Helicopter Footage Shows Devastating Aftermath Of “California’s Deadliest Wildfire Disaster” in 2017

CALIFORNIA FIRESTORMS: Disaster Capitalism At Its Worst

ABEL DANGER: “Catastrophe Bond Market” – Vulture Profit From California Fires

by David Dawkins

Posted Nov 19, 2018 – Hawkins Malipod™–Con Air Serco’s Paradise Patents—Teachers’ Cat Bond Arcing– McVicar’s Bridge of Fraud™ (Source)

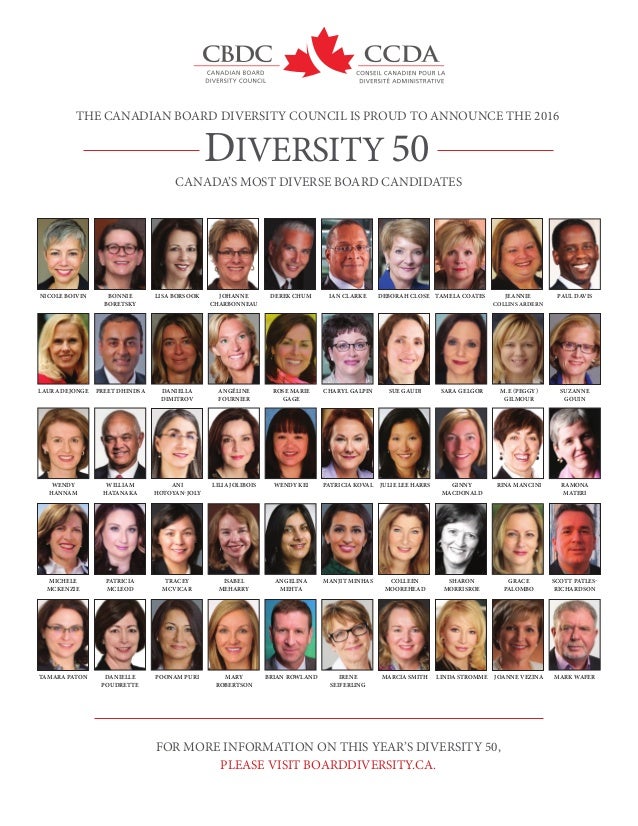

David “Sherlock” Hawkins is using his Malipod™ virtual machine (see references) to investigate Nicholas (Nick) Soames and Tracey McVicar as possible de-facto custodians of patents describing AI and expert-system algorithms including Jerome Lemelson’s “Prisoner [Con Air] tracking and warning system and corresponding methods 2000-04-25 US6054928A Grant” needed by Serco, the USPTO’s outsourcer for Pre-Grant Publication (PGPubs) Classification Services, and its shareholders such as the Teachers (TIAA) pension fund, to sponsor a catastrophe (cat) bond in California—$200 million Cal Phoenix Re Ltd. (Series 2018-1) transaction—where witting or unwitting prisoners and firefighters and scientifically-illiterate teachers…

David “Sherlock” Hawkins is using his Malipod™ virtual machine (see references) to investigate Nicholas (Nick) Soames and Tracey McVicar as possible de-facto custodians of patents describing AI and expert-system algorithms including Jerome Lemelson’s “Prisoner [Con Air] tracking and warning system and corresponding methods 2000-04-25 US6054928A Grant” needed by Serco, the USPTO’s outsourcer for Pre-Grant Publication (PGPubs) Classification Services, and its shareholders such as the Teachers (TIAA) pension fund, to sponsor a catastrophe (cat) bond in California—$200 million Cal Phoenix Re Ltd. (Series 2018-1) transaction—where witting or unwitting prisoners and firefighters and scientifically-illiterate teachers…

- Trigger spot-fixed damage to property and body count for deaths in Paradise, a town in Butte County, California, most likely caused by house fires resulting from arcing and the negligent, reckless, wilful or fraudulent use of patented devices such as Texas A&M University System’s Expert system for detecting high impedance faults 1996-08-27 US5550751A Grant;

- Inject fake news and media plays through the federal bridge certification authority (FBCA) and QinetiQ North America Inc.’s Social engineering protection appliance US9123027B2 to defraud the ‘sheeple’ into believing that the California fires are due to catastrophic anthropogenic global warming (CAGW) caused by man-made emissions of carbon dioxide when, in reality, man-made arcing triggered fires which burnt down the houses in Paradise but left nearby trees standing!

