“Soap bubbles”, CSE272 “Advanced Appearance Modeling” taught by Prof. Henrik Wann Jensen. (Photo source: University of California at San Diego)

Global Sovereign Bond Bubble Ready To Burst

Prevailing Gray Swans: The Clear and Present Danger List for the Week Ending September 30, 2016

7. Bursting of the global sovereign bond bubble and the interconnected financial derivatives network

___

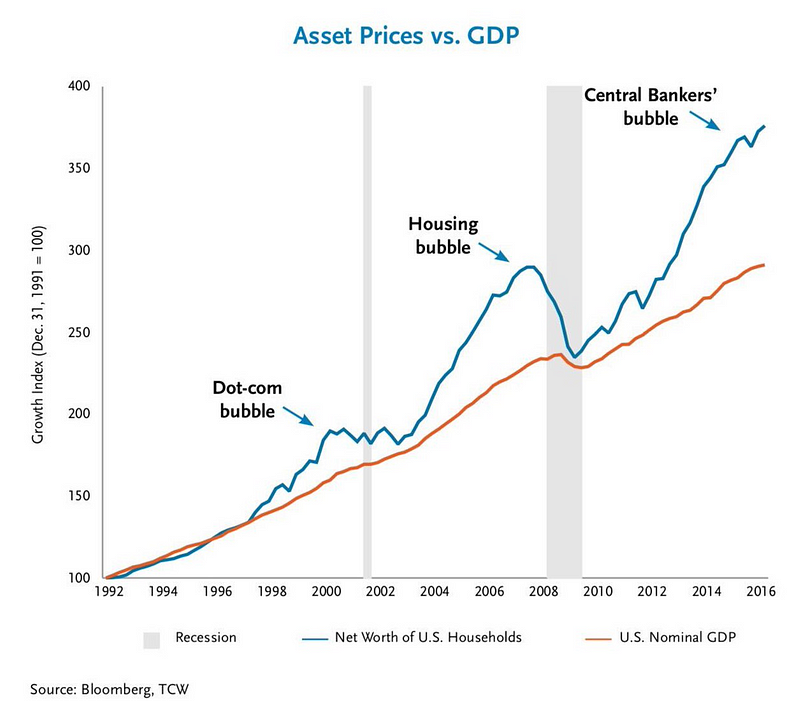

Much has been written about financial bubbles since the dot com equity bubble in 2000, the housing bubble in 2008 and the emergence of several bubbles in the “inflating phase” in the last several years. This intelligence briefing is going to provide deep background on the architecture of a financial bubble that has been silently inflating for over 30 years in the background but has greatly intensified since the housing bubble collapse due to extreme and sustained, global, central bank (CB) intervention. This bubble is the “mother of [all] bubbles” (MOB) because it is monolithic with currencies, bonds, and derivatives and now is contributing to inflated asset pricing of equities and residential and commercial real estate. The MOB is a global architecture mostly composed of currencies trading in high daily volume in foreign exchange (FOREX) flows such as USD, euro, yen, GBP, Swiss franc and the Australian dollar.

The Inherent Sociological Phenomenon of Financial Bubbles

Definitions of financial or asset bubbles:

A market phenomenon characterized by surges in asset prices to levels significantly above the fundamental value of that asset. Bubbles are often hard to detect in real time because there is disagreement over the fundamental value of the asset.

Source: NASDAQ

When the prices of securities or other assets rise so sharply and at such a sustained rate that they exceed valuations justified by fundamentals, making a sudden collapse likely — at which point the bubble “bursts.”

Source: Financial Times lexicon

In economic theory, market actors are assumed to act rationally but if this were true in reality there could never be a bubble: the connection between fundamental or intrinsic value and a higher price exceeding this value would rarely exhibit a transaction because it wouldn’t make sense: restraint — backstopped by logic — would dominate behavior. Simply entertaining the belief that a “greater fool” will take it off your hands at a handsome profit would not outweigh the fact that the net price of the transaction exceeds the intrinsic value of the asset — risk of loss increases nonlinearly with the increasing divergence between the price paid and the value of the acquired asset just like the increasing risk of an avalanche with each additional snowflake on the pile given the divergence from stability as dictated by physical law. So, in reality, market pricing is influenced by sociological phenomena that at times becomes so powerful as to drive asset prices to ludicrous levels:

Irrational exuberance.

“It’s different this time.”

Animal spirits.

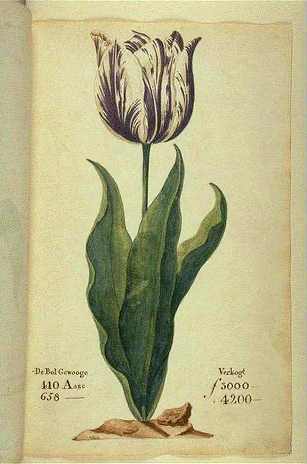

Viral irrationality is nothing new, this has happened throughout history. A good example of just how delusional irrational behavior can become was at the zenith of tulip mania in 1635:

A single tulip bulb was sold for the following items:

• four tons of wheat

• eight tons of rye

• one bed

• four oxen

• eight pigs

• 12 sheep

• one suit of clothes

• two casks of wine

• four tons of beer

• two tons of butter

• 1,000 pounds of cheese

• one silver drinking cup.

(Source: Charles MacKay, “Extraordinary Popular Delusions and The Madness of Crowds”)

The present day value of all these items? Nearly USD 97K! No doubt there is a vast discrepancy between the price paid relative to the value of the asset acquired: a single Viceroy tulip. Unfortunately the MOB rivals the price-to-value gap of this example but the consequences — if manifested — given the scale, would destroy the global economy. How did this — or any — financial avalanche risk germinate and mature?

The Art and Science of Financial Bubble Building in the Global Market Ecosystem

The following discussion of bubbles is going to differ than previous efforts because it will approach the MOB bottoms-up rather than top-down while chronicling its development (i.e. its ontogeny) and not simplistically like the NASDAQ and Financial Times definitions above. In the process of building the MOB from the bottom-up the argument will integrate concepts of architecture, network theory, collateral, risk, markets, liquidity, belief systems, developmental biology, ecology, and sociology in layers until a new understanding of just how bubbles emerge and take on a life of their own from seemingly sound, innocent and logical elemental building blocks. The process will remind you of the strange manner that inanimate chemical elements unpredictably compose a living system due to their hierarchical architecture—[physics → chemistry → biology → ecology] — and it is this same intangible property that manifests as a cognitive blindside evidenced in all financial bubbles. Flying under the radar, it sneaks up on you too slowly to be alarming until its Achilles heel is revealed by a tail-risk event.

The Species

Two primary value systems compete in the market ecosystem as two very different species: absolutism (“investors”) and relativism (“traders”). The market ecosystem is also host to one new species and one that is not new but has become malignant: algorithmic agents and CBs, respectively.

Investors: value is tethered to physical reality and the relationship is invariant, steadfast, and reproducible. Warren Buffett is an iconic value investor. A wise investor will not pay a pence over a well-assessed intrinsic or fundamental value regardless of real or perceived demand unless supply is structurally imperiled and the need is dear or there is information known that is not in the public domain (“inside information” which creates an asymmetrical advantage that mitigates risk). Due diligence erring on the side of skepticism is the calling card of the iconic investor because preservation of capital is more important than assuming risk to achieve phantom profit. Unknown risk — even though impossible to articulate — is always assumed and speculation is anathema. Resultantly, slow growth is an acceptable tradeoff. Sustained compound interest with a core earnings engine defended by a moat is cherished and the holy grail is a universal good or service with monopoly status that is affordable by the global masses with no trade barriers.

Traders: value is untethered to intrinsic or fundamental value and, instead, “goes with the flow” within a range of supply and demand dynamics and there are many different trading philosophies that are usually expressed by historical pricing patterns on charts from which predictions are made.

The trader’s assumption: past trends are offered as evidence of future trends even though this is classic fallacy of inductive logic and is the underwriter of all financial bubbles:

I stayed up all night studying for the exam, and then I got an “A” on it. Lack of sleep must make me more intelligent and alert.

(Source: Fallacies of Weak Induction)

With dyed-in-the-wool traders, if ten people bid two Hope diamonds for aViceroy tulip and an eleventh bids three, then it is — by definition — presently “worth” three Hope diamonds simply because of the existence of the bid. If this event never happened due to lack of proof of a second willing buyer at the same price, a bubble could never germinate — there must be faith that more buyers will materialize sooner or later at the same or higher price even though at this lonely moment in time you alone offer a(nother…) crucial icebreaking bid. This defines the minimal structure (necessary and sufficient) and cognitive process of creating higher highs: bubbles are impossible without the means of creating higher highs in the presence of nonexistent justification and nonexistent secondary buyers of equivalent concurrent bid.

But what happens when — not if — the music stops?

Algorithmic agents: computer algorithms that either have rigid programming structures (like older AI expert system architectures) or more recent deep learning architectures that have a goal state (the objective function) to optimize profit [deep portfolio theory, more…]. Essentially, algorithmic agents are setup to evolve in complex environments that have nonzero-sum game properties. At the present time the trading volume of these types of algorithms are minuscule and experimental but as they improve (think of how algorithms went from losing to beginners at Go to defeating the world champion). Do not confuse this approach to high-frequency trading (HFT) which has a dominate trade volume in major equityand electronic (but not total) bond markets. These algorithms are AI-based traders, not investors. They do not consider intrinsic “fundamental” values; their value-system is restricted to the realm of mathematics that quantitatively addresses risk and reward within a game-like, digitally-based, Darwinian ecosystem. They compute trends in correlations between asset classes and the acceleration of volumes in those trends while learning from those trends. Instead of the rules of chess or Go it is the rules of electronic financial markets but beyond concrete, enforced legal rules a deep learning system will evolve tactics and strategies that no human would think of and do so unsupervised.

CBs: The US Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BOJ), and the Swiss National Bank (SNB) are the primary central banks. These actors since 2008 have become apex (alpha) competitors within the financial ecosystem and are dominant actors not just because of their large financial resources (virtually unlimited when they “print” money) which are progressively becoming cooperative (CBs as “teammates”). They do not obey the rules that constrain all other actors, they can make new rules at will through the legal and political apparatus, can punish other actors, and they also can wield political influence like at FOMC meetings, etc. The sum of their influence on the financial ecosystem is such that the original conception of free markets based on supply and demand dynamics has been suspended and the value-system of investing strategies has been destroyed leaving only trading tactics and strategies.

Market Dynamics: Bulls and bears, buy and sell, long and short, supply and demand

Market dynamics create the battleground where investing and trading tactics and strategies compete head to head. Being bullish or bearish is a mixture of investing and trading value systems that has properties of concrete fundamental values of assets along with historical trends based on fallacious logic. The major cause of initial instability that then snowballs is the error of confusing causation with correlation (fallacy of induction) that then becomes codified dogma: investors seek sound causation at all costs whereas traders base decisions on correlation due to flow properties or trends — even invented trends or patterns. The sine qua non fallacy of logic that births catastrophe is: Flow properties (trends) can be charted and if they can be charted they are assumed to be “data” and therefore are “objective truth” when all that really happened is that they have been fooled by randomness. Caveat emptor.

“Momentum” (safety in numbers becomes a surrogate for validity and truth) is then used as proof of objectivity and at this point sociology will drive the market and valid fundamentals are abandoned and in modern times “old-fashioned” values and sound metrics become ridiculed by main street media financial apologists through media channels. At some point new metrics are invented to further fuel momentum such as in 2000 where “eyeballs”, “stickiness” or “rate of downloads” became a proxy for future earnings in internet stocks or in 2008 where the meme “real estate values never decline” took the raging bull by the horns. When further leaps of faith fail to drive buying activity at the Viceroy level even though “tulip prices never go down” is tattooed into our psyche, only sellers remain and the drop in price can be breathtaking as greed morphs into panic in less time than a lemming’s heart beat — ergo, avalanche. Investors wait patiently until there is blood in the streets with prices sometimes reaching levels far below book value while panic reigns and then sanity returns from a seemingly geologic hibernation. In the interim, however, investors can be burned by going short too early and witness Keynes’ “The market can stay irrational longer than you can stay solvent” effect. Caveat emptor.

Understand: A bubble cannot form when the collective adopts an absolute-based valuation approach but with a relative-based valuation approach the sky is the limit and, theoretically, even beyond the sky is fair game given the extremely intoxicating power of human beliefs running unbridled amongst the euphoric masses. Traders are “creative” (they invent new “this time it’s different” paradigms to accommodate their beliefs and justify their positions however ridiculous when judged post-collapse) whereas investors stick to the fundamentals but the basis of fundamental values do change slowly (like how to assess companies like Facebook or Google which exist only in the abstract digital realm as new classes of service that have no precedent).

The Habitat: MOB Architecture

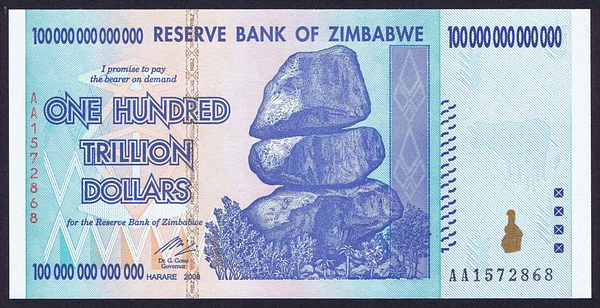

The MOB architecture is a hierarchy composed of three layers: currency, bonds, and derivatives. All currencies in the world today are fiat currencies: that have zero intrinsic value (i.e. they are not “backed” by tangible goods, no exchange value as collateral like a physical commodity) and are legal tender only because of government decree. All fiat currencies eventually fail, it is just a question of when, not if. They perish either by being inflated away to infinity (examples: Weimar Germany or Zimbabwe) or by default (outright or by currency devaluation featuring a vast and immediate loss in purchasing power where, for example, a 100 dollar bill is replaced by a 1 or 10 dollar bill by fiat).

Bonds are debt instruments denominated in a currency that an investor loans currency to (like a country) for a time period (tenor), at a specified price and interest rate (yield). The price and interest rate of a bond vary inversely over the tenor (i.e. when the price increases the yield decreases). Bonds, like their underlying currency, have no intrinsic value. Although bonds issued by the G7 nations (particularly U.S. Treasury bonds) are considered the absolute highest standard in collateral quality (basically “risk free” and even the definition of “risk free”) they only assume this status because they have not failed in the recent past, not because they are either fail-safe or, if they do fail, you receive compensation at par or any given percentage of par for your loss of principal. Bonds are not true collateral: If a country — any country — defaults on an interest payment to a creditor there is no guaranteed collateral to compensate for the loss. This is a risk that the creditor assumes and the compensation for that risk during the time the bond is held is the yield. Classically, a high risk bond like from a 3rd-world country would feature a cheap price and a high yield relative to a low risk bond’s high price and lower yield. Rating agencies like Standard & Poor’s,Fitch, and Moody’s assess the creditworthiness of the bond issuers for potential investors.

Financial derivatives are financial instruments whose value are based upon the changes in pricing of an underlying asset like stocks, bonds or commodities. They are a vehicle for trading financial risk and serve many functions such as for managing interest rate risk, currency, equity and commodity price risk, and credit risk. They can be used to hedge or to speculate. There is nothing intrinsically wrong with derivatives but in recent years the means of properly assessing the realtime market value of some classes of derivatives (e.g. not “marked-to-market”) has become a serious problem under conditions of rapid change to the underlying asset (i.e. “crisis”) which then translates to sudden loss of liquidity resulting in wide bid-ask spreads (or even no buyers or “bid-less” conditions, what is known as a “falling knife” where the price is in free fall and/or there is fear of counterparty insolvency). The uncertainty caused by the opacity compounded by highly leveraged positions with rapid changes in asset prices under stress create systemic hazards in the global financial ecosystem. Assuming that derivatives will “net out” close to zero is faulty under these conditions and can result in catastrophic losses greatly exceeding any stress test condition conducted by international or government agencies.

