Greece: The Achilles’ Heel That Will Bring Down The European Union

GREXIT Can Only Be Postposed, Not Prevented

TMR Editor’s Note:

“Markets Twist And Turn On Every Headline In The Endless Greek Tragedy” — ZeroHedge.com

The preceding headline reflects the current market dynamics across all markets, not just equities and bonds. In the digitally connected global marketplace, Greece has become the quintessential Achilles’ Heal of the world economy, not just the European Union.

You really have to wonder if the EU founders ever projected Greece to be such an Achilles’ Heal that it would bring down the whole misguided and unpopular enterprise … because that’s exactly what is going on here. Didn’t the Brussels bureaucrats and blind bankers see the writing on the new “Berlin Wall” between north and south?

Brussel’s constant refusal to recognize the will of the people of Europe is certainly at work here. The aggressive discouragement of national referendums across the continent really pissed off a lot of Euro-citizens. When the will of the people was so blatantly subverted and thwarted at every turn, what good could ever come from the EU project? Only dissolution awaits this tyrannical socialist dictatorship.

Which is why Germany has been so intractable and determined to find a resolution that does not include a GRexit. Not only is the very future of the EURO at stake, the orderly resurrection of the Deutsche Mark is also at great risk. The German economic engine cannot tolerate such a radical downshift which a GRexit will surely precipitate.

These are tumultuous and unpredictable times, indeed, as a full-blown GRexit looms. With that eventuality, the whole European Union ship will likely sink in a day and a night, not too unlike … … … Atlantis!

The following article well explains many of the technical reasons why once an Achilles’ heal, always a Achilles’ heal, until the foot is amputated. Time to let it go, EU, or else gangrene will set in and spread to other member states. Once the contagion gains momentum, there’ll be no stopping it. All the other PIIGS will squeal and squirm as they too experience the financial convulsions and economic downturn that a GRexit will surely bring.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Greece Exposes The Global Economy’s Achilles Heel

by Chris Martenson via

Peak Prosperity

The new Greek political party, known as Syriza, the Coalition of the Radical Left, has done the unthinkable: they’ve dared to speak the truth.

In this case, the truth is perfectly captured by the blunt assessment by the new Greek finance minister, Yanis Varoufakis, who recently declared “I’m the finance minister of a bankrupt country.”

Such honest assessments are not supposed to be uttered in politics, no matter how true they may be. And so, as you can imagine, the machinery of the defenders of the status quo is in quite a lather over the whole affair. And it’s doing everything it can to minimize and marginalize the new Greek government.

One editorial in the Financial Times summed up the establishment view quite well, I thought, putting its contempt for those who dare to simply state what is true right on the table:

Athens plots a daring escape from the troika

Feb 2, 2015

Syriza is as radical as any party to take power within the eurozone. Hardly any of Greece’s new cabinet have experience of government; predictably, its first week was studded with chaotic interventions, including a clumsy blunder into EU-Russian relations. Syriza’s rhetoric is still more suited to a university seminar than a serious programme of government.

(Source)

To summarize, the European establishment considers Syriza to consist of radicals with no experience in government who are acting chaotically as they blunder about brandishing immature rhetoric more suited to young students than the serious business of governing.

And that was just the opening paragraph.

As I said, the new Greece administration has got the powers that be in quite a lather. Why is that?

I think it’s because the new Greek rulers have dared to call a spade a spade. They’ve spoken the unspeakable. They’ve said that the vast quantities of debt accumulated by Greece, enabled by central bank money-printing programs, are simply unpayable under current terms.

Of course, this is no different than the situations of Italy, Portugal, Ireland, Spain, the UK, France, Japan — or even the US — which is precisely why it’s being considered such a horrendous foul for Greece to publicly speak as it is now. Such honesty does not have a welcome place in modern politics, and more dangerously, it threatens confidence in the entire system.

Who Is Syriza Exactly & Why Are They In Power?