Hawkins Malipod™ investigations suggest that agents of Soames, McVicar and Serco have been using expert-system algorithms and a ‘submarine’ version of the Lemelson prisoner-tracking patent in Antigua since the mid-‘90s to conceal an international racketeering network where SWAT teams of prisoners, parolees and victims are monitored for “heart rate, pulse, blood pressure, respiration, temperature, and chemical properties of selected body fluids such as sweat and/or breath” and rewarded for the removal or spoliation of evidence from murder-for-hire, hard-core and child-pornography and online-betting sites, formerly operated by Vancouver-based Starnet Communications, as was apparently the case …

- In August 1999, when ‘SWAT teams and computer specialists from the U.S. Internal Revenue Service and the U.S. Customs Service, invaded Starnet’s Carrall Street office and seized equipment and records’;

- On 9/11, when Nicholas Soames deployed Serco Con Air dead-pool SWAT teams to the 47th floor of WTC #1 and Tracey McVicar attempted to remove a computer from the WTC complex;

- In August 2010, when SWAT teams appear to have “tidied up” the flat of the late MI-6 spy Gareth Williams and removed fingerprints from the padlocked bag containing his body; and,

- On December 15, 2017, when SWAT teams appear to have removed electronic straps from the wrists of the late Barry and Honey Sherman; returned alibied Con Air killers to their prison cells; and, injected fake news of a murder suicide into the Toronto Police communications system.

_______________________________

FILE – In this Thursday, Nov. 15, 2018, file photo, residences leveled by the wildfire line a neighborhood in Paradise, Calif. Northern California crews battling the country’s deadliest wildfire in a century were bracing for strong winds Sunday, Nov. 18, that could erode gains they have made in containing the fearsome blaze, which has killed dozens and leveled a town [but left the trees standing]. (AP Photo/Noah Berger, File)

Utility company says it sparked Thomas Fire

Audio: Dispatch from the destructive Camp Fire and fire dispatch audio

Catastrophe Bonds as “Disaster Capitalism”

Copy of SERCO GROUP PLC: List of Subsidiaries AND Shareholders! [Note Serco shareholders and Con Air SWAT teams appear to have sponsored leverage-lease and cat-bond frauds for the Double Occurrence demolition of the Twin Towers on 9/11 where 343 NYPD firefighter died wrongful deaths]

Archive.org shows the archived page has been scrubbed (Link)

Hawkins has identified Nicholas Soames, a grandson of Winston Churchill and former Minister of State for the Armed Forces from 1994 to 1997 in the government of John Major, as the primary custodian of patents covering Con Air AI/expert systems and Entrust PKI devices who, allegedly, ordered Serco and the UK MOD to adopt the version of Entrust PKI developed by a CAI investee, the B.C.-based MacDonald, Dettwiler and Associates Ltd., for the secondary custodian Tracey McVicar, founder of the Vancouver branch of the NYC-headquartered CAI Private Equity Group, whose special investors were alleged clients for Starnet’s online LGBT, child pornography and pig-farm murder-for-hire services from 1996 to 2002.

Hawkins is recommending that families who lost loved ones in HVT or mass-casualty events associated with the negligent, reckless, wilful or fraudulent use of patents in the de-facto custody of agents of Soames, McVicar, Serco or the CAI Private Equity Group, including their shareholders, investment bankers or clients, should follow civil procedures with claims for damages for wrongful deaths similar to those used by the Brown and Goldman families where were awarded compensatory and punitive damages totalling $33.5 million after O.J. Simpson was acquitted in a verdict announced on October 3, 1995 of the murder of his ex-wife, Nicole Brown Simpson, and her friend, Ron Goldman, but where Simpson as sole defendant in the civil case was found responsible for both deaths.