So, at the bottom of the MOB structure are currencies involved in foreign exchange (FOREX) like carry trades. In this base layer, daily FOREX volume is around USD 5T and is leveraged 100 to 300:1 by large trading firms. Sovereign bonds are denominated in these FOREX currencies and derivatives are referenced to and reflect changes in FOREX and sovereign bond properties such as interest and exchange rates. All of this is fiat based.

The Size of the Habitat

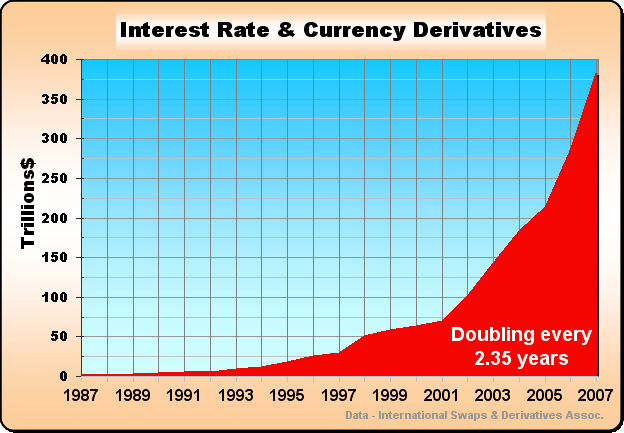

In 1990 he total value of the FOREX market was much greater than the equity and bonds market which was greater than the derivatives market which was mostly composed of commodity derivatives (options and futures for tangibles like pork bellies and crude oil). The sum of all of these three markets relative to global GDP was a small multiple. In other words, financial markets were more balanced with the underlying real world economy of goods and services and existed in their service. But by 2010 the sum of all three of these financial markets dwarfed global GDP while the derivatives growth rate exploded relative to everything:

Derivatives have been growing exponentially with a doubling rate every 2.35 years:

And examining just the different derivatives classes, interest rate contracts are the lion’s share of all derivatives:

The interest rate segment accounts for the majority of OTC derivatives activity. For single-currency interest rate derivatives at end-December 2014, the notional amount of outstanding contracts totalled $505 trillion, which represented 80% of the global OTC derivatives market (Table 3). At $381 trillion, swaps account for by far the largest share of outstanding interest rate derivatives.

(Source: Bank for International Settlements (BIS) OTC derivatives statistics, April 15, 2016, p.2)

In 2008 during the housing bubble crash, it was the relatively tiny USD 15.5T sliver that collapsed and put the global economy at risk, not the larger FOREX fraction or the gargantuan interest rate vast majority. US public debt (the “national debt”) was USD 10T then and is now USD 20T (2016):

How big are these financial markets now? The derivatives market varies from USD 630T to USD 1.2 – 1.5Q (quadrillion) depending upon who is counting and what is counted:

What is a Sovereign Bond Worth, Really?

When it comes to stocks, investors have concrete metrics on how to value the worth of a company (e.g. the market capitalization of Apple is USD 600B). But what about sovereign bonds? What is the market cap of the US? This is a difficult question and without at least a ballpark number it is impossible to assess the relationship between risk and return. Mostly that is left up to the credit rating agencies previously mentioned. But is that wise?

In assessing the creditworthiness of a sovereign, some have focused on its debt-service capacity. That is, the probability of default is linked to the sustainability of external debt and to problems associated with short-term illiquidity or long-run solvency. Among the macroeconomic variables that are likely to affect a sovereign’s ability to service its debt (and the expected direction of the effect) are: current account to GDP, terms of trade, reserves to imports, external debt, income variability, export variability, and inflation.

(Source: Miao Di, McMaster University, Department of Mathematics & Statistics, April 20, 2005, p.5, “Pricing Sovereign Bonds”, (pdf))

This intelligence briefing is going to present an argument that it is unwise to trust the credit rating agencies in regard to assessing sovereign debt creditworthiness and valuation. The basis of this argument will be a simple (but not too simple) common sense construction of what creditworthiness means and will be supported by data that is true beyond a shadow of a doubt. Nothing will be cherry picked to make this case, a fruitful rebuttal is not possible. At the end of the presentation it will be clearly apparent that the gap between assumed value and actual value are not only unbridgeable but also disjoint and divergent. That presentation is next.

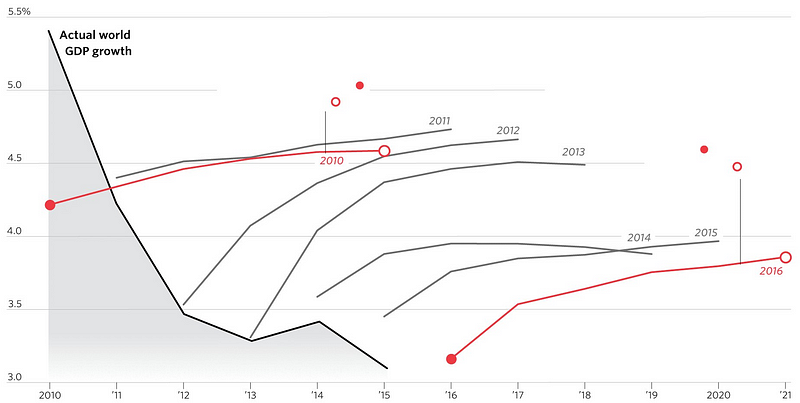

Longterm Trends in GDP and GDP Growth Rates

GDP measures the monetary value of final goods and services — that is, those that are bought by the final user — produced in a country in a given period of time. It counts all of the output generated within the borders of a country. GDP is composed of goods and services produced for sale in the market and also includes some nonmarket production, such as defense or education services provided by the government. One thing people want to know about an economy is whether its total output of goods and services is growing or shrinking. But because GDP is collected at current, or nominal, prices, one cannot compare two periods without making adjustments for inflation. To determine “real” GDP, its nominal value must be adjusted to take into account price changes to allow us to see whether the value of output has gone up because more is being produced or simply because prices have increased.

GDP is important because it gives information about the size of the economy and how an economy is performing. The growth rate of real GDP is often used as an indicator of the general health of the economy. In broad terms, an increase in real GDP is interpreted as a sign that the economy is doing well. When real GDP is growing strongly, employment is likely to be increasing as companies hire more workers for their factories and people have more money in their pockets. When GDP is shrinking, as it did in many countries during the recent global economic crisis, employment often declines.

(Source: International Monetary Fund (IMF))

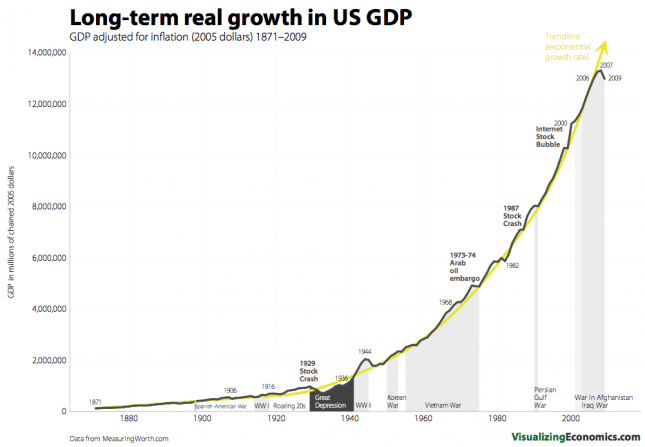

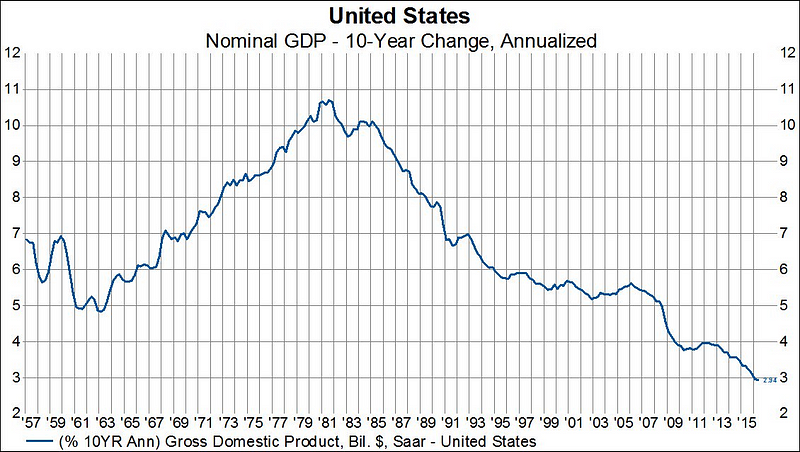

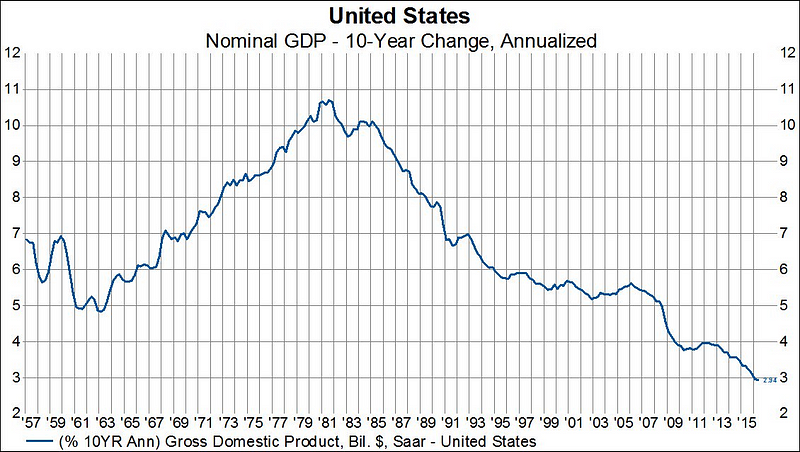

For most of the history of the United States GDP mirrored an exponential growth rate…

but as with all exponential growth rates that are representative of real world phenomena they must plateau or collapse…

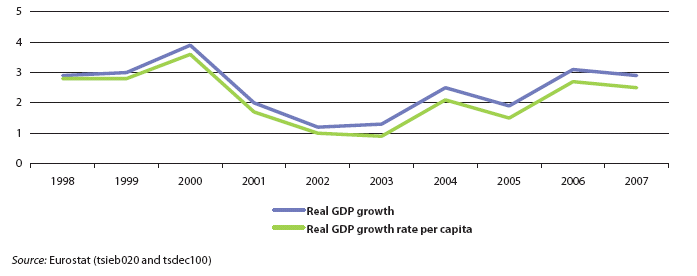

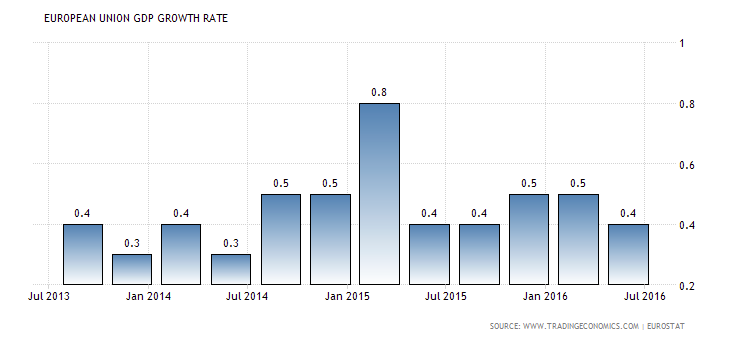

This same dynamic is present in both the EU and Japan:

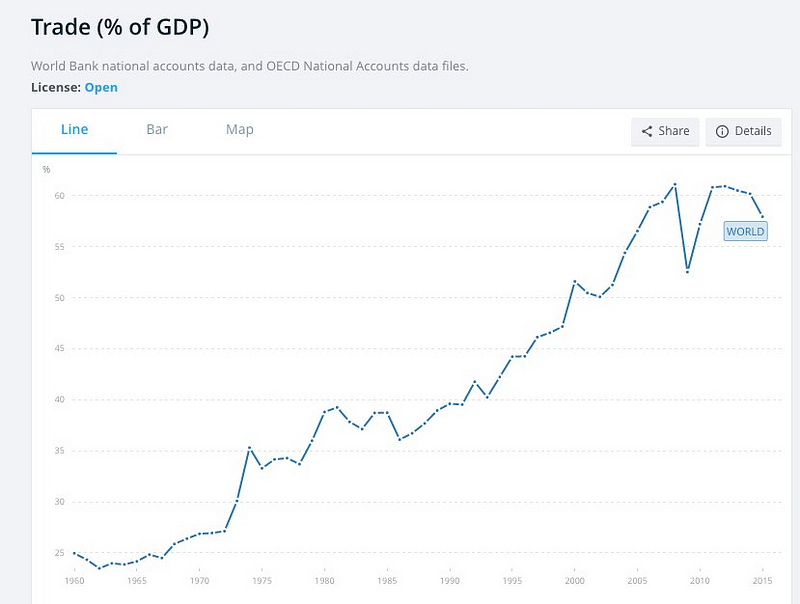

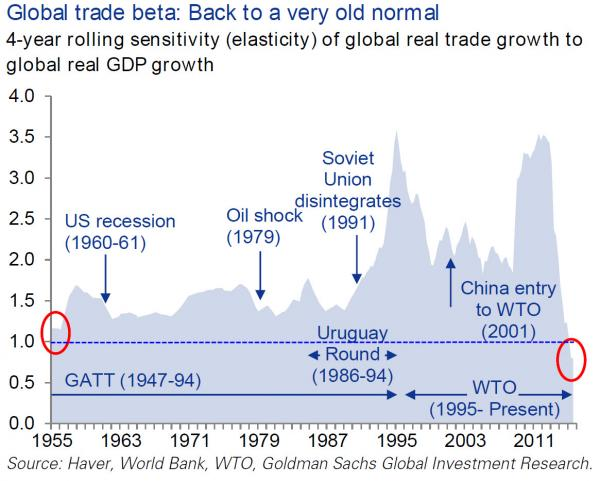

Global trade has plateaued and peaked for 10 years relative to global GDP and may even be declining:

…and using different data sets:

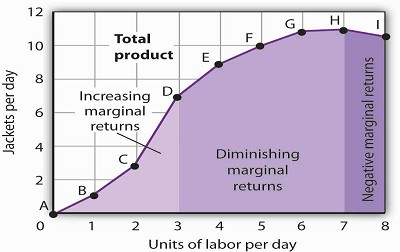

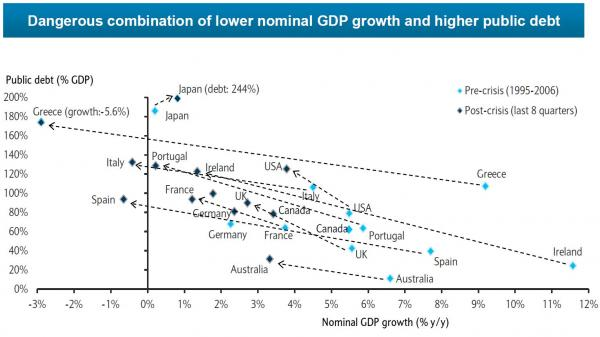

The creditworthiness of a country is increased when GDP has a long-term history of solid growth and the underlying fundamental means exist for that trend to increase in the future.This does not exist in the US, EU or Japan. Instead, GDP growth is, at best, decreasing (like from a 3% to a 1.5% growth rate, or diminishing marginal returns) and is heading toward contraction (a negative growth rate like from +1.5% to -1%, negative marginal returns).

Projections, however, are always published in contrary to reality, a reality distortion field that supernaturally — like a Jedi magic trick — GDP will regain previous growth rates of the glory days post-WWII but this will not happen simply because all exponential functions have concrete limits in the real world;the real world is governed by physics and physics is nonnegotiable.