Since the Syriza party is causing such a stir, I suppose we should take a closer look, especially since so many other ‘anti-austerity’ groups exist in Europe that might become emboldened and try a similar path.

In Wikipedia we find this description:

The coalition originally comprised a broad array of groups (thirteen in total) and independent politicians, including social democrats, democratic socialists, left-wing populist and green left groups, as well as Maoist,Trotskyist, eurocommunist but also eurosceptic components. Additionally, despite its secular ideology, many members are Christians who, like their atheistic fellow members, are opposed to the privileges of the state-sponsored Orthodox Church of Greece.

In 2012 Syriza became the second largest party in the Greek parliament and the main opposition party. It came in first in the 2014 European Parliament election. In mid-2014, polls showed it had become the country’s most popular party. In 2015, in the snap polls held on 25 January, Syriza defeated the ruling coalition and went on to become the winning coalition getting 36.3% of the popular vote and 149 out of 300 seats in the Hellenic Parliament.

Syriza has been characterized as an anti-establishment party, whose success has sent “shock-waves across the EU”. Although it has abandoned its old identity, that of a hard-left protest voice, becoming more populist in character, and stating that it will not abandon the eurozone, its leader Alexis Tsipras has declared that the “euro is not my fetish”.

The party has grown in power over the same time frame that the people of Greece have been living under what most consider to be punishing austerity.

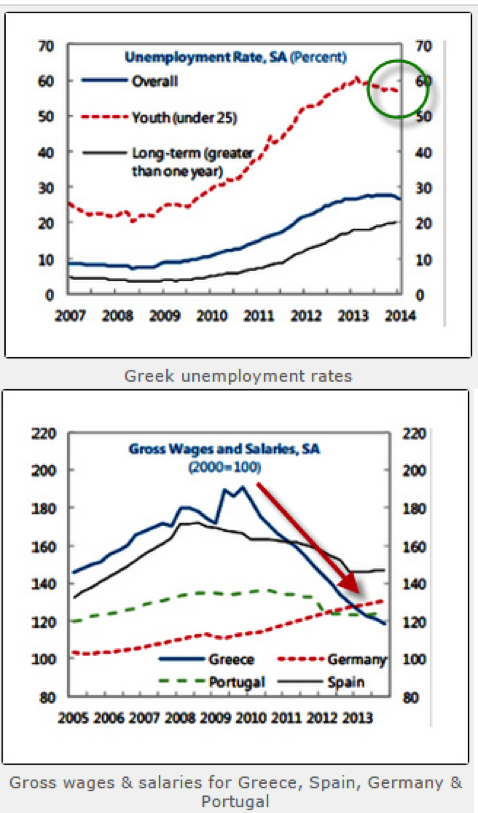

Under the austerity conditions imposed by the European bureaucrats upon the Greek nation, suicides have risen by 35%, unemployment is nearly 30% overall — nearly 60% for those under the age of 25, having fully doubled from 2010 levels — while wages have fallen by nearly 40%.

Note that the rise of Syriza aligns very well with the decline of employment and wages:

(Source)

These are quite understandable reasons for the rise of a party touting a plan to end the pain. Whether they can deliver on that plan is another matter.

The attempts to malign and bully the Syriza politicians into conformance with standard EU practices is likely to fail. The Syriza politicians have a mandate from the people that will not last if they kowtow to the standard ‘kick the can down the road and follow orders’ crowd from Brussels.

The basic problem for the EU political leadership is that the Syriza party is made up of people who came from the outside, consider themselves outsiders, and have no instinctive desire to please existing institutions or lobbyists. They simply aren’t playing the game as it’s “supposed” to be played.

Weeks Away From Running Out Of Money

The clock is ticking…Greece is possibly only weeks away from running out of money. So the situation is quite serious:

Greece may be ‘weeks’ away from running out of money

Feb 3, 2015

Carl Weinberg, chief economist at High Frequency Economics in Valhalla, N.Y., reminded clients in a recent note that Greece’s debt schedule eventually leads to a scenario that ends in a government shutdown and/or default, possibly within a matter of weeks.