Hawkins has also stated that if he is given all or any of the $10 million reward offered by the family for his help in solving the Sherman murders, he will share the reward equally with Jason Goodman, founder of Crowd Source the Truth, as the only investigative journalist with the technical ability to work with Hawkins on the real-time ‘discovery’ of evidence needed to identify the principals of network who use patented devices or systems to spot fix times of death or body counts at HVT or mass-casualty events.

Introduction to Reverse Engineered Crime Scene Investigation with David Hawkins

David Hawkins

©2018 David C. Hawkins

References

“Why use Malipod to describe a virtual machine to reverse engineer coordinated and spoliated HVT and mass-casualty events? [‘Mali-’ because it is derived] from dismal (adj.) c. 1400, “unlucky, inauspicious,” in dismal day, earlier as a noun, in the dismal (c. 1300) “in days of misfortune or disaster, under inauspicious circumstances, at an unlucky time,” from Anglo-French dismal (mid-13c.), apparently from Old French (li) dis mals “(the) bad days,” from Medieval Latin dies mali “evil or unlucky days” (also called dies Ægyptiaci), from Latin dies “days” (from PIE root *dyeu-“to shine”) + mali, plural of malus “bad” (from PIE root *mel- “false, bad, wrong”) and ‘-pod’ because Con Air SWAT teams tend to bond together as experts to exploit different vulnerabilities—Sex, Fear, Greed, Power—in their victims.”

“Catastrophe Bonds: An Important New Financial Instrument July 2014 Michael Edesess, PhD Research Associate, EDHEC-Risk Institute … The ultimate investors in CAT bonds are principally institutional investors such as pension funds, endowment funds and hedge funds. Primary investors are both institutional investors investing directly and dedicated ILS funds such as those managed by U.S.-based Fermat Capital Management, Inc., and Swiss-based Plenum Investments Ltd., which are organised like hedge funds and in which institutional investors and accredited individual investors can invest. Institutional investors that invest directly include such entities as TIAA-CREF, the academic and non-profit organisation retirement fund manager, Ontario Teachers fund [partnered McVicar’s CAI Private Equity Group in funds used by Macdonald Dettwiler to embed Entrust PKI in the federal bridge, track prisoners with mobile radio data systems, and, develop the IAP decoy and drone maneuvers used in the 9/11 attacks fraudulently attributed to Osama bin Laden], and hedge funds like DE Shaw and AQR.”

“California’s electric utilities under investigation again for starting deadly wildfires

New law could protect utility shareholders despite electric companies’ suspected role in starting fires.

MARK HAND NOV 13, 2018, 11:50 AM

California’s two largest electric utility companies are under investigation again for their role in starting major wildfires in the state. But the companies are probably less worried about how the devastating fires could impact their finances after state lawmakers passed legislation earlier this year to protect the companies and their shareholders from full financial liability.

Pacific Gas and Electric (PG&E), already facing lawsuits and fines for its role in causing devastating wildfires in previous years, owns the transmission lines that may have caused the Camp Fire in Northern California, the deadliest wildfire in California history.

And in Southern California, state regulators are investigating the possible role played by Southern California Edison (SoCalEd) in the massive Woolsey Fire currently burning in Los Angeles and Ventura counties, California.

California lawmakers, however, are growing frustrated with electric utilities’ alleged role in the state’s wildfires. State Sen. Jerry Hill (D) is looking into legislation that would break up the state’s investor-owned utilities or turn them into public power utilities following reports about how equipment owned by PG&E and SoCalEd may have started the Camp and Woolsey fires, KQED reported Sunday.

“If PG&E is found responsible for burning down the state again, at some point we have to say enough is enough and we have to ask should this company be allowed to do business in California?” said Hill, who represents an area of Northern California south of San Francisco, the Associated Press reported.