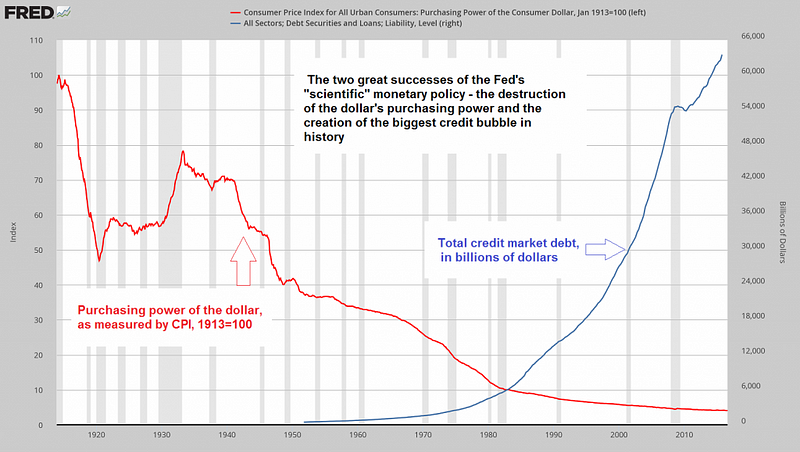

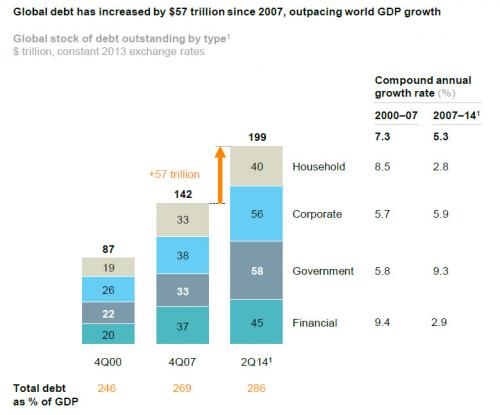

What quietly happens in the background are five economic forces which overlap to compensate for the decay in the exponential GDP growth rate as it slows and flattens out:

- a background inflation that lowers the purchasing power of the underlying fiat currency that is nearly imperceptible (this happens with all fiat currencies when examined over long time scales);

- an exponential increase in credit expansion in consumer, corporate and financial capacities;

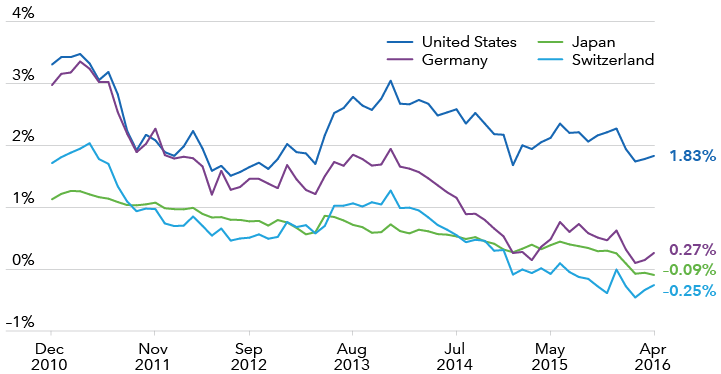

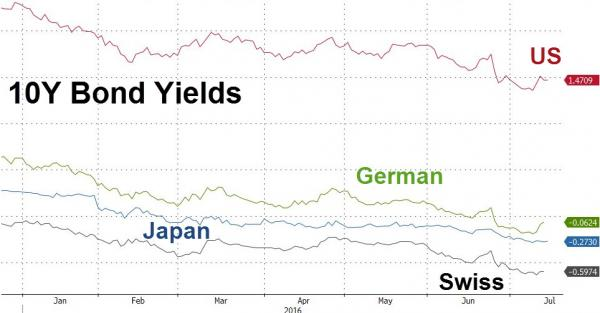

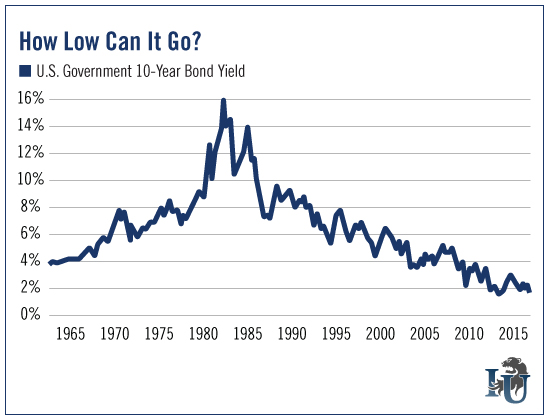

- a steady decline in sovereign bond yields even to the point of breaching the zero bound in the EU, Switzerland and Japan (i.e. negative interest rates or NIRP);

- credit expansion eventually spreads to the central balance sheet going beyond sovereign bond purchase (which drove #2 and 3) and mortgage-backed securities of the GSEs (government-sponsored enterprises Fannie Mae+ Freddie Mac which allowed for the inflation of the 2008 housing bubble and its current reinflation by offloading risk exposure from the banking sector to the taxpayers and bond holders) to purchase of equities directly or indirectly (inflating a new equity bubble via direct purchase and/or incentivizing stock buybacks); and finally

- spreads beyond monetary stimulus into fiscal stimulus (aka “helicopter money” injected directly into the real economy) with eventual hyperinflationary phenomena signifying the senescent phase of a fiat currency’s lifecycle.

[The same conceptual process of progressive devaluation (“inflation” or monetary expansion) occurred in ancient Rome. It is important to understand the logic and consequences of currency debasement because it is happening now with obvious Viceroy effects on asset prices. This is an excellent infographic of how it works and why. [Source: Visual Capitalist]

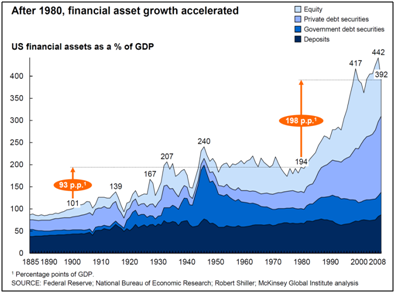

The ratio of financial to economic (real world) assets is expanding exponentially and these financial assets form the foundation of the MOB with the derivatives network sitting on top:

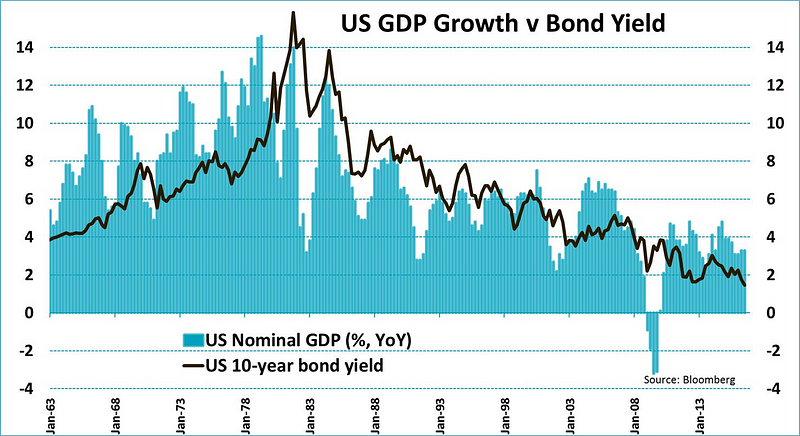

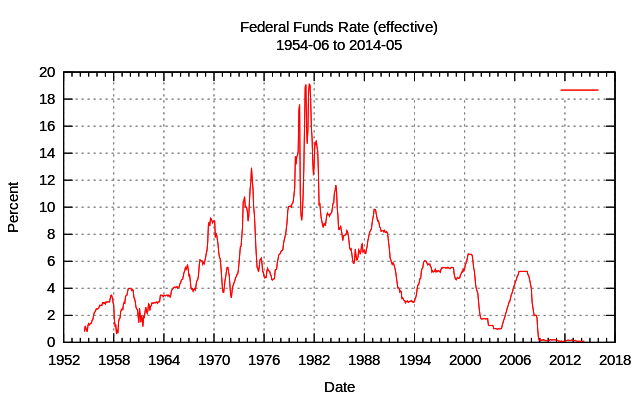

And is mirrored by the Fed Funds Rate (overnight interbank interest rate) which is the interest rate spoken of by Federal Reserve Chairperson or equivalent in other regions (Greenspan, Bernanke, Yellin at the US Federal Reserve, Mario Draghi at the ECB or Haruhiko Koroda at the BOJ) when they raise or lower interest rates which benchmarks the short-end of the yield curve:

All G20 countries have been experiencing a steadily rising debt-to-GDP for a long time as GDP growth rates have decayed from exponential growth rates to nearly zero (plateau or “stagnation”):

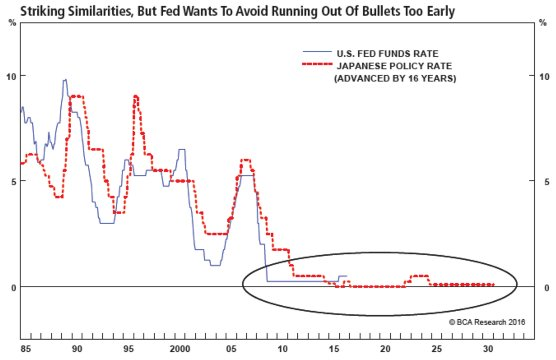

The debt-to-GDP in Japan is staggering and has served as a bellwether for the EU and US:

…the US in 2016 is where Japan was in 1998:

After the 2008 global financial crisis stemming from the bursting of the housing bubble, a new phenomenon has emerged: sustained CB intervention by the US Federal Reserve, the ECB, BOJ, and SNB. This intervention was promoted as an emergency means to stabilize the global economy in the aftermath of the banking crisis but has continued unmitigated through the present day. This intervention has now become such an integral and assumed financial force (i.e. emergency expedients have been gene-spliced into the “new normal”) that it has influenced the global financial ecosystem to the point of adaptive and maladaptive responses that have severely distorted the historical dynamic equilibrium of healthy and balanced economic activity between investors and traders to the point that the value system based on investor principles is endangered and is on the verge of extinction.

Once this extinction event occurs, only variants of traders/speculators will remain and this means that the global economy and the financial layer — that once only existed in the service of the physical economy — will have totally bifurcated: they will be for all intents and purposes independent domains because the organic feedback loops between them that existed before are no longer able to perform meaningful, regulatory function — the tail wags the dog. Prolonged access to underpriced credit (cheap money) misallocates resources to the point that healthy recycling of capital through liquidations is impaired and underperforming businesses and weak business models limp along on life support. This is like in a real ecosystem if an uncompetitive species like dodo birds were protected from predators by an invisible hand and food magically fell from the sky. Utility and innovation are marginalized; the CBs have forced Darwinism into extinction.

Central Bank Intervention

First, an examination of CB intervention trends beginning with the big picture and ending with a present day granular perspective:

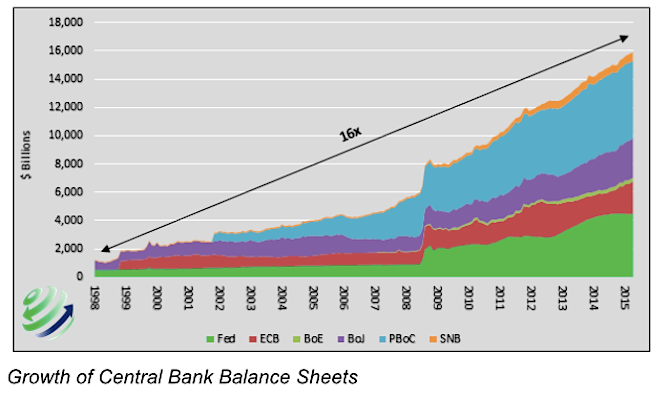

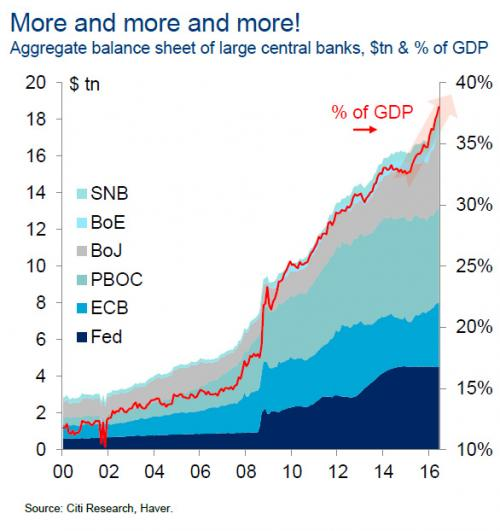

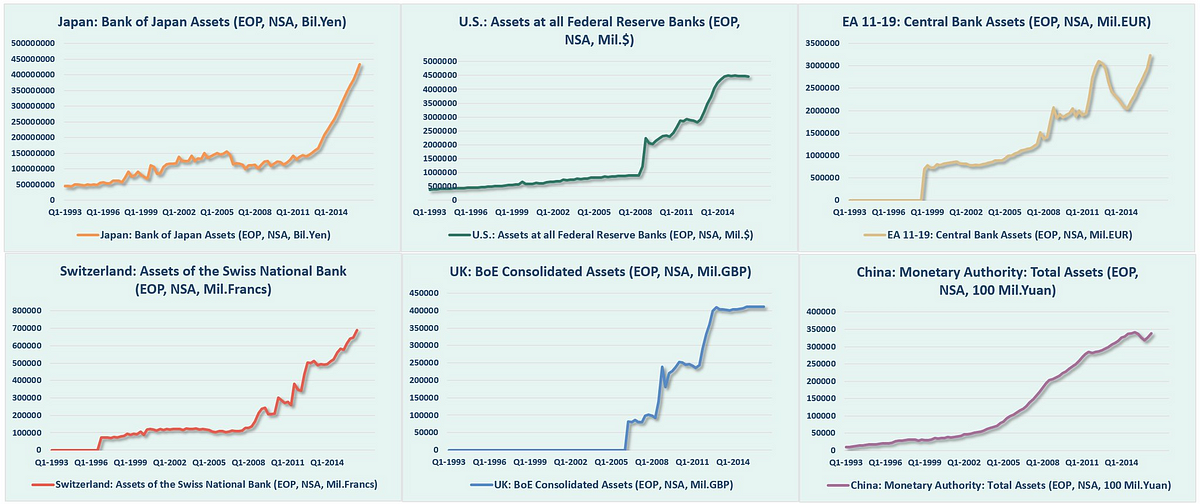

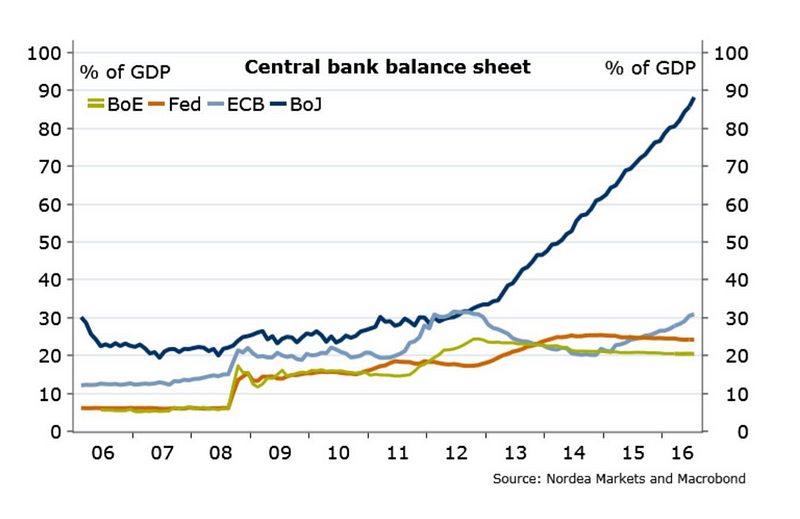

Central bank balance sheets exhibited zero to low growth rates (with the exception of China) until the 2008 crisis but then, in aggregate, have been growing overall since then (US stopped in 2014 after the last round of quantitative easing (“QE”) but BOJ, ECB and SNB continued unabated):

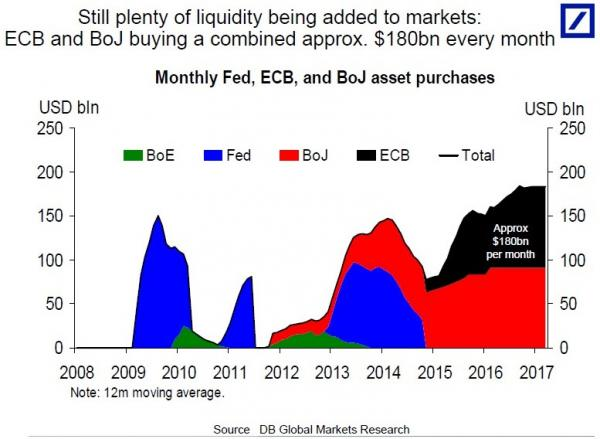

The ECB + BOJ are currently and projected to expand central bank purchases at the rate of USD 180B per month:

And here are the central bank balance sheets as a function of GDP (once again, Japan is the bellwether in this capacity as well as in debt-to-GDP as exhibited earlier):

Central Banks and Equities

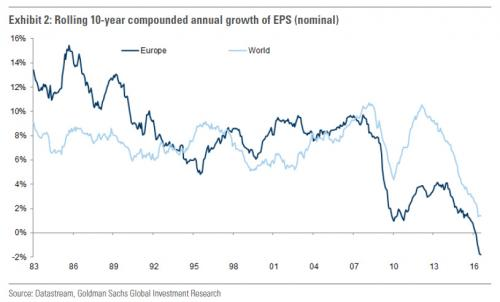

Just like there has been a slowing of global GDP growth rates in the US, EU, and Japan there has also been a mirroring in global corporate earnings per share (EPS) growth rates that is causal, not merely correlative, because business is the engine of GDP. This decline curve would be even steeper than shown for tracking earnings (i.e. just the the “E” part, not EPS) because share buybacks directly increase EPS (a decrease in “S” directly increases EPS) whereas pure earnings would not be influenced by the denominator. This effect will be examined in-depth now.

