U.S. Fed Exported QE Travesty: Meet The BLICS Nations

by Jim Willie

The aggravated global financial situation is working toward a series of powerful climax events. The various USDollar platforms are either undergoing seizure or suffering from abandonment by primary players. The grand Reich Finance application is failing finally, with extraordinary lies, propaganda, market rigging, doctored statistics, and $trillion patches leaking. The Western banking system is being lashed at another level, after the multi-lateral lashing with derivatives tied the big Western banks all together following the Lehman kill-job in 2008. A new global lashing has begun to show itself, yet another obscenity.Witness the export of QE globally by the USFed via the unlimited vast Dollar Swap facilities (massive slush funds). The new 5 BLICS nations under Western thumb are being used to purchase huge tracts of USTreasury Bonds, surely using Dollar Swap funds, on behalf of the USFed master criminal organization. One is left to wonder what the sweetener was for the five nations, like perhaps shared narcotics funds, or a promise of hidden banking system relief. The self-dealing using nations to buy USTBonds with free money has come to the fore, in another desperate attempt to save the system. It cannot be saved. It is cratering. It is rotting from the inside. It is fracturing. It will fail. The fiat paper currency system and its many attendant systems are seizing up, being rejected, and are failing in what has begun to be the grandest financial event in modern history.

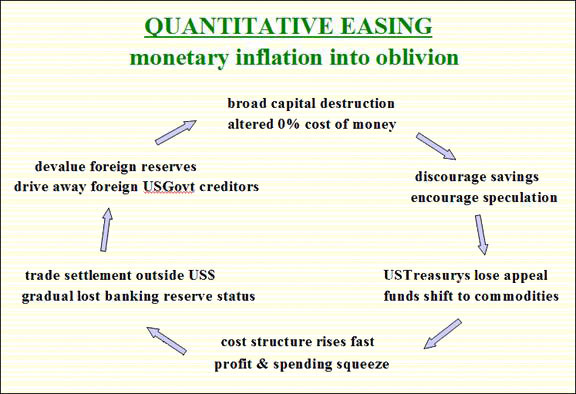

Review many of the extreme events in progress to conclude a systemic failure occurring in full view. It will be very difficult to paint this wall effectively with a phony message before it crumbles and falls. World’s central banks hit the panic button in early May. Once again their actions are proving that all Western markets are rigged. For Germany and Italy each to sport negative (or near negative) bond yields on their 10-year security is a grand obscenity and perversion. Bond market bailout is constant, control universal, using derivative props, a true disappearance of free markets. The USTreasury Bond market has been effectively destroyed, the convulsion phase having begun. The QE is not stimulus, but instead more like an overdose of potassium to the heart. The USTreasury Bond market is dying a horrible death. It is ruined by USFed monetary policy, in parallel to the wrecked economies from capital destruction. QE is fast killing the USTBond market, whose dead features are easily identified. The systemic risk is rising quickly. A solution is urgently required, rooted in Gold.

- USTreasury Bond market volume is down markedly to danger levels

- USFed is the principal buyer, lapping up all paper sold

- USFed soaks up Indirect Exchange in the $billions for foreign asset purchases

- USFed uses fake money to cover hidden derivative losses in the $trillions

- USFed balance sheet has turned toxic, with cancerous growth

- REPO market dried up, stuck in reverse

- Dollar Swap market dried up, stuck in reverse

- Negative interest rates at big banks, stuck in reverse

- Yields are hyper-sensitive with no stability, due to diminished liquidity

- Money market funds are a wasteland with no returns given

- Hidden Petrodollar damage from dismantled derivatives

- Strain to the primary bond dealers (surprised not all dead yet)

- Strain to pension funds and insurance companies, stuck in mud

- The USFed is exploiting secondary nations to export QE, a global lashing.

MEET THE BLICS NATIONS

The USFed is using derivatives and formal vehicles to integrate the bond monetization scheme. To be sure, QE is being exported via a global integration process, using several front offices under control. A vast new lattice work is under hidden construction. They involve permanent reciprocal currency arrangements, whereby foreign outpost central banks tap Dollar Swap lines to invest in US Treasuries. Witness emergence of the BLICS (not BRICS) nations, a new proxy entity. QE is being exported. The systemic risk is being spread to secondary nations, whose endorsement might be laced with deep bribery and privilege, if not protection. The credit goes to Chris Hamilton, in his Hambone’s Stuff analysis. The Jackass takes no credit, except to stand on a hill and trumpet the QE export claim in global contamination of the monetary system and universal spread of risk. Let us expound upon his work, and provide some details, which include two of his graphics. The data is from public source, namely the TIC Report from the USGovt. The banking leaders who have sacked control of the US Govt have a perverse practice to inform their victims.