State Sen Jerry Hill in response to @KQEDnews report that PG&E line might be tied to #CampFire:

“Revoking their charter, their license, their ability to be a monopoly … I think that should be under serious consideration.”

Says he will look at legislation to break up utility.

Hill’s district was the site of the deadly 2010 San Bruno natural gas pipeline fire and explosion. In 2017, a federal judge imposed a $3 million fine, five years probation and forced PG&E to run ads informing the public about its role in the explosion.

Earlier this year, the California Department of Forestry and Fire Protection (Cal Fire) released a report that found electric equipment owned by PG&E caused 12 wildfires that killed 18 people and burned hundreds of square miles in October 2017.

The Camp Fire in Butte County has burned 113,000 acres and resulted in at least 42 deaths. As of Monday evening, the fire was 30 percent contained, according to Cal Fire. The Woolsey Fire has burned more than 91,000 acres in Los Angeles and Ventura counties with an estimated 370 structures destroyed and at least two people killed. As of Monday evening, the fire was 30 percent contained.

Even if the utilities are found to have played a major role in the two wildfires, new legislation passed earlier this year could offer them some financial protection. In September, California Gov. Jerry Brown (D) signed wildfire reform legislation that included changes to wildfire liability laws that protect utilities from bearing the full financial burden when their equipment is found to have caused wildfires.

Residents and consumer advocates complained that state lawmakers who voted for the legislation are more concerned about how wildfires could harm shareholders of utility companies like PG&E than how the change in law would raise electricity prices for the company’s customers.

The law made it easier for utilities to pass along costs from fire-related damages to their consumers and also avoid possible bankruptcy from a series of major fires that occurred during the 2017 fire season.

It remains unclear how the law will impact electric utilities for damage caused by wildfires in 2018. The new law created two mechanisms for the state’s investor-owned electric utilities — PG&E, SoCalEd, San Diego Gas and Electric — to shift the costs of wildfire lawsuits onto their customers. One process begins in 2019, and the other process covered lawsuits that resulted from the devastating 2017 wildfire season.

But the new law kept the previous rules in place for the 2018 wildfire season. Given their willingness to protect electric utilities from financial costs for the record 2017 wildfire season, it is likely the California Legislature will go back and pass a law that offers electric utilities protection from the huge financial costs of the 2018 wildfire season.

PG&E could be facing huge costs if it is determined that its equipment caused the Camp Fire. A day before the Camp Fire started, PG&E contacted a local resident, Betsy Ann Cowley, about accessing her property due to the company’s power lines causing sparks. In an email communication with Cowley, describedto the Associated Press, PG&E told her “they were having problems with sparks.”

The next day, the fire started near Cowley’s property and then traveled to neighboring Paradise, California — town of nearly 27,000 people — that was almost completely destroyed.

Firefighters on Monday declared the area surrounding the power lines on Cowley’s property a crime scene.

Last Friday, PG&E told the California Public Utilities Commission (CPUC) that it had detected an outage on an electrical transmission line near the site of the fire. The area where CalFire says the fire started and where PG&E says sparks were detected on Cowley’s property is roughly the same, according to the AP report.

Meanwhile, SoCalEd also reported an outage near the spot where authorities say the Woolsey Fire started last week. Authorities say the fire started during the afternoon last Thursday, near Woolsey Canyon, east of Simi Valley. Later that day, the utility notified the CPUC that it had experienced an outage two minutes before the fire reportedly started at 2:24 p.m. PT.

In a statement, SoCalEd said it has been in communication with the CPUC with respect to these fires and has submitted an initial electric safety incident reporton the Woolsey Fire.

“The information in the report is preliminary. There has been no determination of origin or cause of either wildfire,” SoCalEd said. “SCE will fully cooperate with any investigations.”

PG&E has provided an initial electric incident report to the CPUC. The utility said it will fully cooperate with any investigations, although it emphasized there has been no determination on the causes of the Camp Fire.”