So, why haven’t stock price indices declined to reflect this reality?

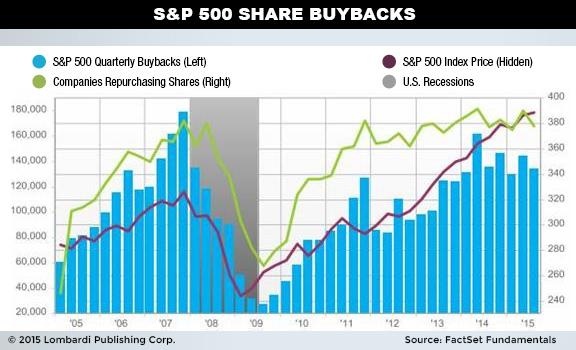

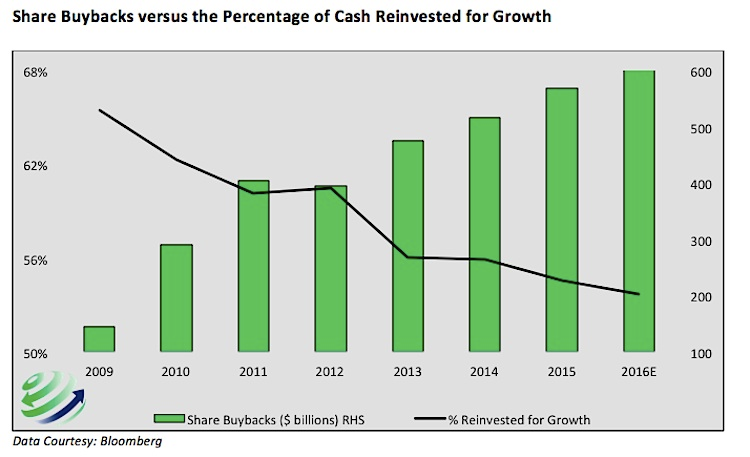

Corporations can reinvest earning into stock buybacks to reduce the number of shares outstanding thus “earning per share” increases. Thus, even though EPS growth rate is either slowing (or earnings are contracting…) the stock price that everyone pays attention to increases: “IBM stock is up this year,” etc. Prior to 2008 corporations were doing exactly that:

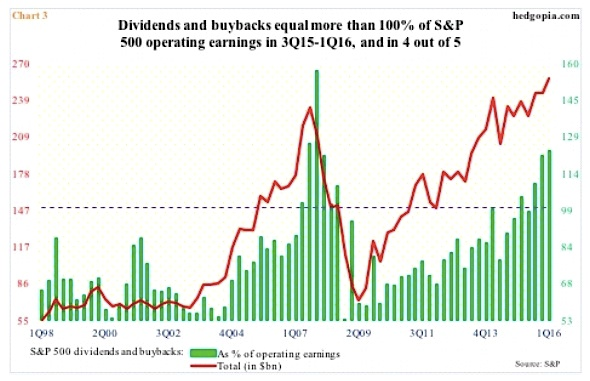

The US Federal Reserve does not directly purchase equities but through monetary policy post-2008 artificially low interest rates have changed equity markets drastically by influencing corporate behavior through stock buyback activity to the point that in 4 of the last 5 quarters dividends and buybacks were greater than 100% of S&P 500 operating earnings and in the last two quarters greater than 120%:

In the past, corporations would reinvest earnings in capex (capital expenditures) by investing to further the growth prospects of the business (purchase of equipment, new facilities/infrastructure, greater employment, etc.) but now these funds go to buyback shares in lieu of capex:

You can no more force corporations to invest for growth if they don’t believe it’s safe than you can force people to watch John Oliver if they don’t think he’s funny. And the truth is that if you paid me to watch HBO, just as Central Banks are basically paying corporations to borrow money, I’m going to watch 20 Game of Thrones re-runs before I watch a single episode of Last Week Tonight with John Oliver, just as corporations are going to buy back stock and hoard cash 20 times more than invest in new jobs or new equipment.

(Source: Salient Partners, July 7, 2016, “When Narratives Go Bad”)

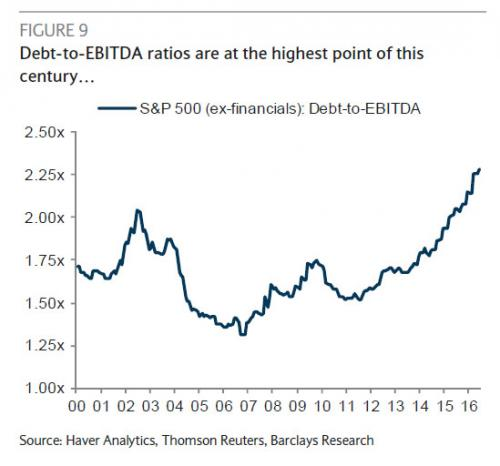

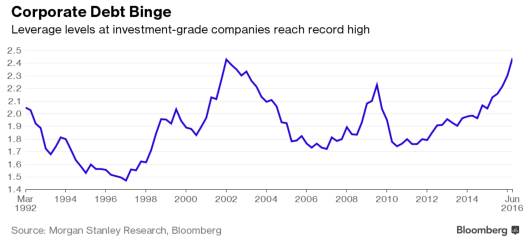

Question to ponder at this point: Corporations know their business better than anyone: if they are not willing to invest in themselves then why do you invest in them? The only reason would be that central banks are going to continue to provide cheap money so that EPS increases (“S” decreases even though “E” flounders) and the “market” continues to tolerate a PE (price-to-earnings) expansion via increased corporate debt and leverage increases despite an organic decline in aggregate earnings rate:

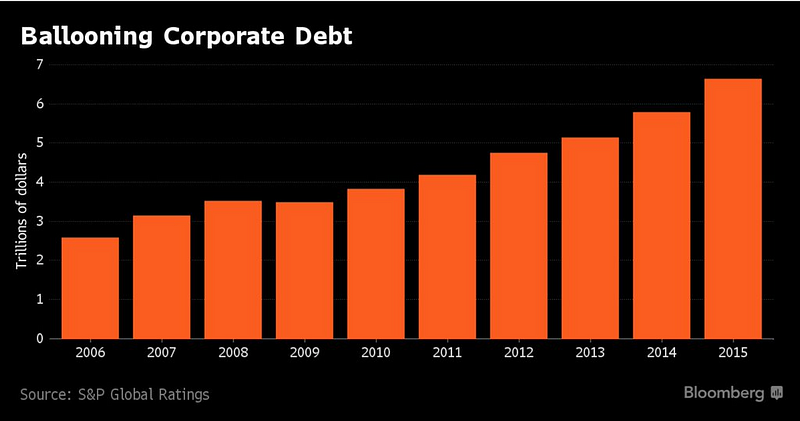

Looking at the S&P 500, less the financial sector, debt-to-EBITDA (earnings before interest, taxes, depreciation and amortization) and leverage ratios are increasing and are going vertical which was at lower leverage (but still increasing) during the dot com bubble in 1999–2000:

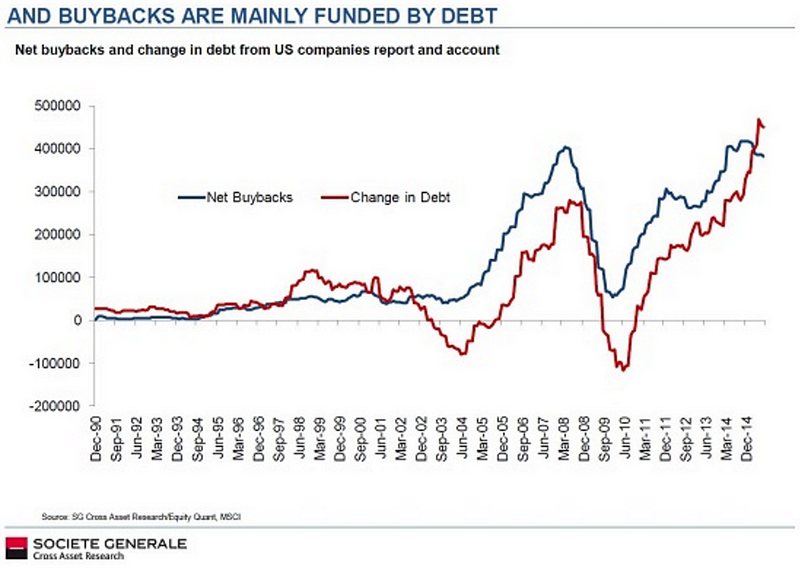

The leverage increase is because, overall, most of the stock buyback money is coming from taking on cheap debt complements of CB “emergency” monetary policy, not earnings:

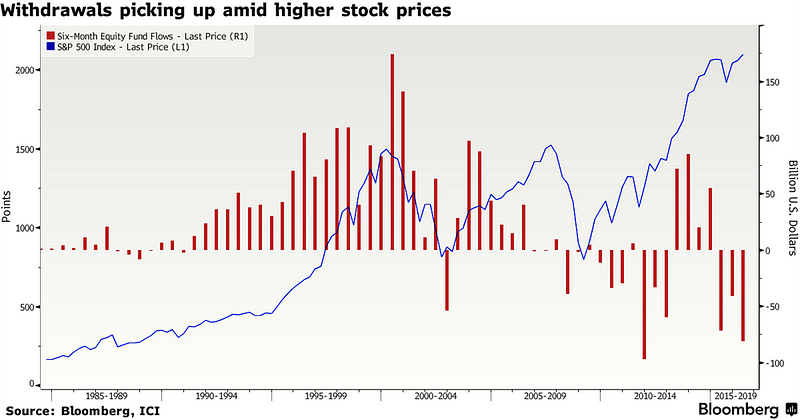

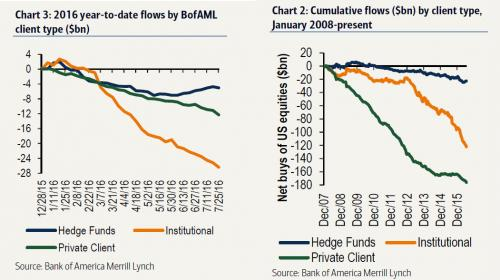

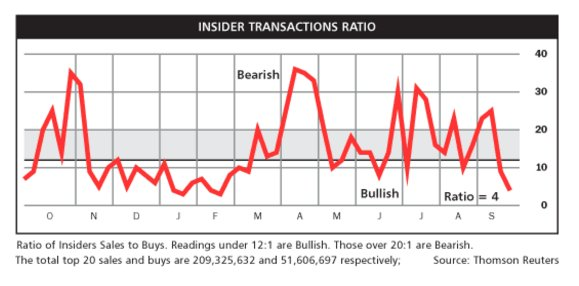

Additionally, while stock prices rise with the central bank tailwind, cumulative withdrawals — that is, stock selling — has recently been robust and sustained:

…but selling by insiders is not happening because they know that prevailing forces are bullish due to CB intervention that has become a central force in the new normal. If CFOs are willing to leverage their balance sheets to increase EPS (but not on capex) and CBs are committed to artificially low interest rates (Japan commits for the next 16 years at the zero-bound) and copious cheap credit, why not be bullish? What’s not to like?

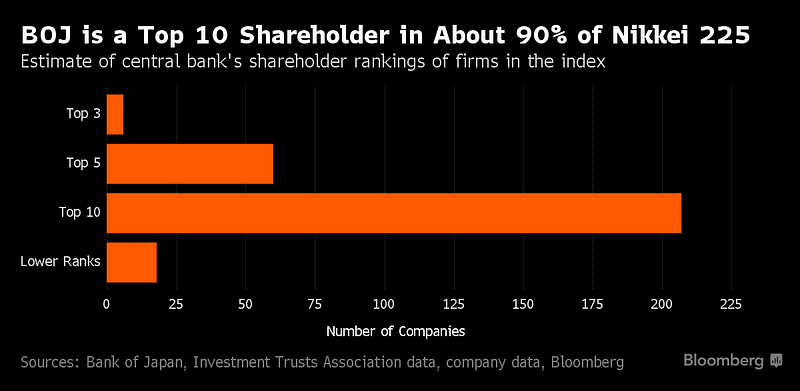

In Japan and Switzerland these effects are taken to the next level by direct stock purchase activity of ETF’s (exchange traded funds) by the BOJ to the point that the BOJ has become a hedge fund on steroids:

[See SNB’s holdings of US equities | Source: NASDAQ]

Make no mistake about it: a CB directly purchasing equities or even creating perverse incentives for CFOs to repurchase shares with artificially low interest rates (“cheap money”) to the point of possibly even decreasing the book value of a corporation is some form of “helicopter money” (from either the corporate helicopter taking out the loan or from a BOJ or SNB helicopter buying shares) but only benefits the top 15% demographic but particularly enriches the top 0.01%.

The process:

- Corporation takes out a loan at a very low interest rate, a corporation issues corporate bonds at extremely low or even negative interest rates, or a CB buys shares (e.g. The SNB does owns Apple stock).

- If a loan or corporate bond sale, then buyback own company’s shares.

- The stock price increases.

- Sell some shares.

Helicopter money = the difference in the stock price caused by the (loan or bond sale) amount used to buy shares

Note: It is beyond the scope of this intelligence briefing to go into detail on Japan’s financial predicament but that is explored in-depth in the Prevailing Gray Swan on The Collapse of Japan. It is important to understand Japan’s predicament because the US and EU are following in its footsteps. Ex-Fed Chairman Bernanke has been advising Japan on financial and monetary policy for a long time. At this juncture, circumstances constrain monetary flexibility of the ECB and US to an extremely limited set of viable options (e.g. doing what Fed Chairman Paul Volcker did in 1980 to control inflation, for example, is no longer possible).

Back to the big picture: The preceding forensic analysis of equities was part of the equation in determining the worth of sovereign bonds: business is the engine of GDP vis-à-vis a country’s creditworthiness and assessing long-term, structural corporate earnings performance is integral to that end. Now for a closer examination of “GDP” in the US as another part of the same equation.

Is the US GDP Growth Rate Greater than Zero?