— USEconomic growth has been both a fraud and a fallacy since 2007. Both Zero Interest Rate Policy and Quantitative Easing serve as life support in a bizarre episode from the Twilight Zone which has merged with our reality. The US Federal Reserve is using 17 central banks working in concert through currency swaps to maintain the fraudulent monetary system, which are probably tied into Forward Rate Agreements (FRA) and Interest Rate Swap derivatives between central banks. Chris Hamilton states, “QE is when the USFed and US Govt stepped in and took over the economy in order maintain asset values. The USFed and US Govt intervened in markets to artificially increase asset prices and create [if not] enhance the wealth effect for unsuspecting sheeple masses. The global governments and central banks began their debt binge to postpone the inevitable crash, kicking the can down the road. The landing strip is fast approaching and the plane’s nose is down, but the plane’s landing gear wheels are not. What comes is a crash of epic proportions or a statist market take-over, or possibly a market holiday where asset valuations are politically determined and set by controlling governments.” The end of free markets occurred long ago. Next comes the end in a politically stamped and approved openly visible process, where working toward a controlled financial economy has failed in a glorious manner.

In the last three years, tremendous distress has befallen the USTreasury Bond complex. If not the London Whale event, or JPMorgan bankers leaping out of buildings, or the Belgium Bulge of $420 billion in USTBonds exposed, it has been misdirections like Operation Twist to conceal the vast shifts behind the USFed walls. Legitimate buyers of USTBonds have largely vanished. Taking their place is the main QE window, JPMorgan derivative machinery, Wall Street carry trade, and hidden BLICS hands. The USFed has exported QE while it claims to wind it down. The criminal banking syndicate has been integrating the USTBond purchase program to new proxy fronts. The TIC Report reveals their identity, all friends to the fascist state. Notice the huge decline in official bond holdings by the typical traditional former allies. No more!

BELGIUM, LUXEMBOURG, IRELAND, CAYMAN, SWISS

The hidden evidence is coming to the fore. The challenge is to identify which entities are buying US Govt debt in the form of USTreasury Bonds. The USFed is no longer permitted to purchase additional US Govt debt issuances due to its ownership limits, unless it changes the portfolio rules. Or else, the USFed chooses not to add to its $4.5 trillion toxic balance sheet, since wrecked beyond repair. In recent months, six nations have been carrying the load of maintaining USTreasury yields at ZIRP. Those nations are Japan and the BLICS: Belgium, Luxembourg, Ireland, Cayman Islands, and Switzerland.

From June 2011 to January 2015, the USFed has bought $825bn in US Treasuries, while the BLICS have quietly bought $818bn in US Treasuries during the same timespan. These are small nations without huge trade surpluses. The source of data is the Treasury International Capital (TIC) Report provided by the Federal Reserve itself. The only remaining offices for purchasing USTreasury debt securities comes down to just Japan and BLICS nations. The US Govt and USFed have conspired as a Ponzi Scheme, using digital counterfeit to purchase perhaps all net new USTreasury debt since July 2011. QE has been exported in a den of thieves and a nest of lies.

Hamilton makes several conclusions regarding the massive project over the last few years. It is the USFed’s backdoor QE initiative to conceal the QE to Infinity (as Jackass describes it). They use central bank currency swaps principally. He asserts the following. Excellent intrepid work by Chris Hamilton, in his Hambone’s Stuff. See Economica (HERE).

- Fed likely uses off-shore locations to maintain continued USTreasury buying because of limits established by Ownership Limit rules.

- Fed created currency swaps to provide USDollars to other country’s central banks.

- In December 2007, the Fed’s FOMC (Federal Open Market Committee) announced it had authorized temporary Reciprocal Currency Arrangements (central bank liquidity swap lines) with the European Central Bank and the Swiss National Bank to provide USDollars to these central banks.

- By April 2009 the swap lines were extended to 11 more central banks including the Banks of: England, Japan, Australia, Brazil, Canada, Mexico, South Korea, Sweden, Denmark, Norway, and Singapore.

- The Fed has maintained that these swaps are not being utilized, in steady lies.

- In October 2013, the Fed and its recently partnered 13 central banks announced that the existing temporary liquidity swap arrangements had been converted to standing arrangements that will remain in place until further notice. In other words, the temporary currency (liquidity) swap arrangements between central banks became permanent until further notice in October of 2013.

FINANCIAL SYSTEM IN TRANSITION

The Western financial system is collapsing. Experts know it but remain silent. Time is running out on both the — USEconomy and the US nation. The USDollar is soon to fade into oblivion. The hidden dismantle of the Petrodollar mechanism has been full of intrigue. It has been followed by the seizure of the sovereign bond markets amidst grotesque blemishes like negative rates and perverted money market funds. Given the massive USTreasury Bond dumping soon to arrive, the facilities are in place to soak up the volume, even while deceiving on the limits imposed on the USFed itself. Be sure to know that true QE volume in total is possibly over $1 trillion per quarter. It is a backdoor bailout of Wall Street banks, given a phony label of stimulus. Arsenic and hemlock are stimulus also, if one considers convulsions as activity. The Gold Standard will return, but through the trade window.