“Greece will end up with a default, possibly in the form of a restructuring with a sizable haircut, but possibly in the shape of an outright default,” Weinberg wrote. “The only question is how soon. To believe otherwise cannot possibly be more than wishful thinking.”

Pinning down the exact date when the government would run out of cash under current circumstances is difficult due to a lack of daily data on its exact cash position. But Weinberg says that, unofficially, the government was down to 2 billion euros ($2.3 billion) in mid-January.

In order to finance all the repayments, Greece would have to roll over the outstanding T-bills, run a balanced budget on at least a cash basis, and sell €27.6 billion in new bonds, Weinberg says.

(Source)

With just a couple of billion euros in the coffers, the Greek government has almost no breathing room. It did hold an auction to roll over some of its debt on Feb 3rd, but the bids were very small, and only 625M euros of T-Bills (very short term paper) were bought at the offered rate of 2.75%.

That was barely two-thirds of what was needed to service the upcoming T-Bills maturing on Feb 6th, which total 947M euros. And then on Feb 13th, another 1,400 M euros of T-Bills will mature. And so on throughout the coming weeks and months.

At this rate, the 2 billion euros on hand will not last long. Without some sort of relief, Greece will enter default, triggering all sorts of fun for the holders of its debt and any unfortunate parties that waded back into the pool to sell credit default swaps for Greek debt (and some did).

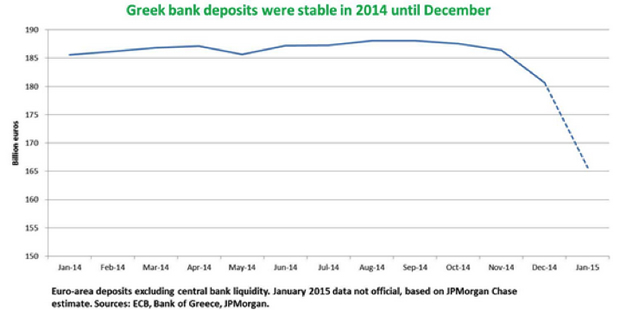

The only logical thing for anyone in Greece to do is to remove their deposits from Greek banks and place them somewhere safer, like in a non-Greek bank (or even under the mattress).

Many are finally now doing that. Though given the obvious warning signs over the past few years, it’s a mystery to me why they’ve waited this long:

(Source)

The ECB has just recently upped the pressure by removing a waiver that allowed Greek banks to post Greek sovereign debt as collateral for euro liquidity (are you watching Spain?). Essentially, this means that the Greek bonds the banks were holding as an ‘asset’ have just become a non-asset as far as the ECB is concerned.

The next step in this crisis is for capital controls to be imposed, to prevent further hemorrhaging of deposits from Greek banks in order to preserve the banks and prevent their utter collapse.

Despite all of this pressure and the inability of the Greek government to fund itself, it seems that the Syriza party is sticking to its course:

Greece Sticks to Anti-Austerity Demands Following ECB Loan Cut

Feb 4, 2015

(Bloomberg) — Greece held fast to demands to roll back austerity as the European Central Bank turned up the heat before Finance Minister Yanis Varoufakis met one of his main antagonists, German counterpart Wolfgang Schaeuble.

The encounter at 12:30 p.m. in Berlin came hours after Greece lost a critical funding artery when the ECB restricted loans to its financial system. That raised pressure on the 10-day-old government to yield to German-led austerity demands to stay in the euro zone. Shares of Greek banks plummeted.

The government “remains unwavering in the goals of its social salvation program, approved by the vote of the Greek people,” according to a Finance Ministry statement issued overnight. Its aim is “coming up with a European policy that will definitively put an end to the now self-perpetuating crisis of the Greek social economy.”

