Greece debt crisis: Eurozone deal laws backed by MPs

BBC

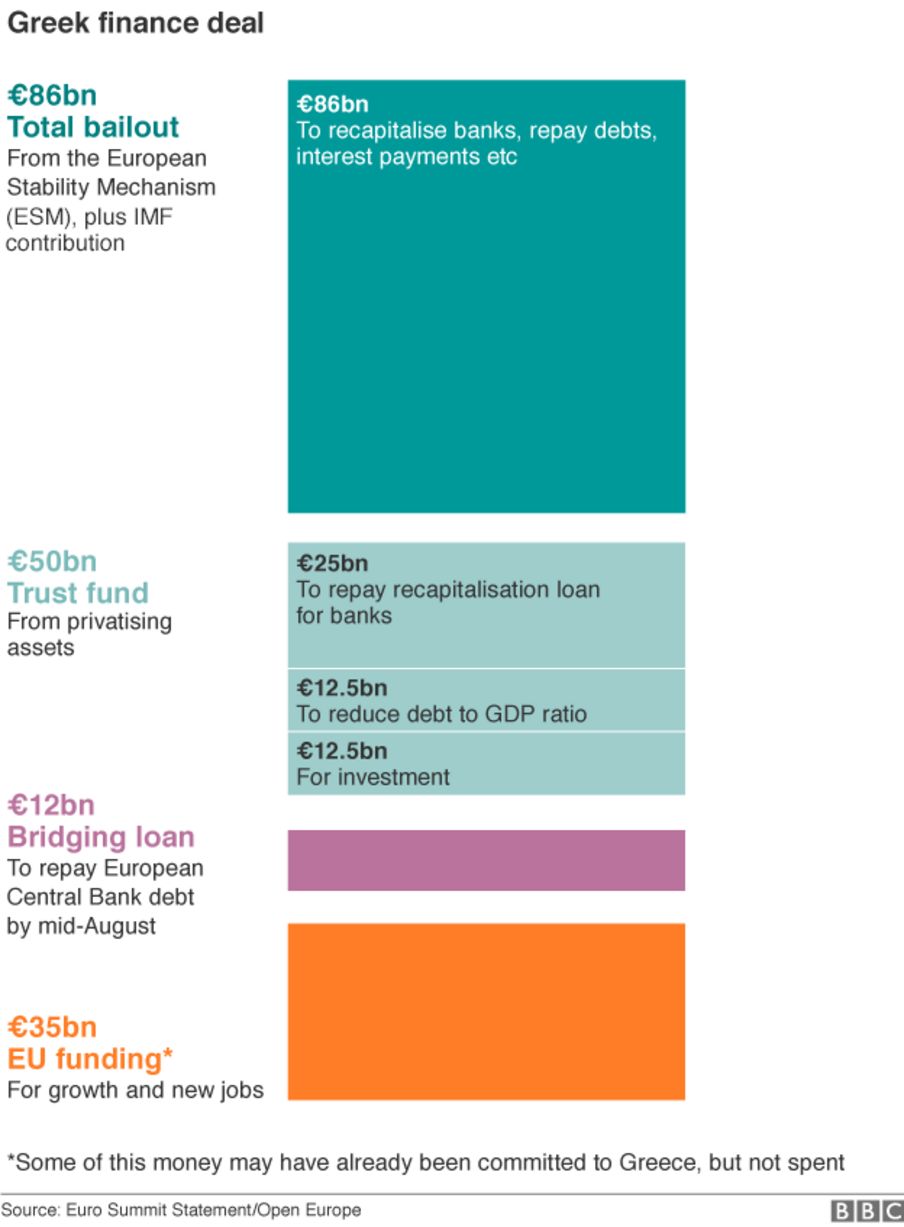

Greek MPs have approved tough economic measures required to enable an €86bn eurozone bailout deal to go ahead.

The legislation includes tax rises and an increase in the retirement age.

Two hundred and twenty nine lawmakers voted Yes, 64 voted No and six abstained. Half of the No votes came from the governing Syriza party.

Ahead of the vote, protesters threw petrol bombs at police during an anti-austerity protest close to parliament, and police responded with tear gas.

Prime Minister Alexis Tsipras had said he did not believe in the deal, but nonetheless urged MPs to approve the measures.

He said he was willing to implement the “irrational” proposals to avoid the collapse of the banks and disaster for Greece.

In a passionate speech just before the vote, Mr Tsipras told parliament: “The Greek people are fully conscious and can understand the difference between those who fight in an unfair battle and those who just hand in their weapons.”

The vote passed despite 32 of his ruling left-wing Syriza party voting No and six more abstaining.

Among the No voters was parliamentary Speaker Zoe Constantopoulo, who walked out during the debate, before returning to make a fiery speech condemning a “very black day for democracy in Europe”.

Former finance minister, Yanis Varoufakis, who resigned on 6 July, also voted against the package, having written a scathing blog about the bailout deal earlier.

Analysis: Mark Lowen, BBC News, Athens

The measures passed comfortably – but not without a major rebellion within the government.

Thirty-eight of the prime minister’s MPs refused to back the deal, with the speaker of parliament calling it “social genocide”.

Alexis Tsipras said he’d had to choose between a deal he didn’t believe in or chaotic default. He has been weakened and will now need a reshuffle or a vote of confidence.

Meanwhile eurozone finance ministers will hold a conference call today to discuss the next steps in the bailout. Of immediate concern is how to fill Greece’s short-term cash needs, with the country facing a big payment to the IMF next week.