The many crucial new Gold platforms are being assembled, one by one. The most recent platform in view is the Asian Infrastructure Investment Bank, which will render obsolete both the International Monetary Fund and the World Bank. Actually, the IMF will be useful for China to seed the global banking system with a few types of RMB-based bonds. These Chinese Yuan denominated bonds will have a few flavors. In addition to the Chinese Govt Bonds, expect the arrival of some other sovereign bonds held in RMB denomination. They might include UK Govt Bonds or Italian Govt Bonds, even assorted Western corporate bonds, which will reduce investor risk.

The Chinese took control of the IMF, not just to shut it down, but to exploit it as a warehouse distribution center and primary model. They have an agenda. As the global banks place more RMB bonds in their reserves shelves, they will find the US Treasuries of much reduced function and use. Further accumulation of US Treasuries will not occur in the entire Eastern banking system. They will be converted conveniently to Gold bullion during the restoration phase. The Chinese hand moving the IMF lever is a brilliant stroke. Other important steps are in progress. Last weekend, the Chinese announced the creation of a new fund which will operate more like a window to convert sovereign bonds to Gold bullion in very high volume. The target is the ever-present toxic US Govt debt paper cluttering and contaminating the global banking system. The conversion to Gold bullion will be seen as a declaration of financial war. We are entering a new phase. Nothing vague or ambiguous about the official statement. China is planning to launch “a 100 billion Yuan fund led by the Shanghai Gold Exchange, which will in turn facilitate gold purchase for the central banks of member states, [useful] to increase their holdings of the precious metal.” This was just published by news outlet Xinhua in China mainland. Recall the silly critics of Jackass analysis, when in 2005 and 2006 my work warned that China will move from outsourced producer to trade partner, then to trade rival, finally to opponent in trade war. They are moving to executioner of the King Dollar.

SOLUTION & PROTECTION IN GOLD

The solution to the untreated Global Financial Crisis is the gold device. The Eurasian Trade Zone will be built upon the gold route. The heralded Gold Trade Note used as Letter of Credit in facilitated trade will become a critical piece to the emerging platforms. The movement cannot be stopped, not by war, not by sanctions, not by toxic monetary spew, not by hidden channels, not by rigged markets. The global rejection of the USDollar continues. The nascent Eurasian Trade Zone will soon include Germany and whatever nation follows its prudent lead. The preservation of Greece might be done in order to draw Germany into the new trade union, along with Greece, without deep wounds. A strategic stroke rises into view. The King Dollar is dying a horrible death, as Gold will return to its rightful throne. The toxic USD will be chucked into the dustbin of history. Bond fraud, financial market rigging, bizarre features like negative bond yields, and expanded QE will be exposed, certainly not to continue as the system enters the next phase of failure. The climax will be two-fold, in the arrival of the Gold Trade Note, and the launch of the New Scheiss Dollar. The current USDollar will soon find a shut door on trade settlement, as Eastern nations will demand proper payment for products sold in good faith. When you go to the hardware store to purchase a hammer, they will not take fancy toilet paper in payment at the cash register.

The many platforms are finally in view to observe their coordination. The devices and window are visible for converting sovereign debt securities used as toxic banking reserves into Gold bullion. We are moving past drawing board sketches into actual implementation of the greatest dumping of debt paper in modern history. The USTreasury Bond will be destroyed in the process, giving rise to sturdy Gold, with its shiny Silver companion. The Chinese have issued a declaration of financial war, while the United States has installed a vast hidden lashing device to distribute bond demand. The fervent Jackass hope is that the Interest Rate Swap machinery is exposed, along with the Exchange Stabilization Fund for its role, and in the process some ugly details on the London Whale bond derivative losses estimated well over $100 billion and maybe as much as $250 billion for JPMorgan. Clearly JPM is an office overrun and sacked.

The New Scheiss Dollar will be launched in order to guarantee import supply to the beleaguered US nation. However, the New Dollar will not pass muster. It will quickly fail, due to final phase fraud. The many global players will require the United States to make payments in trade with a valid currency. Debate will be tumultuous and nasty. The US nation cannot any longer pay in trade settlement with a currency it is printing with abandon via QE like Zimbabwe. The many global players will demand a true independent accounting of the US Govt gold ledger in accounting. An exciting new chapter comes soon, as the palette full of new Gold & Silver backed currencies will include the Chinese Yuan, the Russian Ruble, the Gulf Dinar, the New Nordic Euro, possibly the New Mexican Peso (silver backed), possibly the Central American Dollar (if Panama can elude US obstacles).

Gold & Silver will be at the core of the new monetary system. Following the Global Currency Reset, better named the Return of the Gold Trade Standard, precious metals will prevail once again. My source is a participant as consultant to the process, which removes speculation and assures implementation. Some very tough lessons cometh. The majority put their trust in paper, and will lose. The people were deceived on matters of money and capital, and are in line to lose both life savings and family fortunes. The American public knows very little about concepts of money and capital, and therefore will be treated harshly in the transition. These confuse money, legal tender, and the dollar. They have turned blind to capital formation and wealth generation. Only precious metals and certain physical assets will survive the storm, as it takes center stage for trade, currency, and banking. The absent solution to the global financial crisis lies in the basic fact that Gold has been excluded from solution, until the next chapter unfolds.