“Texas A&M University System’s Expert system for detecting high impedance faults 1996-08-27 US5550751A Grant Abstract An expert detection system includes a method and apparatus for detecting high impedance faults occurring on a distribution circuit coupled to an AC power source. Based upon an expert’s knowledge of high impedance fault behavior and the performance of various fault detection techniques, the expert forms a belief as to whether a high impedance fault has indeed occurred. The expert’s beliefs may be adjusted with an elliptic formula, and then used to weight the status output of each technique. The weighted multiple technique outputs are combined to determine whether a high impedance fault has occurred. The expert’s beliefs are calibrated during initial start-up by comparison with a confirmed performance history of the detector using a scoring rule. The belief calibration may be included during operation to provide on-line adaption of the expert detector to the changing situations of the distribution circuit.”

“Serco Processes 4 Millionth Patent Application for U.S. Patent and Trademark Office

HERNDON, Va., Nov. 15, 2018 /PRNewswire/ — Serco Inc., a provider of professional, technology, and management services, announced today that the Company recently processed their 4 millionth patent application for the U.S. Patent & Trademark Office (USPTO). USPTO is the government agency that grants U.S. patents and registers trademarks. Since 2006, Serco has performed classification and other analysis services through awarded contracts including Pre-Grant Publication (PGPubs) Classification Services, Initial Classification and Reclassification (ICR) Services, and Full Classification Services (FCS) contracts.

Serco’s Intellectual Property (IP) team is responsible for the analysis of the full disclosure including claims, specifications, and drawings in patent applications to identify the subject matter contained in each application and to assign the appropriate U.S. and international classification symbols representative of proposed inventions. These classifications are critical elements to the patent process and are used to enable examiner and public search as well as for internal routing of documents at the USPTO.

In processing 4,000,000 applications, Serco patent classification experts have analyzed more than 56,000,000 claims, and assigned more than 18,000,000 classification symbols with a quality measure greater than 95%. Serco exceeded contractual timeliness measures by delivering over 99.99% of these applications to the USPTO on-time. Serco has received multiple awards and recognitions from the government for exceeding quality and timeliness standards.

On the program, Serco has driven innovation by integrating artificial intelligence (AI) and other automated toolsets into business processes that streamline the classification decision process and enhance classification quality. The Serco IP Program is located in Harrisonburg, VA and currently employs over 100 scientists, engineers, and IP professionals. Additionally, the team supported the USPTO’s classification transition to the Cooperative Patent Classification system launched as a joint effort between the USPTO and the European Patent Office (EPO) in 2010.

U.S. Congressman Bob Goodlatte, who has visited the facility on multiple occasions, congratulated Serco for their support of the USPTO and processing their 4 millionth application. “America is the world leader in innovation and creativity,” said Congressman Goodlatte. “The strength of our economy and American jobs rely on a strong patent system that fosters an environment of innovation. Congratulations to Serco on achieving this milestone and continuing to help make America more competitive.”

“We take great pride in the work our team does for the USPTO because it promotes U.S. innovation and assists the USPTO in achieving their mission of providing timely and high quality protections to U.S. inventors,” said Tom Watson, Senior Vice President of Serco’s Federal Services Business Unit.

In addition to the patent classification services to the USPTO, the Serco IP team offers a variety of search, analysis, and training services to legal practitioners and corporate clients. The team provides the strategic framework for efficient and successful approaches to identifying relevant prior art in patent litigation or patent prosecution. For more information on all of our IP services visit www.SercoPatentSearch.com.

About Serco Inc.

Serco Inc. is a leading provider of professional, technology, and management services. We advise, design, integrate, and deliver solutions that transform how clients achieve their missions. Our customer-first approach, robust portfolio of services, and global experience enable us to respond with solutions that achieve outcomes with value. Headquartered in Herndon, Virginia, Serco Inc. has approximately 6,000 employees and annual revenue of $1 billion. Serco Inc. is a wholly-owned subsidiary of Serco Group plc, a $4 billion international business that helps transform government and public services around the world. More information about Serco Inc. can be found at www.serco-na.com.”