It could be financed from an EU-wide fund, which Britain opposes. And so there’s still a long road ahead. But one big obstacle here has been cleared.

More than half of the members of Syriza’s central committee signed a statement condemning the bailout agreement, describing it as a coup against their nation by European leaders.

Opponents of the deal took to the streets of Athens ahead of the vote, and unions and trade associations representing civil servants, municipal workers and pharmacy owners held strike action.

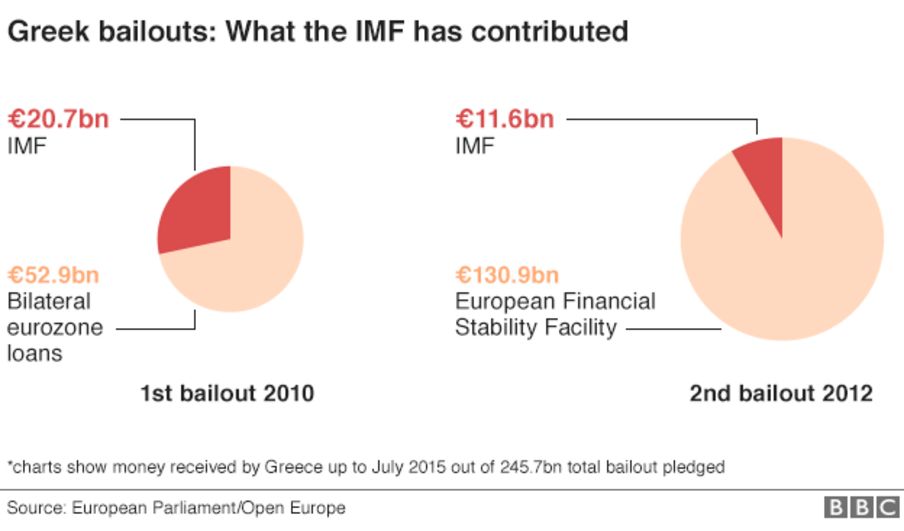

The possible bailout was agreed in Brussels on Monday by eurozone members, though one of Greece’s creditors, the International Monetary Fund (IMF), has suggested in a report that it does not go far enough – and that Greece will need some of its debts to be written off.

Greece’s economy has shrunk by 25% in the last five years amid austerity measures designed to curtail its ballooning public sector debt.

In order to begin negotiations over a third bailout worth €86bn (£61bn; $95bn) over three years, Greek MPs needed to approve measures including:

- The ratification of the eurozone summit statement

- VAT changes including a top rate of 23% to take in processed food and restaurants and; a 13% rate to cover fresh food, energy bills, water and hotel stays; and a 6% rate for medicines and books

- The abolition of the VAT discount of 30% for Greek islands

- A corporation tax rise from 26% to 29% for small companies

- A luxury tax rise on big cars, boats and swimming pools

- And end to early retirement by 2022 and a retirement age increase to 67

As parliamentary committees considered the details of the laws, deputy finance minister and Syriza member Nadia Valavani announced her resignation, saying: “I’m not going to vote for this amendment, and this means I cannot stay in the government.”

Greek Finance Minister Euclid Tsakalotos told MPs: “Monday was most difficult day of my life. It’s a decision that will weigh on me for rest of my life. We had no choice.”

He added: “We never said this was a good agreement.”

And tempers flared when Mr Varoufakis was heckled with shouts of “You got us here” while addressing one committee.

The jeers came when he said he doubted the deal could work, and compared it to the conditions imposed on Germany in the Treaty of Versailles after World War One.

Meanwhile, French MPs have overwhelmingly backed the Greek bailout deal. Because of their constitutions, several eurozone members, including Germany, must ratify the deal in their parliaments before it can proceed.

Banks stay shut

Greece faces an immediate cash crisis. Banks have been shut since 29 June.

Mr Tsipras has warned banks are unlikely to reopen until the bailout deal is ratified, and this could take another month.

The European Commission has formally proposed a short-term €7bn loan for Greece through the EU-wide European Financial Stability Mechanism (EFSM).

Use of the EFSM for eurozone rescues has been opposed by Britain and other countries which are not part of the euro but are European Union members.

One British official in Brussels told the BBC the UK government had no objection in principle to the use of the EFSM – as long as British taxpayers’ money was ring-fenced from any liability.

Valdis Dombrovskis, a senior European Commission official, said it was working to protect non-euro states from any negative financial consequences should the loan not be repaid.

‘Need for debt help’

The IMF report was written before the eurozone reached a deal with Greece in the early hours of Monday. It was shared with eurozone leaders in advance, but made public only on Tuesday.

It predicts that, in two years’ time, Greek debt will reach close to 200% of GDP (national income) which could “only be made sustainable through debt relief measures that go far beyond what Europe has been willing to consider so far”.

It recommends a “very dramatic extension” on the maturity of Greece’s debts, “with grace periods of, say, 30 years on the entire stock of European debt”.

“Other options,” it says, “include explicit annual transfers to the Greek budget or deep upfront haircuts (debt write-offs)”.

Germany, the largest contributor to Greek rescue funds, and a number of other eurozone countries have long resisted any talk of haircuts and debt relief.

The European Commission published its own assessment on Wednesday, taking a more optimistic view of Greece’s debt sustainability than the IMF but also suggesting debt relief.

The Commission’s report says rescheduling the debt is possible, but only if Greece implements the reforms being demanded by its creditors. It rules out debt write-offs.