of England And You Might Never See It Again

by Ronan Manly

BullionStar.com

In early November 2018, it first came to light that the Bank of England in London was delaying and blocking the withdrawal of 14 tonnes of gold owned by the Venezuelan central bank, Banco Central de Venezuela (BCV). At the time, Reuters and The Times of London both reported that according to unnamed British ‘public officials’, the delays were being caused by the difficulty and cost of obtaining insurance for the gold shipment back to Venezuela, and also due to “standard measures to prevent money-laundering“.

As I explained in a BullionStar article on 15 November titled ‘Bank of England refuses to return 14 tonnes of gold to Venezuela’, the explanations given to Reuters and the Times for the withdrawal delays were completely bogus, and that the real reason for blocking the BCV gold withdrawal was undoubtedly US and UK joint government interventions to stall the withdrawal. As I wrote at the time:

“The reasons put forward by official sources in the Reuters and Times articles for why Venezuela can’t withdraw its gold from the Bank of England are clearly bogus. The more logical and likely explanation is that the US, through the White House, US Treasury and State Department have been liaising with the British Foreign office and HM Treasury to put pressure on the Bank of England to delay and push back on Venezuela’s gold withdrawal request.”

As it turns out, this was an entirely correct prediction, since by 25 January, Bloomberg confirmed in an ‘exclusive report’ (two and a half months later) that:

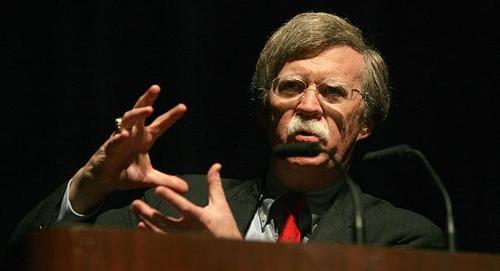

“The Bank of England’s decision to deny Maduro officials’ withdrawal request comes after top U.S. officials, including Secretary of StateMichael Pompeo and National Security Adviser John Bolton, lobbied their U.K. counterparts to help cut off the regime from its overseas assets, according to one of the people, who asked not to be identified.”

Why Bloomberg took so long to state the obvious is not clear, but from the outset, the entire interventionalist playbook of the Americans and British in this saga has been entirely predictable to anyone observing the situation. This intervention by the Bank of England on behalf of the US and UK shows a complete disregard for sovereign gold property rights, and the Bank of England has now literally ripped up a custody gold storage agreement that it had entered into with another of the world’s central banks.

Predicting the Coup – Look to the Gold

More interestingly, the Bank of England’s stalling tactics on the BCV gold withdrawal has also been useful in predicting the timing of the current Western powers’ move against Maduro and in signaling how long this foreign backed coup has been in the planning in Washington DC and elsewhere. Let’s look at a few facts and their timing.

From at least early September 2018, the Bank of England (BoE) began stalling on allowing a central bank gold custody customer (the BCV) to withdraw sovereign property (gold bars) that the BCV had entrusted to the Bank of England under a gold custody agreement.

Why early September 2018? Because, as the Reuters report dated 5 November stated, the BCV gold withdrawal request had “been held up for nearly two months”. This would put the original BCV withdrawal request to at least early September. And since the BCV’s gold withdrawal request was not actioned by the BoE at that time in early September, then this implies that the Bank of England already had its instructions to begin stalling the BCV during at least early September, which also implies that the British and US governments were already involved.

Arguably, concern in Bank of England, British Foreign Office and US State Department circles, and associated hatching of plans to stall and block BCV gold bar withdrawals, could have began as early as April 2018. This was the month in which the BCV paid Citibank $172 million to recover gold bars at the Bank of England that the BCV had put up as collateral in a gold swap operation with Citibank. According to a Reuters article last June about the termination of this BCV-Citi gold swap, “the policy [of the BCV] is to recover the gold“.

So when the swap was closed out last April, the Bank of England and associated intelligence actors (UK Treasury, Foreign Office, State Department, US Treasury etc) would all have known that the BCV again had title to some gold bars in the Bank of England’s vaults and wanted to “recover the gold”. So its also possible that the BCV gold withdrawal request to the Bank of England was pending from at least May onwards.

Stalling while awaiting backup

It is now also apparent that the Bank of England was engaged in its stalling tactics while waiting for new US sanctions to come into affect as well as for the beginning of Maduro’s new presidential term on 10 January 2019, when the US and associated allies then upped the coup rhetoric.