(Source)

So an intense game of chicken is playing out before our eyes. Neither side seems willing to bend. On the one side, you have Greece being led by people who know that the current path being demanded by the EU leads to many years, perhaps decades, of punishing depression for the people of Greece. On the other side is the EU, which worries that if Greece “gets away” with debt restructuring, other weak countries in the Eurozone will want to as well.

“Fire!”

There’s no easy path for Greece and the new Syriza administration appears to know this. That’s why they’re seeking to chart a different course. This upsets the lumbering bureaucracy of the EU ,which has shown a remarkable inability to admit that its prior policies were the wrong ones and have obviously failed.

While Greece is a tiny spec of the EU economy (~1%), the fact that the truth is finally being spoken about its broken finances is a very dangerous match to light at this time. Why? Because most of Europe shares the same unworkable math as Greece. Everybody in power fears what would happen if the entire pile of unpayable claims were to suddenly vaporize.

It’s kind of like being in a crowded movie theater when a fire breaks out. The first few people to catch on leave somewhat calmly, as most watch from their seats. But once it becomes ‘socially acceptable’ to leave, there’s a mad scramble for the exits and pandemonium ensues.

So I can understand the desire of the EU officials to avoid such a panic. But at the same time, their absolute inability to acknowledge the billowing smoke is a very harmful form of denial.

With Syriza shouting “fire!”, the EU bureaucracy is predictably seeking to cast the current Greek leadership as illogical, whack-a-doodle pranksters in the hopes that nobody takes them seriously.

Oops. Too late:

In Madrid, 100,000 flock to anti-austerity Podemos rally

Jan 31, 2015

Madrid (AFP) – At least 100,000 people poured into the streets of Madrid on Saturday in a huge show of support for Spain’s new anti-austerity party Podemos, riding a wave of popularity after the election success of its Greek hard-left ally Syriza.

A sea of demonstrators chanted “Yes we can!” and carried signs reading “The change is now” as they made their way from Madrid city hall to the central Puerta del Sol square in the first major march called by Podemos, which has surged ahead in opinion polls in a crucial election year.

(Source)

So the current high stakes are quickly getting higher.

The sad part of this tale is that the time to have begun to deal with structurally-unsound levels of debt was many years ago, even before the crisis hit in 2008. But even sadder, that crisis was the fire alarm that should have been heeded. But it was completely ignored by the political and banking establishments in the developed world, who instead opted to pour more money and more debt into the financial system rather than face up to the simple truth that Too Much Debt is a very bad central operating principle.

Greece has merely exposed the fatal flaw of the modern economy, it’s Achilles Heel (to stay with the Greek motif), which is that, by definition, a system suffering from Too Much Debt cannot pay it back. The only meaningful question to address at this stage is: Who is going to eat the losses?

The banks would like that to be the citizens of Greece, and the citizens would prefer it to be the other way around. This is the drama that is now playing out.

So Why Should You Care?

If you’re living in Greece, obviously you have a direct interest in how Syriza’s brinksmanship plays out. And if you live in the EU, you should be watching closely to see what the larger ramifications may be for the Eurozone. But should this Greek drama concern the rest of us?

Absolutely.

The sovereign insolvency at the heart of the Greece crisis is not unique nor isolated. Most other countries around the globe share the same terminal condition of having Too Much Debt. Greece, a small player, is simply succumbing earlier than they are.

And as Greece proves you can’t get blood from a stone, other countries will similarly demonstrate their debts cannot be repaid in full, either. And losses will eventually — inevitably — have to be taken. And when that happens, watch out.

In Part 2: The Approaching Great Unraveling – Are You Prepared? we detail out how, in today’s over-indebted, over-leveraged, and intensely interconnected global economy, the losses created by sovereign insolvencies will spark a cascade of mortal shocks across the world’s financial system. Some countries will fall into deflationary depressions while others will experience roaring inflation. Massive failures will ripple across industries and vast amounts of wealth will be transferred from the hands of the many into the few well-positioned in advance.

The developments in Greece are sending us a clear warning. Are you listening?