“Cal Phoenix Re wildfire cat bond launched at $200m for PG&E Corp.

by ARTEMIS on JULY 11, 2018

The first pure wildfire exposed catastrophe bond has come to market, as California focused electrical utility PG&E Corporation (the Pacific Gas and Electric Company) turns to the capital markets and ILS investors as a source of collateralized insurance protection with a $200 million Cal Phoenix Re Ltd. (Series 2018-1) transaction.

Being a corporate beneficiary of a property catastrophe bond exposed solely to California wildfire risks you might have thought that the PG&E cat bond would feature a parametric trigger, but it doesn’t as the risk is being ceded via Energy Insurance Mutual (of which PG&E is a member) as the insured and reinsurance firm Tokio Millennium Re AG.

Because of that layering of risk transfer the new Cal Phoenix Re Ltd. (Series 2018-1) catastrophe bond is an indemnity arrangement, with the sale of the notes issued by Cal Phoenix Re Ltd. set to collateralize the retrocessional reinsurance agreement with Tokio Millennium Re, which in turn provides the reinsurance protection to Energy Insurance Mutual, which then insures the PG&E Corporation risk.

It’s an interesting way to see the corporate risk of PG&E cascade through multiple layers of insurance, reinsurance and retrocession to the capital markets, allowing for an indemnity coverage arrangement to be put in place, backed by the efficiency of ILS capacity.

Bermuda special purpose insurer Cal Phoenix Re Ltd. will aim to sell a $200 million tranche of Series 2018-1 notes to investors, with the proceeds providing the capital to back the risk transfer for PG&E.

The cat bond will ultimately provide PG&E with a three-year source of insurance protection against property damages caused by wildfires in the state of California, but interestingly this appears to be third-party wildfire liability so the damage caused by wildfires for which PG&E is liable.

This seems to be a first in the catastrophe bond market, providing PG&E with a way to transfer a significant risk to its business to the capital markets.

It also appears that under loss adjustment expenses will be included certain litigation risks related to the third-party wildfire related property damages, which again appears to be a first in the cat bond marketplace.

The insured Energy Insurance Mutual Limited, actually its subsidiary Energy Insurance Services, Inc., is a provider of third-party liability insurance coverage to energy utility and related companies.

It appears that this new Cal Phoenix Re cat bond is a direct response to the recent severe California wildfire season, which had seen PG&E threatened with liability cases, according to news reports.

Cal Phoenix Re, as issuer, will issue the notes to be sold to ILS funds and ILS investors, with the proceeds backing a three-year annual aggregate and indemnity reinsurance arrangement with Tokio Millennium Re, the reinsured, although the coverage cascades back to PG&E.

The cover is for California wildfires that are caused by or due to infrastructure owned by the insured PG&E.

We’re told that the currently $200 million tranche of Series 2018-1 notes to be issued by Cal Phoenix Re will have an initial attachment point of $1.25 billion and cover a $500 million layer from there upwards, with a franchise deductible per event.

That equates to a modelled initial attachment probability of 1.35%, an initial expected loss of 1.01% and we understand that the notes are being offered to investors with coupon guidance of 6% to 6.5%.

That’s a significant multiple, which could be to ensure investors feel compensated for taking on potential unknowns with this catastrophe bond, such as the litigation risk that could be included under loss adjustment expenses.

It will be fascinating to see how this new Cal Phoenix Re Ltd. catastrophe bond is received by the ILS investor community, given the novel nature of the risk, the layered risk transfer and the potential for third-party liability to add to losses qualifying under the terms of the deal.

We’ve added the new Cal Phoenix Re Ltd. (Series 2018-1) transaction to our catastrophe bond Deal Directory and will update you as information allows.”