Ostensibly US GDP growth rate is presently greater than zero:

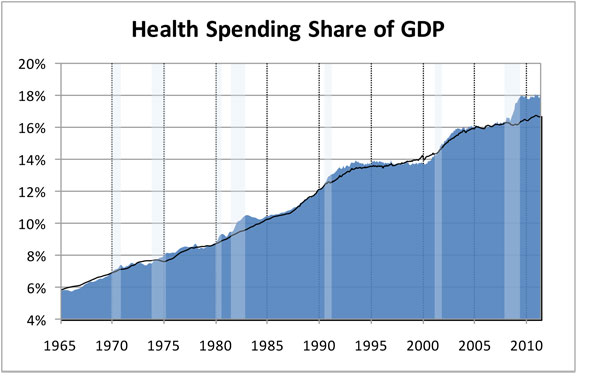

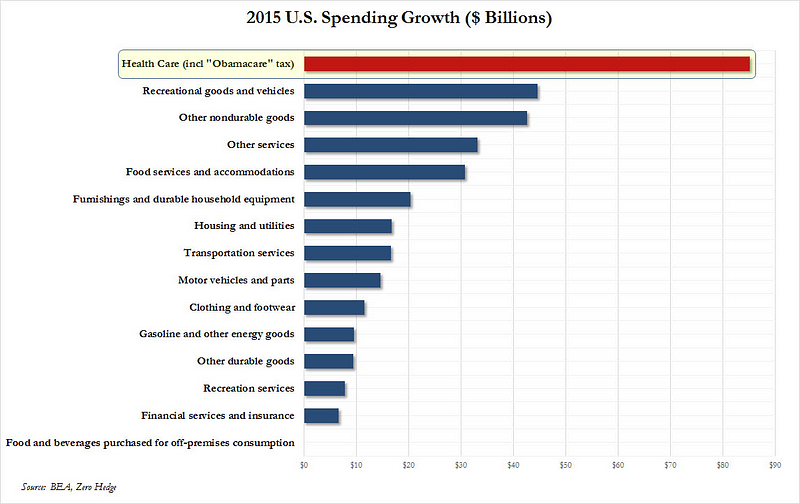

But when GDP is deconstructed into qualitative as opposed to quantitative components, an argument can be made that relative to an assessment of sovereign bond creditworthiness that effective GDP growth is less than advertised. In stealth mode in the background, health care has become an 800-pound gorilla that is measured and valued as a positive contribution to GDP in the face of an overall decreasing gross GDP growth rate but should it count as a positive factor contributing to a US Treasury bond’s creditworthiness?

While the rate of GDP growth has been steadily declining:

…the contribution of health care to GDP has been steadily increasing:

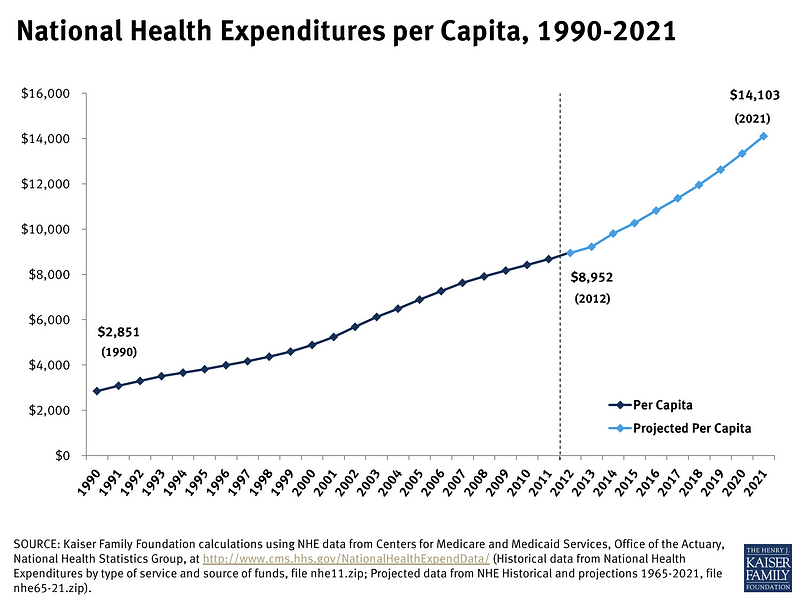

Health care costs per capita have been rising rapidly since 1990:

If this graph were flat at 2005 level, would the GDP growth rate be greater than zero? If not, how much would that impact creditworthiness?

ObamaCare has not significantly increased the number of insured in America. According to the National Health Interview Survey conducted by the Centers for Disease Control and Prevention, about 70% of U.S. residents, age 18 through 64, had “health insurance” in 2015, the second year of ObamaCare enrollments. This was approximately the same percentage that had health insurance in 2006, before the Great Recession swept away jobs and health benefits.

(Source: Investor’s Business Daily, September 9, 2016, “ObamaCare Will Set Back Real Health Reform For Years”)

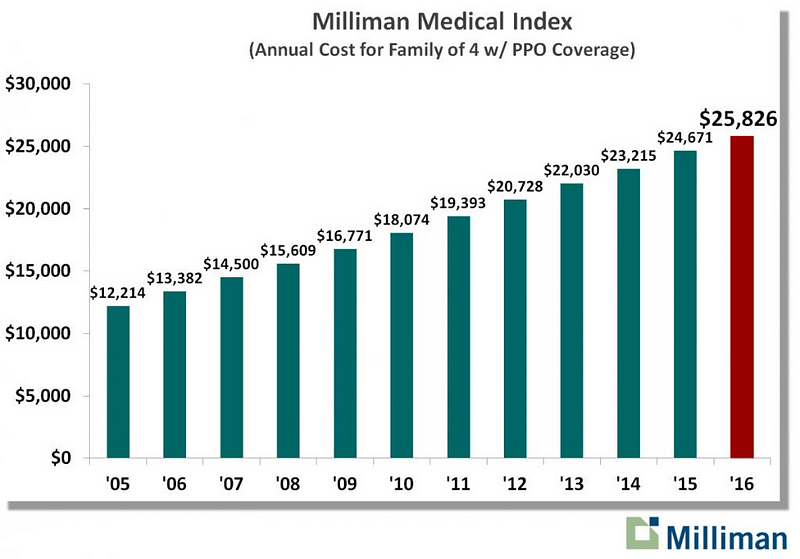

Understanding the Immensity of US Healthcare’s Impact on GDP Growth

To better understand the immensity of US healthcare costs and its growth rate, think of those costs as a percentage of US GDP and compare those numbers with other country’s GDPs:

US GDP (est.) 2016: USD 18.6T

Healthcare cost as % of GDP: 17.5% (2014 per CDC) | Note: this will be much higher in 2017 given projected cost increases from Obamacare. US healthcare is growing faster than the Chinese economy (10% vs. 6.5%).

The arithmetic:

17.5% of USD 18.6T = USD 3.26T

US healthcare costs presently are close to the fourth biggest economy in the world, Germany, at USD 3.47T (per IMF), right behind Japan at USD 4.4T.

A growth rate of 10% on USD 3.26T = USD 326B; just the growth amountfrom 2016 to 2017 is the equivalent of adding the GDP of the United Arab Emirates (USD 325B) or Hong Kong (USD 322B) and from 2017 to 2018 at 10% is USD 359B, very close to adding the GDP of Norway (USD 367B).

At a compound annual growth rate (CAGR) of 10%, US healthcare costs will reach Japan’s GDP of USD 4.4T in just 2 years (USD 4.34T in 2018) or at a CAGR of 8% in 3 years (USD 4.43T in 2019).

Obviously, Obamacare has materially altered the fundamental nature of the marginal increase in overall US GDP growth. Businesses and employees every year are forced to contribute to the rapidly increasing per capita costs of Obamacare as it metastasizes from the size of Germany’s economy to that of Japan’s in just a couple of years. This is a zero-sum proposition: businesses have x dollars to spend after all expenses and employees and their families have y dollars to spend after all expenses and every year an additional amount to account for just the cost increase year-to-year equivalent to the GDP of the United Arab Emirates or Norway is siphoned from both kitties and shunted to Obamacare and not into the greater economy. Increasing taxes — personal + corporate — just robs Peter to pay Paul solving nothing at all. This raises the question: should these Germany GDP-sized funds that shore up the gross US GDP number and keep GDP growth greater than zero count at par value relative to other aspects of the US economy?

Thought experiment: if the gross annual GDP growth rate were increasing at 3% with health care contributing 5% overall and the rest of the economy at -2% [5+(-2) = +3], is that a positive impact on the country’s creditworthiness to payback its debts or is that a negative impact? What does it mean? Judgement of qualitative versus quantitative factors is a much deeper question than is presently realized and cannot be answered by an economist with a spreadsheet: the health prospects of a nation’s constituents is a profound and complex problem that is integral to sovereign creditworthiness especially given the time horizon of 30-year Treasury bonds. Credit agencies sidestep the growing elephant in the room — GDP is GDP, numbers are numbers. This entire mini-argument on healthcare showcases why the concept of GDP is deeply flawed. Senator Robert F. Kennedy raised this question in a broader, more philosophical context in 1968 which is even more true today almost 50 years later:

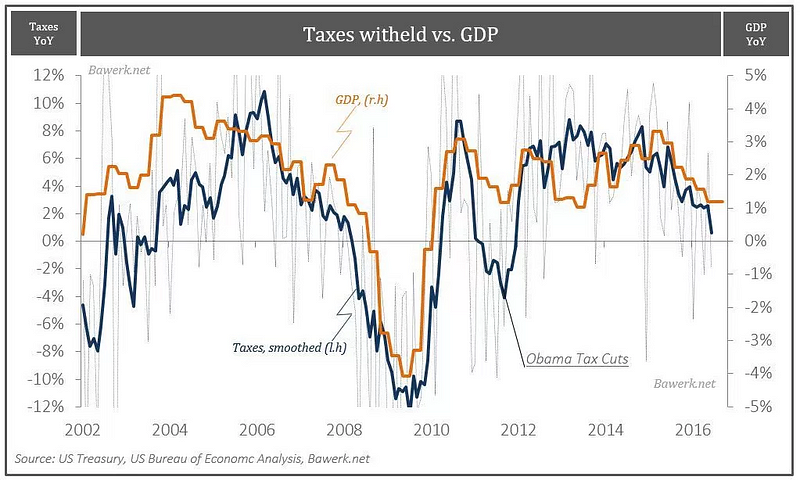

Tax Revenues

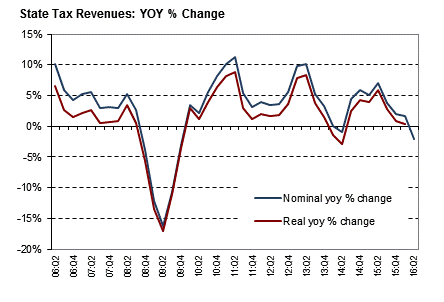

A government pays its bills from taxes derived from GDP and if its costs exceed its income a fiscal deficit (borrowing) occurs. As can be expected, tax revenue mirrors GDP:

…outright declines in corporate income taxes. State corporate income taxes declined by 4.5 percent in the first quarter of 2016, compared to average growth of 0.1 percent in the four previous quarters. Preliminary data for the second quarter of 2016 suggest corporate taxes declined again, by 9.2 percent, marking the third consecutive quarterly declines. Fortunately, most states do not rely heavily on corporate income taxes.

(Source: Nelson A. Rockefeller Institute of Government (SUNY), September 2016, State Revenue Report)

What Should Really Be Meant by the “National Debt”?

In assessing the creditworthiness of a nation (i.e. the default risk of a sovereign bond), examining growth rates (the “top-line” (revenue or GDP) and “bottom-line” (earnings or taxes) is only part of the equation. Current and future liabilities and their rates of change also need assessment (i.e. is the debt being paid off or is it increasing? Is debt [greatly] increasing while income potential is decreasing? …). Once you look at assets, liabilities, income and their rates of change you get a first-order approximation of a reasonable credit limit and concrete evidence of default risk.

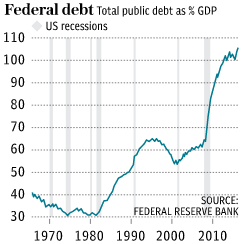

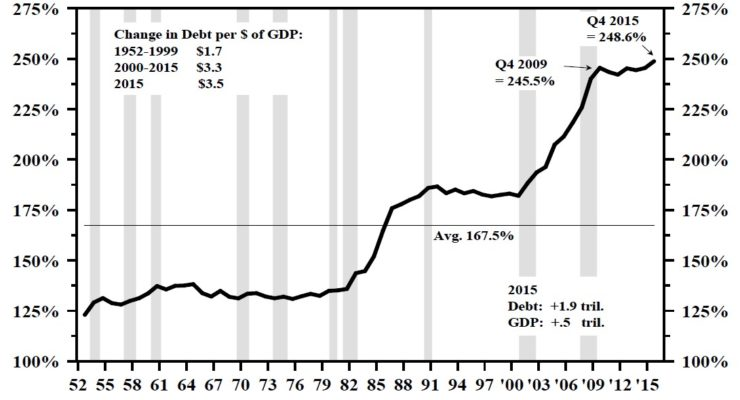

The current national debt is just shy of USD 20T. US public debt to GDP is 105% [See graph since 1965 to present | Source: Federal Reserve Bank of St. Louis]. The change in debt per dollar of GDP has been accelerating since 1952 (i.e. debt has been increasing at a much faster rate than GDP). A longterm trend of a divergence of debt to income source (GDP, “revenue”) is a major negative factor on creditworthiness:

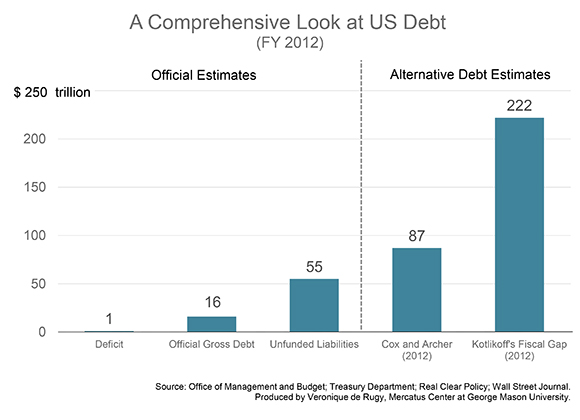

But the national debt is not the big picture of total debt including future unfunded liabilities; there are much larger liabilities that need to be included if you are attempting to assess the creditworthiness of US Treasury bonds relative to default risk given a 30-year time horizon. David Walker, former Comptroller General of the US under Presidents Clinton and Bush (1998–2008), was very outspoken about the real national debt plus unfunded liabilities while in public office and also since leaving office:

In the video, Mr. Walker claimed that total unfunded liabilities were around USD 70T in 2012 and growing at a rate of USD 4T per year (total ~USD 86T (2016)). Given that total Federal tax revenues are presently projected to beUSD 3.3T in fiscal year 2016, this is an intractable problem relative to any mathematical means of managing total US debt and unfunded liabilities in the face of a 2016 fiscal deficit of USD 590B and a trade deficit of USD 500B per year.

Former chairman of the SEC Chris Cox and former chairman of the House Ways & Means Committee Bill Archer (2012) report roughly $87 trillion in unfunded liabilities using data from the Medicare and Social Security Trustees’ Reports. Their measures account for the unfunded liabilities — including Social Security, Medicare, federal workers’ pensions — in addition to the official debt.

Boston University economist Laurence Kotlikoff calculates a “fiscal gap” amount of $222 trillion using the Congressional Budget Office’s alternative long-term budget forecast. The fiscal gap measure takes into consideration the present value of all the expenditures now through the end of time (including servicing the official debt) and subtracts all the projected taxes from that amount.

This means that the government would have to invest $87 trillion or $222 trillion right now in something that will earn a certain positive rate of return in order to meet its future obligations, mainly with respect to entitlement programs.

