Market Rigging Explained

NANEX

We received trade execution reports from an active trader who wanted to know why his larger orders almost never completely filled, even when the amount of stock advertised exceeded the number of shares wanted. For example, if 25,000 shares were at the best offer, and he sent in a limit order at the best offer price for 20,000 shares, the trade would, more likely than not, come back partially filled. In some cases, more than half of the amount of stock advertised (quoted) would disappear immediately before his order arrived at the exchange. This was the case, even in deeply liquid stocks such as Ford Motor Co (symbol F, market cap: $70 Billion). The trader sent us his trade execution reports, and we matched up his trades with our detailed consolidated quote and trade data to discover that the mechanism described in Michael Lewis’s “Flash Boys” was alive and well on Wall Street.

Let’s take a look at what we found from analyzing 5 large trades executed at different times over a 4 minute period in Ford Motor Co. Before each of these trades, the activity in the stock was whisper quiet. Here’s a chart showing millisecond by millisecond trade and quote counts in Ford leading up to one of these 5 trades:

You can clearly tell when the trade hits: activity explodes to over 80 quotes in 1 millisecond (this is equivalent to 80K messages/second as far as network/system latency goes). But the point here is that nothing was going on in this stock in the immediate period before this trade hits the market.

In this particular example, there were a total of 24,800 shares advertised for sale at $17.38 (all trades and offered liquidity will be at this same price) from 8 exchanges. The trader wanted 20,000 of these shares. What he got was only 12,133 shares and 600 of these were on a dark pool (which wasn’t part of the 24,800 shares of liquidity on the lit exchanges)! Worse, someone ELSE was filled for 1,570 shares during these same milliseconds! Remember, nothing was happening in Ford until his order came into the market. Based on the other 4 examples, we are sure that no trades would have occurred during these few milliseconds of time if it wasn’t for this trader’s order.

What happened to the 24,800 shares offered and why couldn’t he get at least 20,000 of them? How is it that others were able to get shares during this time? This is especially disturbing when you consider these other traders (HFT) only bought shares in reaction to the original trader’s order.

Detailed Analysis of a Trade

To answer these questions, let’s take a look at the individual order executions and cancellations at the $17.38 limit price. In the table below, there are 7 columns. The number in the 1st column we’ll use to reference a record. The 2nd column is the timestamp of the event – this is from CQS/CTA, the consolidated quote and trade SIP (Securities Information Processor). The 3rd column shows which reporting exchange sent the information in this record. The 4th column shows the total number of shares offered at $17.38 among the exchanges that trade this stock (Ford) and the 5th column (Add/Cancel) shows the number of shares added to, or removed from the total offered. If the 5th column is blank, it’s because this record represents a trade execution.

To answer these questions, let’s take a look at the individual order executions and cancellations at the $17.38 limit price. In the table below, there are 7 columns. The number in the 1st column we’ll use to reference a record. The 2nd column is the timestamp of the event – this is from CQS/CTA, the consolidated quote and trade SIP (Securities Information Processor). The 3rd column shows which reporting exchange sent the information in this record. The 4th column shows the total number of shares offered at $17.38 among the exchanges that trade this stock (Ford) and the 5th column (Add/Cancel) shows the number of shares added to, or removed from the total offered. If the 5th column is blank, it’s because this record represents a trade execution.

The 6th and 7th columns show information about one order execution resulting in a trade at $17.38 (these columns are blank if the record is a quote update). The 6th column shows the number of shares executed, and the 7th column contains either a number which corresponds to the trade report # received by our trader, or an “X” which indicates someone else got this trade execution.

Note that other than the first entry (which is a reference to how long the 24,800 shares was sitting in the books waiting for execution), there is only 3 milliseconds of time shown here! The entire trade is reported in about 15 milliseconds (but 82% completes in 5 milliseconds).

Looking at the table data, we note the first trade is 100 shares on BOST (NQ-OMX Boston) and belongs to our trader. Note, however, it was the 4th trade reported back to him (“4” in the last column).

The next trade is 67 shares at EDGE (New Bats Edge-A), and that someone else bought those shares (“X”). How does that happen?

Lines 4 and 5 are order cancellations of 100 shares and 600 shares from ARCA and NYSE respectively – all in the same millisecond!

Lines 6, 7 and 8 are trade executions from EDGE and belong to our trader – note the first trade (line 3) was also from this exchange but went to someone else. This also means that the order cancellations from NYSE and ARCA happened before any size appeared.

The next 19 entries (lines 9 to 27) show a flurry of order cancellations coming in from NYSE, ARCA, BATS, NQEX and EDGX. This is before the first trade execution at any of those exchanges! This flurry of cancellations removes 10,300 shares from the number of shares offered (Shares Avail. column drop from 21,400 down to 11,100)!

Within 2 milliseconds, half of the shares have disappeared, someone else stole 67 shares, and our trader has only 13.5% (2,700 shares) of his order filled!

Let’s chart the changes to the available liquidity, the shares executed, and orders canceled to get another look at t

Let’s chart the changes to the available liquidity, the shares executed, and orders canceled to get another look at t his problem.

his problem.

First off, let’s start with the ideal case, which is shown in the chart on the left. The number of shares available at $17.38 is shown by the green line, which starts at 24,800 and decreases from order cancellations and trade executions (it would increase if additional sell orders were added). Note the green line is a plot of the Shares Avail. column in the table above. The cumulative number of shares executed is shown as a blue line.