Specific sanctions appeared on 01 November, when the United States signed Executive Order 13850, an order which imposed sanctions on Venezuela’s gold industry and which bullies the global gold industry not to do business with Venezuela and its gold sector. To put the issue into the public domain and control the narrative in the run up to Washington’s intervention, Reuters and the Times were then feed various bogus stories a few days later by “public officials” and “British officials”, and the resulting stories published firstly by Reuters (story one) and then by the Times (story two).

On the election front, while Venezuela’s president Maduro was re-elected in elections that were held on 20 May 2018, his inauguration was only held on 10 January this year. As other countries jumped on the bandwagon condemning Maduro’s new term and endorsing the relatively unknown Venezuelan national assembly leader Juan Guaidó, if the Bank of England was able to stall until 10 January, then it’s stalling tactics would appear more palatable since by then reneging a sovereign gold custody contract could be buried amid the media scramble and merely be another footnote in the escalating conflict.

This, the Bank of England has managed to do to an extent. In early December, the BoE stalled in its meeting with BCV president Calixto Ortega Sánchez and Venezuelan finance minister Simón Zerpa Delgado when they flew over from Caracas to London for a meeting requesting BCV gold withdrawal. See BullionStar article from 18 December, titled “Venezuela’s gold in limbo amid tug-of-war at the Bank of England” for more details.

The BoE’s stalling also enabled the US-backed Venezuelan opposition to throw its own spanner in the works during December, when Venezuelan opposition politicians Julio Borges (former Venezuelan national assembly president and founder of the Justice First party) and Carlos Vecchio (co-founder of the Voluntad Popular party) petitioned the BoE’s governor Mark Carney to “refuse the handover of fourteen tonnes of gold“.

John Bolton: From the Swamp?

Doubling down on the Gold, doubling up the Stake

In the immediate aftermath of Maduro’s re-inauguration, a number of intriguing developments regarding the BCV’s gold at the Bank of England have also now come to light. These developments merit attention, and are briefly summarised below.

Firstly, the BCV significantly upped the ante in December 2018 by doubling down on its gold holdings at the Bank of England. It did this by closing out another gold swap, this time one that its had on the table with the now troubled Deutsche Bank. This is according to a Reuters reportout of Caracas dated 21 January. According to Reuters, the BCV’s gold holdings at the Bank of England:

“more than doubled in December to 31 tonnes, or around $1.3 billion, after Venezuela returned funds it had borrowed from Deutsche Bank through a financing arrangement that uses gold as collateral, known as a swap…

..Under the deal struck with Deutsche Bank in 2015, Venezuela put up 17 tonnes of gold in exchange for a loan.“

By upping the amount of gold at stake from 14 tonnes to 31 tonnes, the BCV piled on the pressure with the BoE. If 14 tonnes sounds like a lot of gold, then 31 tonnes sounds like a lot more.

Back in December, I did a calculation of how many Good Delivery gold bars equates to 14 tonnes and wrote that it “would be in the region of about 1125 gold bars” which was 27% of the original 4,089 gold bars that the BCV left stored at the Bank of England in late 2011. I said that:

“This is the gold now being frozen by the Bank of England, about 1125 gold bars. If this gold is in custody, it will be set-aside or allocated and the BCV will know the individual serial numbers of every bar.

…the BCV should at the very least publish for everybody to see, the weight list / serial number list of all of these gold bars so that they cannot be confiscated or used by the Bank of England or bullion banks for other purposes, such as being sold to other central bank customers or sold to gold-backed ETFs.”

If 1,125 Good Delivery gold bars equate to 14 tonnes, then about 2,491 Good Delivery gold bars equate to 31 tonnes. So the BCV is now looking to withdraw approximately 2,500 wholesale gold bars from the Bank of England vaults in London. That is not a small number, and should cause ‘consternation’ among the LBMA and Bank of England vault managers that the reputation of the London Gold Market has now been tainted by freezing the withdrawal of 2500 large gold bars belonging to another sovereign nation. Not to mention ‘consternation’ among the world’s other central banks (more then 70 central bank gold custody customers) which store their gold in the BoE vaults in London.