(Source: Veronique de Rugy, Senior Research Fellow, Mercatus Center, George Mason University, July 16, 2013, “The US Debt in Perspective”)

As a result, the optics are sobering. Career politicians only discuss such matters at their own peril despite the fact this should be the centerpiece of any reality-based political platform. Ron Paul is the last US presidential candidate to base a campaign on fiscal discipline and constitutional adherence. Instead of acting responsibly and respectively as a superpower, we milk the luxury of having the US dollar as the world’s reserve currency which functionally serves as a parasitic tax we levy at will on global trade. Each transaction in global trade denominated in USD is no different than a micro-bailout with no strings attached.

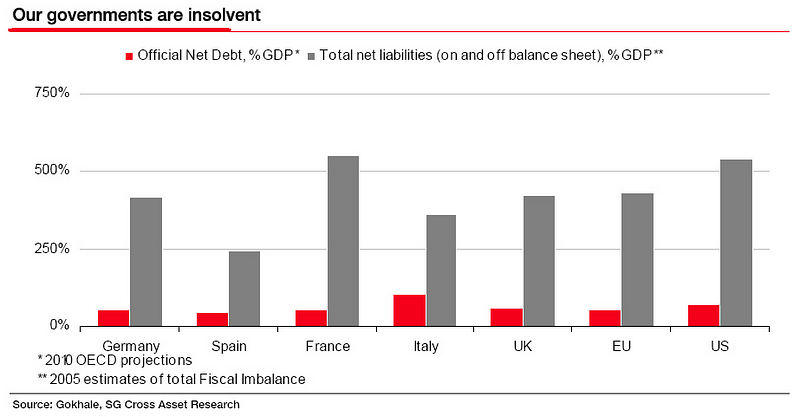

No economist of sound mind with facts in hand would dare to construct an argument that the US, eurozone constituents, or Japan are solvent, that is a fool’s errand. That would even have been mission impossible long ago. In lieu, we rely on our neurobiological coping facility of cognitive dissonance to sweep it under the carpet of awareness while considering anyone who mentions it as “being negative” or an annoying killjoy.

Summary

- The longterm trend for the US GDP growth rate is in decline and approaching zero (does not include any qualitative deductions like Obamacare).

- Total annual Federal tax revenues are approximately flat at approximately USD 3.3T per year.

- Total unfunded liabilities are increasing by approximately USD 4T per year.

- The US fiscal deficit is approximately USD 600B per year.

- The US trade deficit is approximately USD 500B per year.

- The national public debt + current total unfunded liabilities is approximately USD 86T (pensions shortfalls not included and other estimates are much higher than this best-case USD 86T number).

The original question of assessing the default risk and intrinsic value of a US Treasury bond and the creditworthiness of the US is not a fruitfully debatable economics problem because the US has been mathematically insolvent several times over for a long time. This same exercise can be duplicated for the eurozone and Japan on the back of a napkin [See thePrevailing Gray Swan focused on the Collapse of Japan]. The fact of the matter is that on a global basis, credit is expanded to pay current and future obligations with devil-may-care concern for fiscal responsibility. Authority by fiat — not sound economic principles — is in total command beginning with the nature of currencies and terminating in the edifice of the MOB. The milestone of surpassing theViceroy threshold happened many zeroes ago at around the time Nixon took the US off the onerous, Sisyphean gold standard.

Simply, there is no credit limit until there is and this limit, if not manifested by a global financial supernova, will be perceived by psychological means (qualitatively), not by mathematical means (quantitatively) due to the cognitively-overwhelming profundity and global consequences of this epiphany of insolvency — identically to how the innocent but “ignorant” child immediately proclaimed that the Emperor was naked while all the court’s grand academic intellectuals and their acolytes failed to see it.

The townsfolk play along with the pretense [that the emperor is wearing clothes], not wanting to appear unfit for their positions or stupid. Then a child in the crowd, too young to understand the desirability of keeping up the pretense, blurts out that the Emperor is wearing nothing at all and the cry is taken up by others. The Emperor suspects the assertion is true, but continues the procession.

(Source: Wikipedia in reference to: Hans Christian Andersen’s “The Emperor’s New Clothes” (1837))

[other resources: US national debt clock ]

The Structure and Evolution of the Bond Market

The nature of the bond market has changed dramatically in the last 30 years. There was a day not too long ago that stocks and bonds were complementary counterbalances: if stocks were trending up and starting to overheat then bond yields would rise and increase the cost of money and thus act as a natural restraint on equity bullishness. Additionally, the depressed bond prices would be a carrot for equity bulls to take profits and re-invest them in lower cost bonds that pay a fat fixed income.

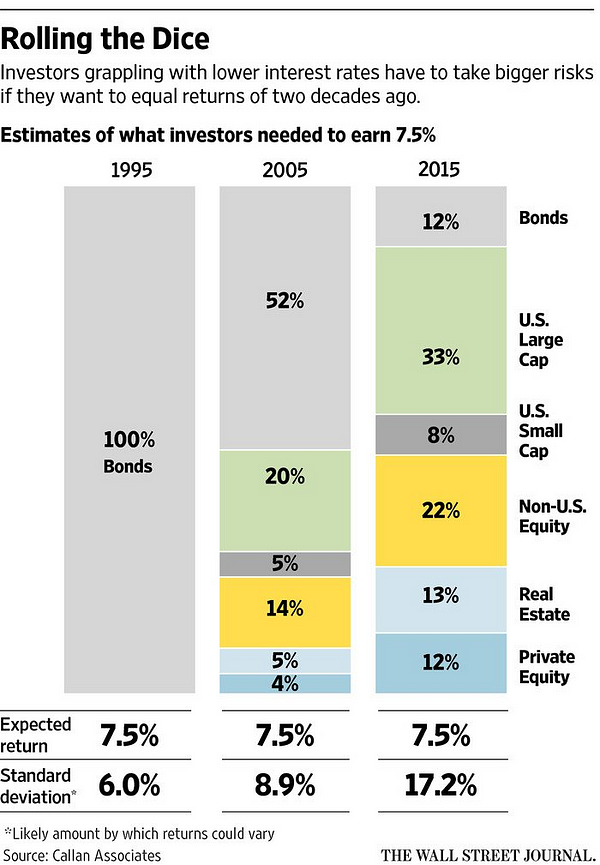

The flip side would be in a bear stock market interest rates would decline with bond prices rising so bond holders would cash in the high priced bonds and re-invest in stocks at bargain prices. Corporations would take advantage of cheap money and take out loans at low interest and invest in capital expenditures to start a new growth cycle. But no more. This natural process of re-cycling between stocks and bonds and bulls and bears has been destroyed by CBs manipulating the ecosystem to the point that markets no longer exist: through mechanisms of stimulus like QE, both stocks and bonds have become price appreciation vehicles and now both have become inflated to become dangerous co-bubbles with the next step being direct purchase of stocks by the CB, more QE (perhaps seeing NIRP at the short-end of the yield curve) or helicopter money (fiscal stimulus).

An important side effect of stocks and bonds being co-bubbles is that portfolio theory is now not only obsolete but a dangerous practice, adhering to its tenets essentially foments gross imbalances and exposures to losses across asset classes, the opposite intent — the anti-benefit — of old school portfolio theory. As a substitute, common sense must be obeyed — not classical academic theory.

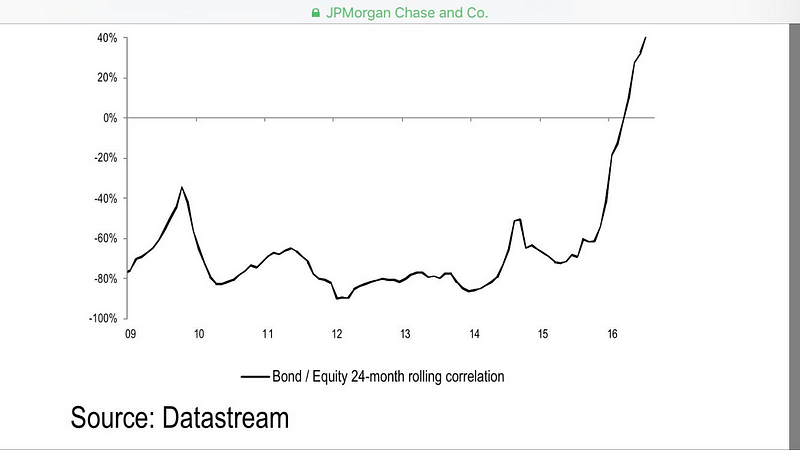

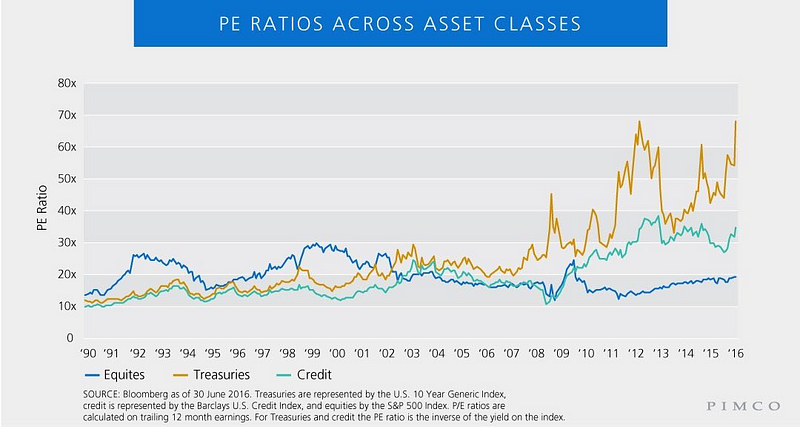

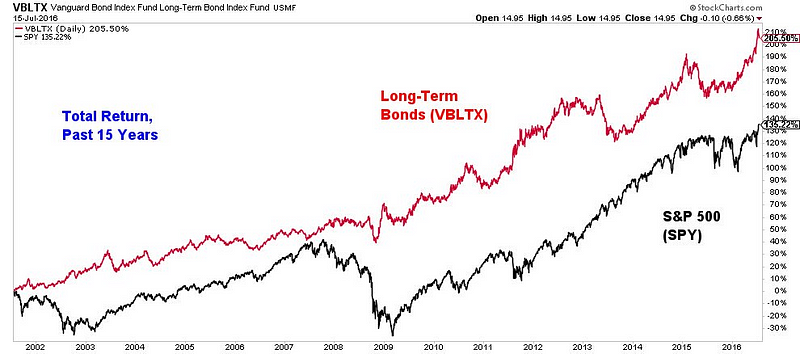

This chart frames the death kneel of classical portfolio theory:

When stocks and bonds become positively correlated it means that bond bulls AND stock bulls are simultaneously correct and loving life, a fundamental impossibility given textbook behavior: all bear species must hibernate to survive under these conditions. In July of 2016 something inexplicable happened: the S&P 500 and the 10-year US Treasury bond yield experienced simultaneous extremes on the same day:

It is crucial to explain why this extraordinary phenomenon is happening because it is the fuse that will detonate the MOB. Please remember, the entire rationale for addressing the financial ecosystem ands its extant species; the ABCs of sovereign creditworthiness and providing a simple but unassailable argument why the US, eurozone and Japan are hopelessly insolvent; and the chronology, buildout, and vulnerabilities of the MOB’s architectural hierarchy of currencies, bonds, and derivatives is to transform a previous black swan into a gray one for all to see as plainly as the innocent child did in The Emperor’s New Clothes.

The MOB is a clear and present danger to societal stability and well-being and will continue to expand until it doesn’t, that fateful Icarian moment in all bubbles when there are no buyers in sight and that first widely-awakened soul with much to gain or lose pushes the sell button.

The way a seasoned fiduciary at a pension fund or insurance company view bonds (or your grandfather) as an investment instrument is very different than how bond traders view them today. Of course there have always been bond traders but the new species of bond traders swim in very different waters with starkly different cognitive frameworks than those in the deafening Wall Street trading pits of old. Time to explore the modern bond trader’s world.

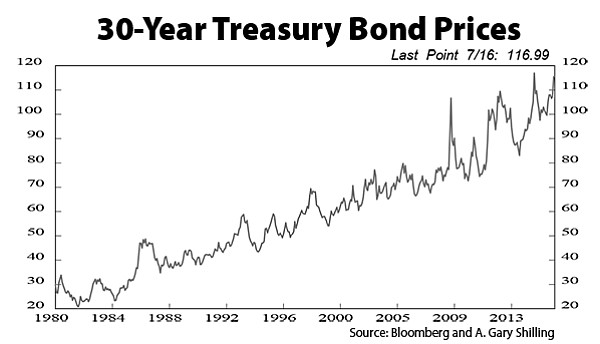

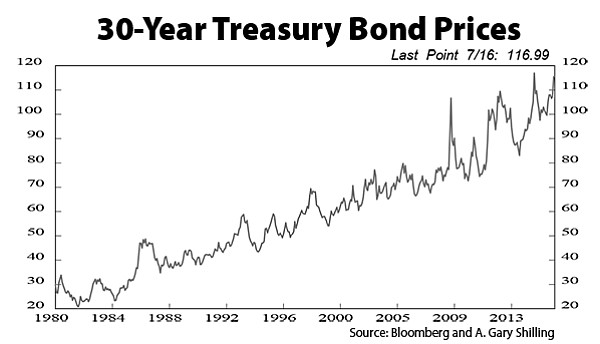

When you look at the next chart your first perception will be dead wrong, it looks like a price chart for Microsoft but it is way too long; Microsoft crashed half-way through in the bursting of the 2000 dot com bubble. No stock or stock market has kept on going up and to the right pretty steady for 30 years. But if you look at the price instead of theyield of US Treasury bonds — the “gold standard” of “collateral” — bond bulls have been in a bull market for 30 years and since QE have been in bond bull heaven with the CBs having the herd’s back while they relax on cruise control beyond the redline, levered up on margin banking on higher highs. Bond yields with close to a zero yield (ZIRP) are extremely expensive price-wise but bonds with a negative yield (NIRP), like in Europe and Japan, are vintage Viceroy, the borderline of where the mathematical realm of division by zero crosses the Rubicon into imaginary numbers. Understand: a negative interest rate by definition implies a negative risk — and that means the debtor gets paid the risk premium! In theory and in historical practice, a high-risk bond would have a cheap price with a 20% yield whereas a creditworthy bond should be very expensive with a low yield, say 5%.

This next statement sums up just about everything to this point:

In today’s mathematically-inverted financial ecosystem, a sovereign bond issued by an insolvent nation commands a Viceroy-level price while wielding a yield implying a negative risk of default.