“Who’s behind Artemis Steve Evans owns and operates Artemis. His background is diverse, coming from an internet start-up with a focus on the reinsurance sector and reinsurance publishing and analysis. As far back as 1995 Steve Evans was responsible for information management and editorial concerns at the risk & reinsurance focused internet startup WIRE Ltd. He helped create the Risk Information & Services Exchange (formerly rsx.co.uk, some of you may remember it), worked on the first version of Aonline, created, launched, updated, marketed and managed Artemis.bm in its early guise and built websites for clients such as Lloyd’s of London, Kiln, SVB Syndicates and many other London market and international insurance and reinsurance companies.

After his time with WIRE he moved on and worked in the reinsurance industry for Willis Group, one of the largest insurance and reinsurance brokers in the world. Leading their ebusiness development department and delivering both customer facing and internal websites and services whilst continuing to write for and manage Artemis.

Artemis then became solely owned by Steve Evans and the website continued to evolve while he worked in a number of senior executive level international e-commerce and knowledge management roles for some of the largest corporations in the world. Responsible for the functional, editorial and technical development and operations of websites which turned over hundreds of millions of dollars per year for brands including Virgin and Travelocity.

Steve Evans is owner and editor in chief of Artemis.bm and also of new venture Reinsurance News. He also provides advisory services and expert insight to a number of new or innovative ventures in the ILS, reinsurance and risk transfer space as well as to some venture funded internet start-ups.

You can find out more about Steve Evans on Linkedin.”

“Details CSR and responsible investing initiatives on governance, diversity and inclusion, community and sustainability

NEW YORK, November 15, 2018 – TIAA’s efforts to maximize its positive impact on society and the people and institutions was highlighted today in the publication of its second Responsible Business Report.

“Throughout our first 100 years, TIAA has made a positive impact in many ways – from volunteering in our local schools to pursuing responsible investing around the globe,” said Roger W. Ferguson, Jr., president and CEO of TIAA. “As we enter our second century of operation, we remain guided by the values that have brought us this far and committed to improving the lives of our customers and stakeholders through responsible business practices.”

The latest report covers TIAA’s corporate social responsibility and responsible investing policies and programs across four key impact areas: governance, diversity and inclusion, community, and sustainability. It also details progress of key milestones over the past year, including:

Responsible Investing – more than $650 billioni of total firm assets now adhere to the United Nations’ Principles for Responsible Investment (UNPRI).

Diversity and inclusion – more than 6,500 employees have completed some or all of the Journey to Inclusion program, an initiative designed to increase awareness of common biases and provide tools for managers in hiring, coaching, and developing diverse teams.

Sustainability – seven of TIAA’s offices in New York, Charlotte and Denver have achieved the U.S. Environmental Protection Agency’s Energy Star Label.

Community – employees participated in 100 Days of Difference, a nationwide employee volunteer and community service program between March 5 and June 12, 2018 as part of the company’s centennial celebration. Over the course of these 100 days, over 9,000 TIAA volunteers participated in 341 projects, impacting more than 650,000 lives.

Governance – Nuveen’s Responsible Investing team supported 100% of shareholder proposals requesting disclosure of a company’s climate risk and plans to manage its carbon footprint in 2018.

As the investment management division of TIAA, Nuveen is one of the largest managers of responsible investment assets in the industry, with two-thirds of its investments across asset categories managed according to the United Nations-backed Principles of Responsible Investment.

“Our number one goal is growing and protecting our clients’ investments in a way that meets their long-term needs and expectations,” said Vijay Advani, CEO of Nuveen. “Responsible investing plays an important role in how this is done. We believe the right investments can create positive outcomes for investors and the communities where we live. Responsible investing is a journey and not a destination.”

For more information about how TIAA is making an impact and to read a full copy of this year’s responsible business report, please visit https://www.tiaa.org/public/pdf/tiaa-responsible-business-report.pdf .

About TIAA

TIAA (tiaa.org) is a unique financial partner. With an award-winningii track record for consistent performance, TIAA is the leading provider of financial services in the academic, research, medical, cultural and government fields. TIAA has $1 trillion in assets under management (as of 9/30/2018)iii and offers a wide range of financial solutions, including investing, banking, advice and guidance, and retirement services.

Press contact

Mike Tetuan

888-200-4062

media@tiaa.org