In the ideal case (left chart), a trade arriving first, would execute against all the liquidity until the order was complete or liquidity (shares available) became exhausted. The blue line rises in synch with the green line, until 20,000 shares are traded.

In the real world, things are not that simple. There is another variable to account for: namely order cancellations. The cumulative number shares for sale at $17.38 that have been canceled is shown by the red line.

There is also a fourth variable – trade executions that belong to other traders, but we’ll leave that out for now for simplicity sake.

The chart on the right clearly shows that order cancellations happen far faster than trade executions (red line goes up faster than blue line). This is why our trader wasn’t able to get the advertised liquidity – the orders simply disappeared faster than exchanges processed his buy order.

In fact, more shares are canceled than executed – note the red line ends above the blue line. Also note how much of the activity takes places in about 2 milliseconds (09:47:56.571 to 09:47:56.573).

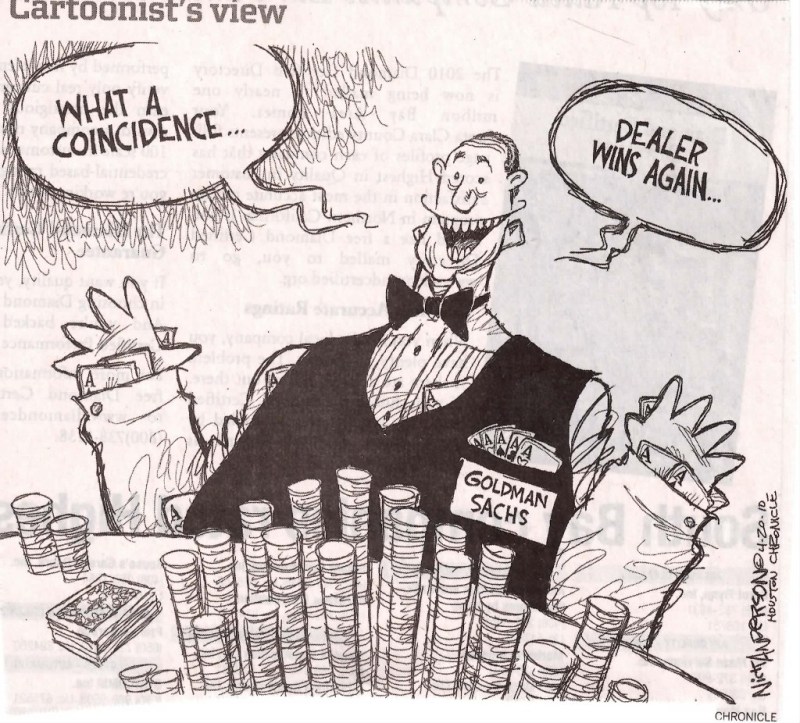

Perhaps this is just an isolated case and the order cancellations happening a fraction of a second before the trader’s order were just a coincidence?

Not an Isolated Case

If we take the number of shares available when the order first started executing, and plot the percentage of those shares that were canceled during the trade execution, we’ll arrive at the Share Cancel % (which is simply the percentage of shares were canceled and not executed). In the first example we detailed above, the percentage was slightly more than 50%. The following chart shows the percentage of orders canceled for each of the 5 trade examples. If the chart below doesn’t sufficiently cause alarms to go off, then you might want to restudy the data up to this point. The Share Cancel % is shockingly high:

The next (and last chart) breaks down into detail where the available shares went when our trader’s order started executing. It includes the component “HFT Shares” – which are trades that should have gone to our trader, but were instead stolen by other market participants, who only made those trades after reacting to his order. Note in some examples, the number of shares stolen is disturbingly high.

Conclusion

All this evidence points to an inescapable conclusion:

The order cancellations and trades executing just before, or during the traders order were not a coincidence. This is premeditated, programmed theft, plain and simple.

Michael Lewis probably said it best when he told 60 minutes that the stock market is rigged. To the fantastic claims made by HFT that they provide liquidity, perhaps we should ask, what kind of liquidity? To the now obviously ludicrous claim that “everyone’s order uses the same tools that HFT uses”, we’ll just say, the data shows otherwise. To Mary Jo White and other officials who claim the market isn’t rigged and that regulators need to look at the data before making any decisions, well, you made it this far – if things aren’t clear, just re-read the above, or just call us and we’ll explain it to you. Or dust off Midas and lets us show you how to work with data.

One more note to the SEC in particular – if you believe that the industry can fix these problems on their own, then we believe you are no longer fit to regulate, because that is not, and never was, how Wall Street works. Honestly, a free for all, no–holds–barred environment would be better than the current system of complicated rules which are partially enforced, but only against some participants. And make no mistake, what is shown above is as close to automatic pilfering as one can get. It probably results in a few firms showing spectacularly perfect trading records; it definitely results in people believing the market is unfair and corrupt.

And to CNBC and other financial media companies who say these problems have all been fixed – we think you might have been lied to. Probably by the ones doing the market rigging.

And finally, to our regular readers: we are taking a break. Everyone has a limit to how much corruption they can witness and digest in a given period of time and we’ve simply reached our limit.

* * *

We wish Nanex an enjoyable break.

We here at Zero Hedge, on the other hand, are not only just getting started, but every new case of corruption (which inevitably 6/12/24 months prior was nothing but another ridiculous “conspiracy theory”) merely doubles our resolve to expose and chronicle this farce of a rigged market, rigged economy, and rigged political theater, as an aid to whatever comes next. One can only hope that the mistakes of this period of near-terminal lunacy will be studied and, hopefully, not repeated.