Stock buybacks blamed for lack of U.S. prosperity

By Russ Britt

MarketWatch.com

“Corporate buybacks are lining executives’ pockets, but are coming at the expense of productivity as well as overall prosperity… examples include ExxonMobil’s XOM, +0.92% failure to invest its own money in alternative energies, but to spend $21 billion a year on stock buybacks, Lazonick says. The energy giant, along with Microsoft Corp. MSFT, -0.01% and General Electric Co. GE, +0.25% , have lobbied the U.S. government to boost its investments in alternative energies though none have done their own investing and have bought back significant chunks of stock. Also mentioned is Intel Corp. INTC, +0.54% , which is calling for greater U.S. investment in nanotechnology, though its own buybacks were quadruple that of government spending on the initiative.”

Academic says it’s time to put a lid on executive compensation.

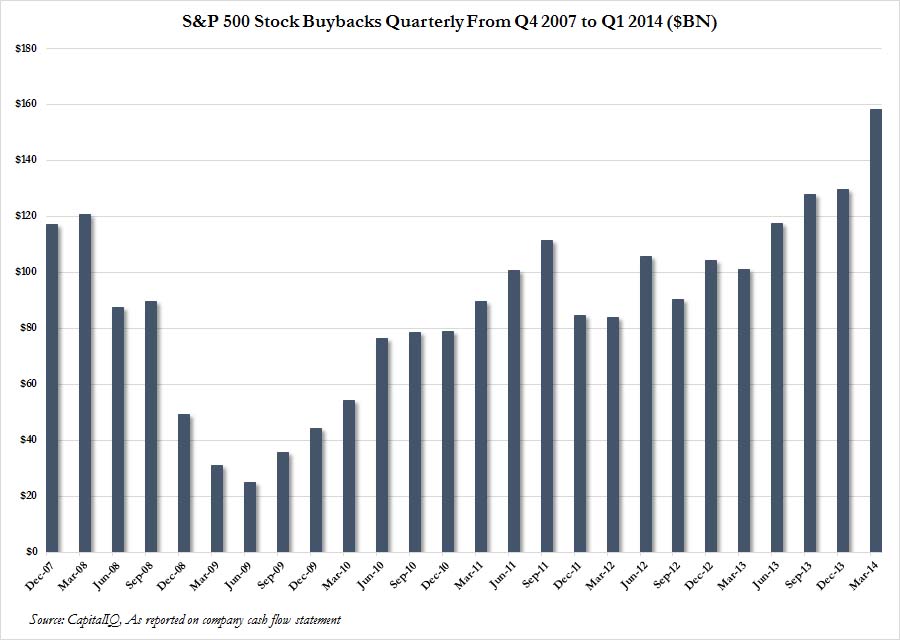

LOS ANGELES (MarketWatch) — As major stock indexes touch new highs on a regular basis, one academic says those profits are here courtesy of massive share buyback initiatives throughout the bulk of corporate America — and could come back to haunt the markets at some point.

Writing in September’s Harvard Business Review, University of Massachusetts economics professor William Lazonick says corporate buybacks are lining executives’ pockets, but are coming at the expense of productivity as well as overall prosperity. That could cost many companies their futures, as a number of businesses are forsaking investments in coming up with new products. They’re also not compensating employees more.

Lazonick says the 449 companies on the S&P 500 that were public from 2003-2012 spent 54% of their earnings on stock buybacks in the last decade, while dividends ate up another 37%. That left little for investments in new products or raises for workers.

“Corporate executives give several reasons, which I will discuss later,” Lazonick writes in his piece.

“But none of them has close to the explanatory power of this simple truth: Stock-based instruments make up the majority of their pay, and in the short term buybacks drive up stock prices.”

He says executives made, on average, $30.3 million each, with 42% stemming from stock options and 41% from stock awards.

Some of the more pronounced examples include ExxonMobil’s XOM, +0.92% failure to invest its own money in alternative energies, but to spend $21 billion a year on stock buybacks, Lazonick says. The energy giant, along with Microsoft Corp. MSFT, -0.01% and General Electric Co. GE, +0.25% , have lobbied the U.S. government to boost its investments in alternative energies though none have done their own investing and have bought back significant chunks of stock.

Also mentioned is Intel Corp. INTC, +0.54% , which is calling for greater U.S. investment in nanotechnology, though its own buybacks were quadruple that of government spending on the initiative.

And Pfizer Inc. PFE, +0.14% , along with other drug makers, is taken to task for charging higher prices for medicines in the U.S., while spending nearly three-fourths of its income on buybacks. Pfizer, Lazonick says, justifies its higher U.S. prices on research and development costs.

Lazonick quotes Laurence Fink, chairman and chief executive of asset manager BlackRock , who said in an open letter to corporations: “”It concerns us that, in the wake of the financial crisis, many companies have shied away from investing in the future growth of their companies.”

An end to open-market buybacks, the reining in of stock-based compensation and reforming boards so that they’re not inclined toward doling out share packages to executives would be good steps, Lazonick says.