FDIC Announcement: Wall Street Banks Lied To The American People, Lending Down Because Of Excessive Stock Buybacks

Federal Bank Regulator Drops a Bombshell as Corporate Media Snoozes

By Pam Martens and Russ Martens

Wall Street on Parade

Last Monday, Thomas Hoenig, the Vice Chairman of the Federal Deposit Insurance Corporation (FDIC), sent a stunning letter to the Chair and Ranking Member of the U.S. Senate Banking Committee. The letter contained information that should have become front page news at every business wire service and the leading business newspapers. But with the exception of Reuters, major corporate media like the Wall Street Journal, Bloomberg News, the Business section of the New York Times and Washington Post ignored the bombshell story, according to our search at Google News.

What the fearless Hoenig told the Senate Banking Committee was effectively this: the biggest Wall Street banks have been lying to the American people that overly stringent capital rules by their regulators are constraining their ability to lend to consumers and businesses. What’s really behind their inability to make more loans is the documented fact that the 10 largest banks in the country “will distribute, in aggregate, 99 percent of their net income on an annualized basis,” by paying out dividends to shareholders and buying back excessive amounts of their own stock.

Hoenig writes that the banks are starving the U.S. economy through these practices and if “the 10 largest U.S. Bank Holding Companies were to retain a greater share of their earnings earmarked for dividends and share buybacks in 2017 they would be able to increase loans by more than $1 trillion, which is greater than 5 percent of annual U.S. GDP.”

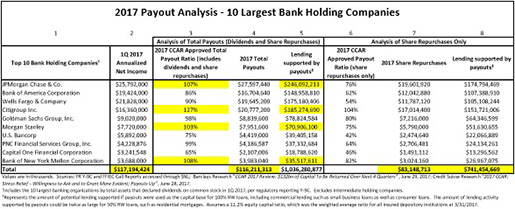

Backing up his assertions, Hoenig provided a chart showing payouts on a bank-by-bank basis. Highlighted in yellow on Hoenig’s chart is the fact that four of the big Wall Street banks are set to pay out more than 100 percent of earnings: Citigroup 127 percent; Bank of New York Mellon 108 percent; JPMorgan Chase 107 percent and Morgan Stanley 103 percent.

What’s motivating this payout binge at the banks? Hoenig doesn’t offer an opinion in his letter but he does state that share buybacks represent 72 percent of the total payouts for the 10 largest bank holding companies. What share buybacks do for top management at these banks is to make the share price of their bank’s stock look far better than it otherwise would while making themselves rich on their stock options. If just the share buybacks (forgetting about the dividend payouts) were retained by the banks instead of being paid out, the banks could “increase small business loans by three quarters of a trillion dollars or mortgage loans by almost one and a half trillion dollars.”

Hoenig also urged in his letter that there be a “substantive public debate” on what the biggest banks are doing with their capital rather than allowing this “critical” issue to be “discussed in sound bites.” Most corporate media responded to this appeal by ignoring Hoenig’s letter altogether.

How 10 U.S. mega banks developed such a stranglehold on the U.S. financial system that they are in a position to starve the U.S. economy of $1 trillion in loans was explained in detail by Hoenig in a speech he delivered at the Conference on Systemic Risk and Organization of the Financial System at Chapman University in Orange, California on May 12. Hoenig stated:

“Following Gramm-Leach-Bliley [legislation in 1999], commercial and investment banks began a series of significant mergers that affected the combined industries in a profound way.

“Investment banks originally were formed as partnerships, where owners were liable for all of the firm’s debts. When the New York Stock Exchange relaxed its rules to permit joint stock corporate ownership in 1970, over time it became an attractive opportunity for the investment banking industry to grow and expand its business model. Investment banks that converted to public companies altered the incentives of owners and management, increasing appetite for risk and leveraging balance sheets. The further effect of combining insured commercial banks and investment banks under Gramm-Leach-Bliley magnified these outcomes. In the end, there was a profound change in industry culture that further changed the competitive dynamics among firms. As universal banks formed and matured, and with increasing support from the expanding safety net, the largest banks were increasingly drawn away from relationship banking and lending and toward the higher risk-return model of the broker-dealer-investment bank focused on trading and other fee-based income.

“Of course a pivotal force of change was the financial crisis of 2008 itself, out of which came more than new legislation. The effect of the crisis on the U.S. economy, the numerous bank failures, and the government’s response in addressing those failures dramatizes accelerated industry consolidation and altered its structure and direction in ways that will have lasting effects. JPMorgan Chase acquired Bear Stearns with government assistance, and subsequently acquired Washington Mutual after it failed. Wells Fargo acquired Wachovia. The government injected capital into Citibank, thus bailing it out. Bank of America purchased Countrywide and Merrill Lynch, and later also received extraordinary government assistance. After the failure of Lehman Brothers, regulators allowed two remaining investment banking firms, Goldman Sachs and Morgan Stanley, to become bank holding companies, providing them explicit access to the federal safety net. In short, the crisis and government’s reaction to it quickly and dramatically changed the composition and structure of the U.S. financial system.

“The crisis altered the industry’s structure in other ways as well. Between 2008 and 2014, there were 507 bank failures and 1,576 private mergers, mostly among community banks; and practically no chartering activity. Among regional and community banks, this trend toward consolidation continues nearly a decade after the crisis.”

In summary, while the reckless Wall Street banks brought on the crises, the Federal Reserve rewarded them in the midst of it by allowing the biggest banks to gobble up other banks, thus becoming a greater future threat to the nation in terms of controlling deposits and lending as well as presenting unfathomable levels of risk going forward.

This is a critical issue that deserves a serious national debate before the next financial crisis is upon us.