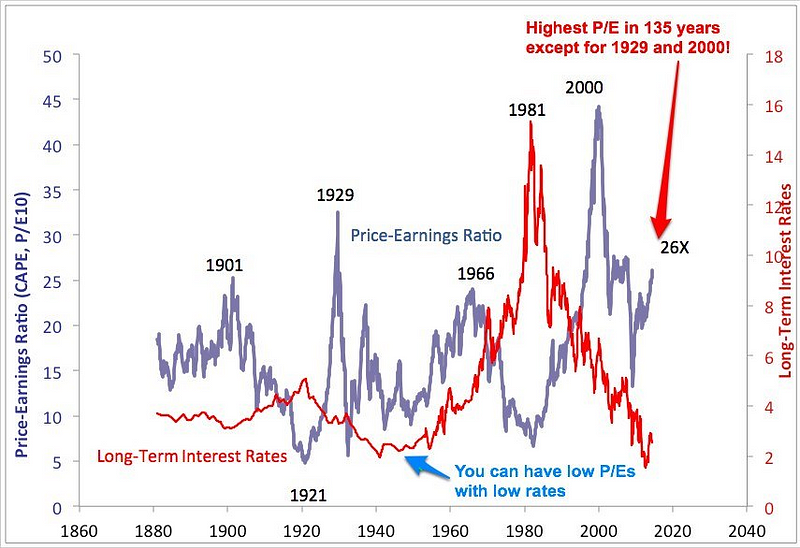

Pimco did some simple math to express US Treasury bonds pricing in a PE ratio-like comparison to equities and other forms of credit. They arrived at a PE ratio of 70x to equities’ 20x, quickly approaching twice the magnitude of the dot com bubble’s stature (~42x in 2000 per Schiller above). This exercise, of course, did not factor in the fact that the bonds are insolvent, a state beyond sizing up risk to reward concerns:

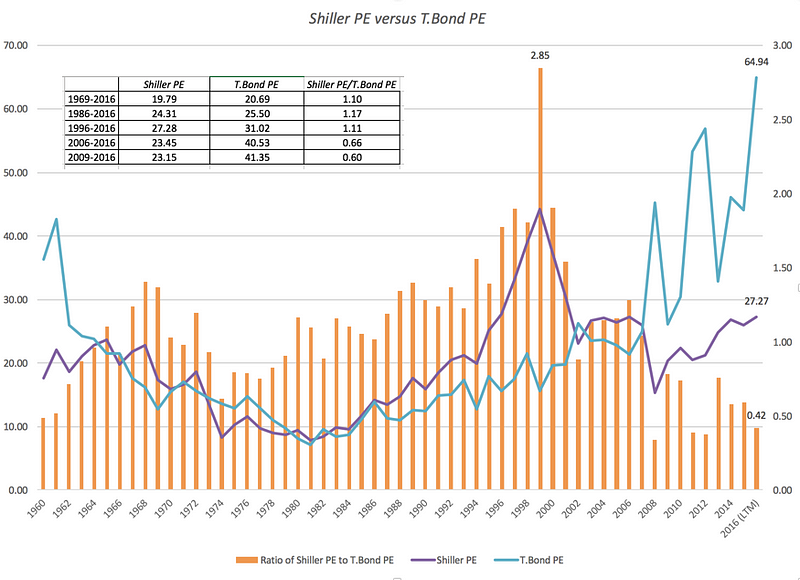

…and for historical perspective since 1960:

Structure of the US Treasury Bond Market

The Treasury bond market has bifurcated into two markets, one for traders (and small investors) and one for big investors/nations (Note: this intelligence briefing does not address primary US Treasury bond or sovereign bond auctions, only secondary markets):

The Treasury market has undergone a significant structural change post-crisis. As a result, the market is severely bifurcated between OTR and OFTR securities. They trade differently (fully automated vs. over-the-counter voice or RFQ). They also have different visibility in the market (live continuous OTRs vs. opaque non-live and not-held markets in OFTRs). But the most overlooked difference may be the market participants themselves. OTR and OFTR securities have different market constituencies: principal trading firms (PTFs) and high volume prop shops in the benchmark issues versus “real money” end-investors, such as foreign central banks, pension funds, mutual funds, insurance companies and banking institutions, in the OFTRs.

As a result, OTRs are now make up 68.5% of total daily volume while OFTR volumes have declined by over 21% just in the past 20 months. This change in market structure has major implications for the U.S. Treasury, the Fed, investors who are long-term holders of its debt, and more importantly, for the array of financial instruments globally that rely on the market as the key risk-free benchmark reference rate against which these securities are traded.

(Source: OpenDoor Trading, Susan Estes, May 25, 2016, “Treasury Market Liquidity: The Forgotten 98%”)

Bond trading versus bond investing are two different species: bond trading, like stock trading, is about chasing price action and results in capital gains. To a bond trader bull, NIRP is a dream come true because the more negative the yield goes the more the bond price appreciates, however ridiculous the valuation becomes (i.e. the valuation is not sanely limited by the 0% interest rate barrier) …and unlimited profit potential is all they care about.

Bond investing, on the other hand, is about long-time horizon, fixed-income derived from risk-averse, predictable, bond yield interest rates (e.g. retirees, pension funds, insurance companies, etc.). This is where 98% of total bond assets live. Bond investors, the analogue of buy-and-hold stocks investors like Warren Buffett, are dumbfounded by how much their old US Treasury bonds are worth after experiencing QE and ZIRP: ebullient bond traders and CBs have driven their bond portfolio values into the stratosphere but they can only realize the one-time windfall profits if they sell them before their peers realize that they, too, are playing high-stakes musical chairs. The flip side of that is pension funds, retirees, etc. dependent on fixed income from bonds at low yields are getting slaughtered. More on that devastating side-effect later.

In the go-go days of the dot com bubble you had millions of people with desktop PCs using E*Trade et al to deftly buy and sell 100 shares of Pets.com, IPOs, etc. creating a bubble driven to Viceroyesque Greenspan exuberance until it cratered. The 2000 dot com bubble, unlike the present one, was not supercharged by CFOs buying back stock or issuing corporate bonds because of guaranteed ZIRP tailwinds (T-bill interest rates were 5%, not ZIRPish). CB monetary policy has ruled the roost since 2008 both in stocks and bonds. Stocks crashed in 2000 and then again in 2008, while T-bonds have been price appreciating handsomely for 30 years…

In the last 30 years: Bond bulls > stock bulls >> any species of bears:

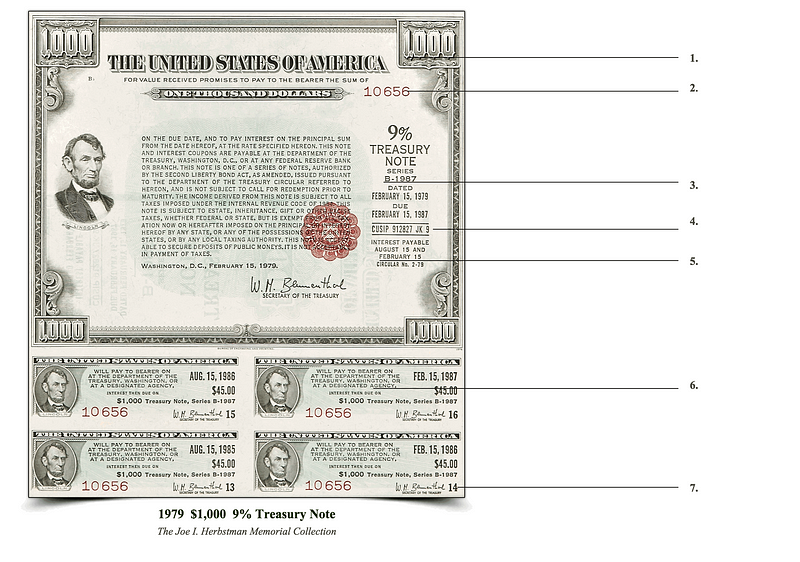

How about now? The bond ecosystem has structurally changed dramatically since 2006 or so due to technology but radically since the proliferation of computers. Prior to the digital age, bonds were paper certificates like this that you locked away in your bank’s safety deposit box:

But today, high-frequency trading (HFT) is not limited to equities, it has experienced exponential growth in the automated Treasury bond market and executes trades in microseconds:

Ultra-fast moving firms, which typically trade Treasuries in microseconds using sophisticated computer algorithms, account for at least half the transactions on electronic platforms, research firm Tabb Group said in a July report. A decade ago, much of Treasury trading was done over the phone with Wall Street bond shops.

“It’s even hard to think about it when things are happening at that rate of speed,” New York Fed President William C. Dudley said at a market liquidity forum on Sept. 30. “There’s a lot more work needed to really understand this area.” On Friday, researchers at the New York Fed said they found evidence that high-frequency traders may be creating an illusion of liquidity, especially when investors look to move large blocks of Treasuries. While nobody is saying the U.S. government bond market is broken and New York Fed researchers also concluded that HFT firms bring more accurate pricing and reduce the cost of trading, the stakes are high. Any worries about undue volatility in Treasuries have the potential to threaten confidence in a market that’s the benchmark for borrowers everywhere in the world.

(Source: Bloomberg Technology, October 12, 2015, “Treasuries Wilder Than Ever as Ultrafast Bond Traders Rise Up”)

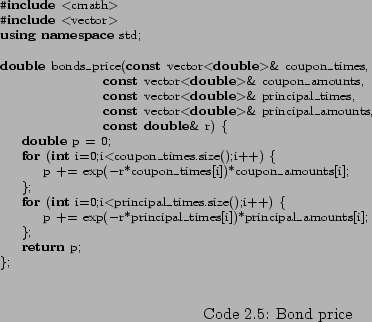

So the bond market has crawled along until this present-day, explosiveCambrian Period: Given the microsecond pricing time-scale of modern bond trading thanks to Moore’s law, the essence of what we used to call a “Treasury bond” (or any bond, really) has evolved into an algorithm representing a bond’s mathematical yield to price relationship. Then, interest rate derivatives are priced based off this bond algorithm crunching data representing the real-time market dynamics of the volume of bids and asks for an underlying bond (all of which, of course, is denominated in some fiat currency).

If all the paper bonds vanished from the surface of the earth, bonds would merrily live on in the digital realm in some server somewhere only coming up for air as pixels on a screen for someone to ponder. With a few “flash crash” exceptions, the bugs have been worked out of the system except for daily price swings over one standard deviation 58% of the time due to liquidity fluctuations. But liquidity is the fly in the ointment and the harbinger and guarantor of an astronomically-sized fly under crisis conditions given the current bond market structure and its integration with the MOB’s infrastructure. Why?

First, the class of derivatives (credit default swaps or CDS keyed to mortgage securities) during the housing crash were tiny in scale compared to currency (FOREX) and interest rate derivatives:

Prior to the crisis, AIG issued almost $2 trillion of CDS on mortgage-backed securities and charged relatively small fees, considering the risk building in the housing market. When housing collapsed, AIG went down with it. In 2013, CDS accounted for about 4 percent of the total notional amount of OTC derivatives, according to BIS. That’s a much smaller proportion than the 10 percent it reached in 2007. Interest rate and foreign exchange derivatives now account for almost 90 percent of total notional amounts.

(Source: Milken Institute, March 31, 2014, “$700 trillion in global OTC derivatives? Behind the number”)

The interest rate segment accounts for the majority of OTC derivatives activity. For single-currency interest rate derivatives at end-December 2014, the notional amount of outstanding contracts totalled $505 trillion, which represented 80% of the global OTC derivatives market (Table 3). At $381 trillion, swaps account for by far the largest share of outstanding interest rate derivatives.

(Source: Bank for International Settlements (BIS) OTC derivatives statistics, April 15, 2016, p.2)

The bond market has bifurcated into two markets: a high-tech electronic market where 2% of the total assets trade at low unit trade volumes but at high frequency and a low-tech voice system that trades infrequently but at very high average unit trade volume but where 98% of the total assets are, a literal iceberg structure:

The Fed and the Treasury describe the U.S. Treasury market as, “the deepest and most liquid government securities market in the world.” While arguably true for the six on-the-run (OTR) benchmark securities, those six securities make up less than 2% of the total $13.4 trillion of total outstanding supply. It is the other 98%, known as off-the-runs (OFTRs) that should be of greater concern to market participants and policy-makers alike.

(Source: OpenDoor Trading, Susan Estes, May 25, 2016, “Treasury Market Liquidity: The Forgotten 98%”)

Liquidity for large trades is a problem even under tranquil market conditions:

Today it is a very different marketplace. The United States is financing a significant deficit, underwritten in large part by the silent majority — real money investors. Total outstanding issuance has tripled. OFTR liquidity is fractured. Indeed, where once billion dollar trades in OFTRs were common, today it is a strain to execute $150 million, and roughly 40% of Treasury securities with maturities of 10 years or greater are now held in the Federal Reserve’s internal SOMA portfolio, according to a 2015 report prepared by its markets group for the FOMC.

(Source: OpenDoor Trading, Susan Estes, June, 2016, “Treasury Buybacks: Not So Fast”)

The boom in fixed-income derivatives trading is exposing a hidden risk in debt markets around the world: the inability of investors to buy and sell bonds. The shift reflects an unintended consequence wrought by central banks, which have dropped interest rates close to zero and implemented policies such as buying debt to restore demand in economies crippled by the financial crisis. Inefficiencies in the $100 trillion market for bonds may make investors more vulnerable to losses when yields rise from historical lows.

“Liquidity is becoming a serious issue,” Grant Peterkin, a money manager at Lombard Odier, which oversees $48 billion, said in a June 11 telephone interview from Geneva. The worry is that when investors try to exit their positions, “there may be some kind of squeeze.” That concern has caused investors to pour into derivatives, which are contracts based on underlying assets that can provide the same exposure without tying up as much capital. As bond trading has slumped, the notional value of over-the-counter contracts soared fivefold in the past decade to a record $710 trillion, based on the latest data from the Bank for International Settlements.

(Source: Bloomberg, June 16, 2014, “Bonds Liquidity Threat Is Revealed in Derivatives Explosion”)

[Primer in fixed income derivatives]

As a result of this structural problem in the bond market with one bond market getting faster and faster and the other still stuck in the stone age and illiquid even under ideal market conditions for large trades, a big problem emerges with no solution in sight. For bond traders and small investors, derivatives that mirror bond price/yield actions have gained popularity (notional value of these derivatives was USD 710T in 2014) because their market clearance mechanisms and capacities circumvent bond’s inherent structural shortcomings and legal obstacles. This has changed the global financial ecosystem drastically as the MOB size and risk exposure mushroomed like introducing a new apex species into a fertile environment with no predators to check its proliferation. It begs the question:

Why not simply have the different bond algorithms, which are now software, link into a cloud-based market exchange and just trade derivatives based on real-time market dynamics?

Now it’s time to put all this together relative to the MOB’s epic collapse.

The MOB’s Vulnerabilities and Likely Collapse Mechanics

The evolutionary pathway of NIRP bonds is a dead end like the dodo bird and — given that bonds are the center of our financial universe — they are the Judas goat of the entire globe’s fateful endgame. Because of this, the MOB will terminate in a supernova. Let’s see how now that we have taken the time to explore the intricacies of the MOB’s infrastructure, species, history, vulnerabilities, and dynamics — worts notwithstanding.

Suggestion: It would be well worth your while to go back to the very top and revisit the MOB structure in a new light before moving on (especially the part where you scroll through the derivatives infographic until your finger fatigues).

Now sizing up NIRP, briefly.