Guaido and Maduro

Late January news also saw official confirmation from Bloomberg that the trip to the Bank of England in December by the Venezuelan central bank president Ortega Venezuelan finance minister Zerpa Delgado had been a waste of time. Again confirming the stalling tactics of the G30 member (Mark Carney) led Bank of England. According to a January 25 article by Bloomberg:

“those talks were unsuccessful, and communications between the two sides have broken down since. Central bank officials in Caracas have been ordered to no longer try contacting the Bank of England. These central bankers have been told that Bank of England staffers will not respond to them, citing compliance reasons, said a Venezuelan official…”

On 27 January, Reuters revealed that Venezuela’s political opposition, not content with just a letter from Borges and Vecchio to Mark Carney in December which pleaded to “refuse the handover of fourteen tonnes of gold“, had gone one step further and roped in Venezuela’s presidential contender Juan Guaido to write additional letters both to British prime minister Theresa May and the BoE’s governor Carney, claiming that Venezuela’s Maduro aimed to sell the BCV gold. “I am writing to ask you to stop this illegitimate transaction” said the Guaido letters, according to Reuters. Remarkably, Guaido’s letter to Thersea May was his first letter ever to a foreign head of government, and shows the desperation of the US-UK forces to block access to this 31 tonnes of gold. Who said gold was just a pet rock?

On 28 January, Britain’s Foreign Office also entered the meddling, when Foreign Office minister Alan Duncan, with a straight face, told the British parliament in a parliamentary debate that the fate of the 31 tonnes of gold:

“is a decision for the Bank of England, not for government……It is they who have to make a decision on this.”

Duncan conveniently forget to mention that “top U.S. officials, including Secretary of State Michael Pompeo lobbied his UK counterparts” (i.e. Duncan) to help cut off Venezuela’s overseas assets. Duncan’s comments can be read on Hansard here, and a Bloomberg summary is here. So the British government is fully involved in blocking the BCV gold withdrawal request from the Bank of England but pretends that its an independent decision from the Bank of England – which itself has been stalling on the withdrawal request for months now.

Troops guarding central bank of Hungary’s gold repatriated from London

Conclusion

In all of this saga, perhaps the most amusing aspect is how any central bank now thinks that the Bank of England and London Gold Market are free from political risk and that London is somehow still a secure and safe place for central banks to store gold bars and to trade gold bars.

Back on the 30 January 2012, when the last shipment of gold came back into Caracas on the instruction of former Venezuelan president Hugo Chavez, the then BCV head Nelson Merentes noted that:

“gold stored in BCV [in Caracas] will reach 86% of the total while the rest, about 50 tonnes, will stay in the banks in which the Republic needs to maintain open accounts for international financial operations.”

Merentes was of course referring here to the Bank of England vaults, where the BCV left 4,089 Good Deliver bars in storage when it repatriated another 12,819 Good Delivery bars to Caracas. These 4,089 Good Delivery gold bars at the Bank of England’s vaults totaled approximately 50.8 tonnes. Fast forward exactly 7 years later and it’s laughable that the Venezuelan gold that was left in London for international financial operations has been blocked by the very custodian that was supposed to be minding that gold on behalf of another central bank.

In the same vein, all of the smug central bankers around Europe who countered calls for their nations’ to repatriate gold from London with the argument that it was being safely held in an international trading center, will now have to backtrack on their claims that the Bank of England vaults are free from political and confiscation risk.

To cite just a few, Germany’s Bundesbank has 432 tonnes of gold stored in London which it claims is stored there “to be able to exchange gold for foreign currencies at gold trading centres abroad within a short space of time.”

The Austrian central bank keeps about 84 tonnes of gold at the Bank of England in London and 56 tonnes in Zurich, which it justifies at these locations since “different storage locations helps the Austrian central bank reduce concentration risk, while still being able to use gold in the gold markets of London and Zurich should the need arise.”

The Bundesbank also claims that

“the part of the Bundesbank’s gold reserves which is to remain abroad could, in particular, be activated in an emergency. Therefore one part will remain… in London, the world’s largest trading centre for gold.

In the event of a crisis, the gold could be pledged as collateral or sold at the storage site abroad, without having to be transported. In this way, the Bundesbank could raise liquidity in a foreign reserve currency.”

The Central Bank of Hungary now looks to have been shrewd when it purchased 28.4 tonnes of gold at the Bank of England last October, and immediately repatriated all of this newly bought gold back to Budapest, and in an instant ring-fenced that gold from confiscation and political interference at the now compromised Bank of England. With many governments and nations of myriad political systems and styles holdings gold in the Bank of England vaults, some of these central banks must at least be wondering if its now time to get their gold out of London.

In a short space of time, the Bank of England reputation’s as an impartial and safe location for the storage and trading of gold looks to have been irreversibly damaged.

This article was originally published on the BullionStar.com website under the title “Bank of England tears up its Gold Custody contract with Venezuela’s central bank”.