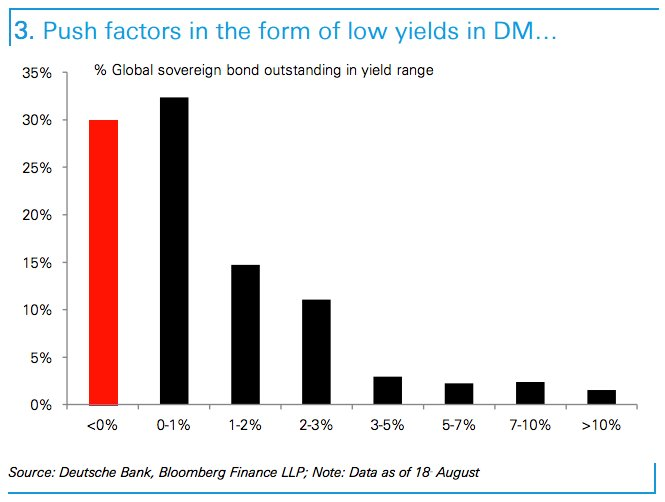

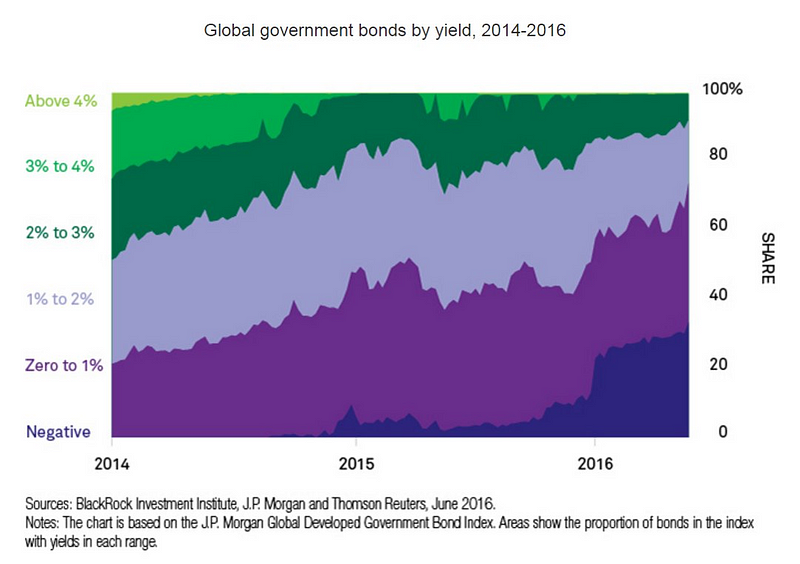

When you look at global sovereign bonds, the vast majority have yields below 2%:

…and the long-term trend is going lower:

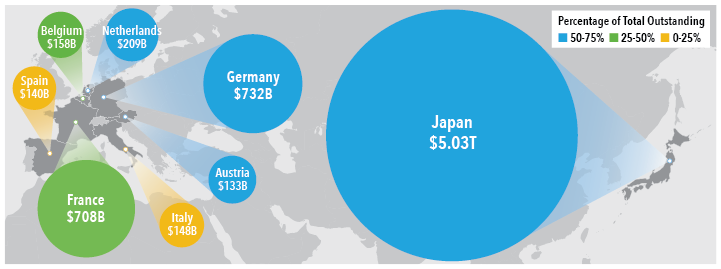

NIRP sovereign bonds are highly concentrated in Japan and the eurozone (none in the US — yet):

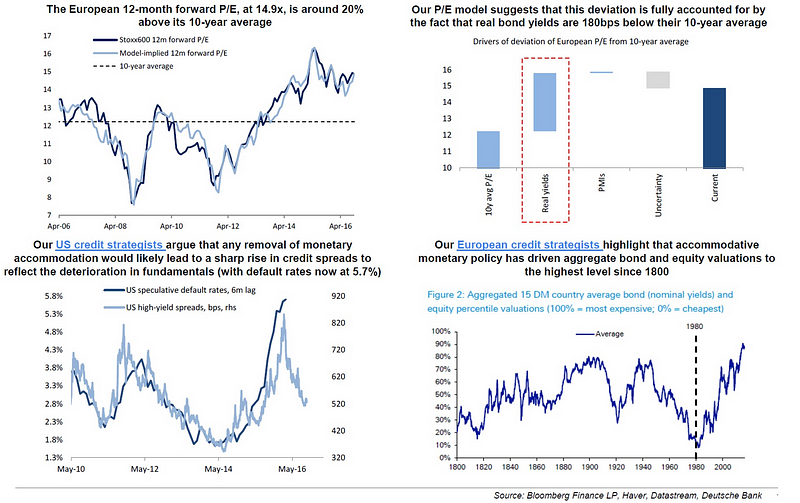

Given that stocks and bonds have become positively correlated due to sustained CB intervention, Deutsche Bank calculated that the composite valuation of stocks + bonds is now at over a 200 year high and rising (a 200 year bubble) and that removal of CB liquidity (i.e. “like letting off the gas pedal”) would cause a sharp rise in credit spreads (lower left and right panels):

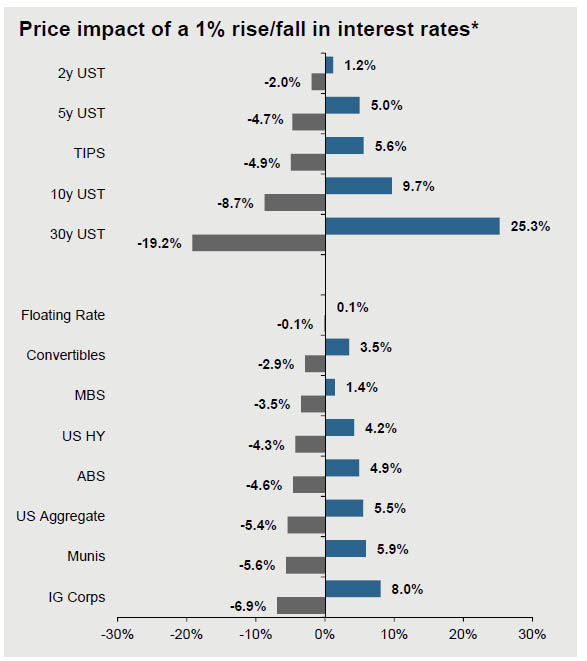

The MOB (the interconnected hierarchy of three layers: {currencies → bonds → derivatives} that is interconnected to the world’s banking and market exchange networks) is the biggest financial bubble in history and unless interest rates go lower (they haven’t been lower in 500 years) we are in the musical chairs phase of the MOB’s lifespan, the eerie point in time when the music stops and the chairs vanish into thin air. Because the sovereign bond market is the underlying reference asset (with currencies undergirding the bonds and with FOREX trade volumes of USD 5T per day and at up to 300:1 leverage…) for much of the world’s total derivative exposure (and in the case of US Treasury bond, well they benchmark everything), a bond collapse (a rapid increase in yields…) is both functionally and structurally the detonator for the entire derivatives network which notionally exceeds USD 1Q. In other words, the Achilles heel of the global financial system is a sustained, high-volume, sovereign bond selloff.

Vulnerability Analysis (assuming a multi-day time horizon and only first and some immediate second-order effects)

- network interconnectivity densely converges at the bond layer (highnetwork centrality because bonds are sandwiched between currencies and derivatives);

- there are positive feedback loops between the initial liquidation of bonds, the increase in leverage from decreasing bond prices that decreases capital reserves forcing margin calls and more liquidation of bonds serving as collateral, and the tail-event standard deviation spikes on interest-rate derivatives hockey-sticking those positions past hedge protection levels and taking counterparties on the wrong side of the trade to illiquidity (frozen credit access) or possible insolvency; and

- throughput is constrained at the bond layer by a structural bottleneck (the OFTR bond market) compounded by a falling-knife (bid-less) bond market.

A bond selloff is an atomic bomb detonating on the bull’s eye. Rest assured that this implosion will purge the thought of derivatives “netting out” in textbook orderly fashion or in pedestrian stress test models — instead, settlement and clearance will be “frozen out” indefinitely.

The MOB’s Network Architecture is Composed of Two Different but Interconnected Networks

Much has been said about the interconnectedness of the globally systemic important banks (GSIBs) such as this network diagram for Deutsche Bank (DB) from the IMF:

If DB were to fail it would put at risk the network nodes that are immediately adjacent (i.e. DB’s counterparties) which then cascade outwardly from there like when Lehman Brothers failed in 2008. But the MOB’s network architecture is the hierarchy and dense interconnectedness of {currencies → bonds → derivatives} and this network is embedded in every GSIB banking node, not just a single node failure like DB or Lehman Brothers in the GSIB network architecture. A bond selloff has high centrality in every node, not just one, and then radiates outwardly simultaneously from each and every node — it is like every major star in a galaxy exploding at the same time. This is an unrecognized hazard and has no remedy.

To say this will not happen is foolish because the scale of the sovereign bond bubble’s overvaluation metrics is currently nearly twice that of the dot com bubble’s stature and is continuing to inflate as NIRP and ZIRP expand raising aggregate bond prices to higher and higher historical highs and taking equity and real estate asset classes along for the ride:

Other gray swan catalysts that can trigger the MOB’s collapse

- Deutsche Bank collapse [Analysis…]

- Italian banking system collapse [Analysis…]

- The collapse of Japan [Analysis…]

- The collapse of the European Union due to a successful Brexit-like referendum in France or Italy [Analysis…]

- Escalation of a war between the US/NATO and Russia originating from the Syrian conflict or from the eastern European border countries (Balkans/Poland) [Analysis…]

Note: These events are not mutually exclusive, they are synergistic relative to damage to the MOB’s integrity.

Ramifications

Five defining questions come to the fore forthright:

- How high can bond prices go before they stall out (i.e. how low will NIRP go) given the enormous, unprecedented scale of the bond bubble already?

- What happens when equity and bond traders, bond holders like Japan, China and Saudi Arabia and institutional CFOs realize that bond prices have peaked and there are no more buyers including CBs willing to break the ice to new all-time highs, and their huge profits — which materially impact the financial well-being of their corporation, industry or nation — are imperiled?

- How will large bond holders exit their positions under crisis conditions given that a USD 150M trade under tranquil conditions is non-trivial?

- Given that the TBTF banks use sovereign bonds as senior collateral for their derivative book with a large percentage of the derivative instruments referenced to bond interest rates and FOREX rates and the banks are highly leveraged (25:1 means a 4% decline in bond price constitutes a collateral wipeout) with capital reserves based on bond prices that are rapidly collapsing given crisis conditions, what happens when multiple banks and investment institutions cannot cover their losses and neither can their counterparties while all credit channels are spooked and frozen solid?

- What becomes the go-to “flight to safety” asset when everyone is panic selling what was considered for decades “flight to safety” assets like US Treasury bonds? Understand: Sovereign bonds become radioactive, anti-collateral in this once-in-a-lifetime collapse of the MOB.

There are no answers to these questions, no pleasant outcomes, no contingency plans. CBs can delay the inevitable by continuing to buy their own debt (i.e. keep the pedal on the gas and do “QE”) and drive yields lower while inflating asset prices even more but not for much longer given the enormous size of this bubble and the carnage borne already by pensions, insurance companies, global banking business models, retirees, etc.:

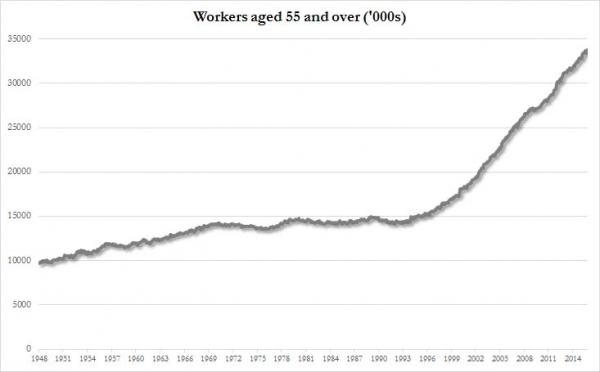

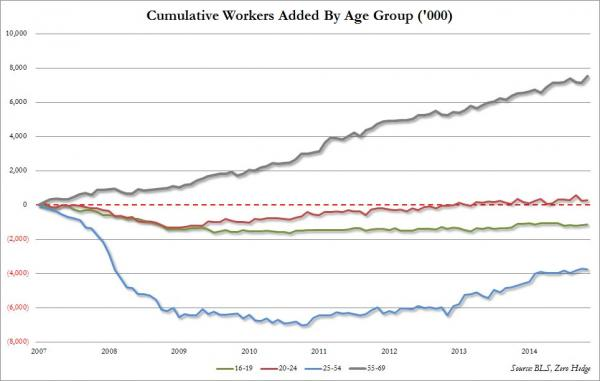

Seniors have taken the lion’s share of jobs since the bursting of the housing bubble with part of the reason being that retirement planning from 20 or 30 years ago projected normal historical interest rates in their golden years which would have produced much higher fixed income as their portfolios shifted from stocks to bond allocations based on classical portfolio theory. This failed to happen with Treasury bonds being in a steady bull market for 30 years and then hitting the afterburner with QE and ZIRP taking a bone-crushing toll on fixed income with new bond issuance since the financial crisis because bonds are now extremely expensive and at historically low yields approaching the zero bound (remember the bond bull traders earlier? They live solely for bond price appreciation which drives yields down whereas seniors need bond yields high just to live). As a result, given a zero-sum employment pool, younger workers that would have entered the workforce as seniors retired now find themselves with student loan debt and a college degree while living at home with their parents.

Senior workers started to hockey stick in the mid-90s:

Japan experienced a “Lost Decade” in the 1990s after their asset bubble burst. The US since 2008 has had its own Lost Decade, especially with younger worker’s lives being put on hold indefinitely. In terms of sovereign bond creditworthiness, what is the impact of the next generation of workers sitting on the couch — unemployed — on global competitiveness, tax revenue and GDP during the tenure of a 30-year Treasury bond issued in 2005? Richard Bolles’ The Three Boxes of Life in 1981 posited that the American dream’s game plan was: [education → career → retirement]. That thesis has been crushed in the aftermath of the 2008 housing bubble crash:

Note: When it comes to the employment picture, the devil is in the details. It is beyond the scope here to address other factors and trends such as: impact of automation (robots + AI), part-time vs. full-time, manufacturing (high wage) vs. minimum wage service jobs, offshoring (i.e. “globalized wage arbitrage”) etc. but all of these factors are influenced by the global financial forces in play that govern the big picture as presented earlier.

CBs are truly trapped and the MOB’s days are numbered. Given that governments are insolvent, raising interest rates increases interest payments on national debts across the globe to absurd levels — there is no going back and there is no going forward and the walls are converging:

“In 2007, we owed $5 trillion and paid an average interest rate of 4.8%. Net interest expense: $237 billion. In 2016 we’ll owe $14.1 trillion and pay the average interest rate I already mentioned: 1.8%. Net interest expense: $240 billion. It’s a wonder we didn’t think of this financial perpetual-motion machine about a thousand years ago.”

(Source: Time, James Grant, April 14, 2016, “The United States of Insolvency”)

With the MOB cornered and on its deathbed, the world today finds itself at an inflection point:

“An event that changes the way we think and act.”

— Andy Grove

And repeating a passage from the very beginning:

…risk of loss increases nonlinearly with the increasing divergence between the price paid and the value of the acquired asset just like the increasing risk of an avalanche with each additional snowflake on the pile given the divergence from stability as dictated by physical law.

There was a well-founded logic for a big short prior to the housing bubble collapse; there is an even bigger motivation to short the bond market which is tantamount to betting against the world’s central bankers, literally taking a bold position against the house (whereas in 2008 it was betting against the housing market):

There is no way in hell the German 10 Year Bund is trading at 30 basis points in five years’ time, let alone in ten years. When bond yields become so compressed that they represent far out of the money call option’s prices, but are not even premium priced for a normal reversion to the mean of the last 10 year average yields of the bonds, this sets up the entire financial system for systemic risk on a grand scale that central banks better start focusing on right now. We have a problem central banks, and it isn’t the problem you are worrying about, forget sluggish growth, we have the biggest financial bubble brewing right now in the largest financial asset class in the world, and the German 10 Year Bund yielding 30 basis points is a disaster waiting to happen for any investor levering up their balance sheets with this ridiculous bond investment.

(Source: EconMatters, January 30, 2015, “The German 10 Year Bund Effectively a Call Option at 30 Basis Points”) [Note: The German 10 year bund traded at +30 basis points in January 2015 and on September 28, 2016 at -13 basis points... how low can NIRP go in Germany before big institutional bond money flees? There are a lot of chips on the table to cash out at Viceroylevels if you are the early bird so opportunity will fuel the MOB’s collapse as well as short sellers.]

Adding fuel to the fire are extremely large bond holders like G20 nations, pensions, insurance companies, bond funds etc. that are built from the ground up for fixed income that find themselves sitting on windfall capital-gains if they sell their bond positions before other large bond holders do (the 98% of the bond market that have multi-year or multi-decade buy-and-hold strategies are getting twitchy). They know this is a mammoth bubble of epic proportion, when should they sell to simultaneously profit and preserve their capital or else risk losing it all?:

What does this mean for investors that bought bonds with long maturities years ago? For example the German 4.75% Bund, issued in 2008 and due in July 2040 trades at 202.3 cents on the euro, having doubled its value over the past eight years. The sellers of those bonds are the true beneficiaries of Draghi’s monetary policies, and they can sell them right to the ECB.

(Source: David Stockman, July 1, 2016, “Price Discovery, R.I.P.”)

After the housing fiasco, Treasury Secretary Paulson was on his knees begging Congress for USD 700B as a downpayment to keep — in the prescient words of President Bush — “this sucker from going down”; the MOB’s demise is a USD 700T margin call the CBs aren’t good for. The buck stops here.