Investigating Deutsche Bank’s €21 Trillion Derivative Casino In Wake Of Admission It Rigged Gold And Silver

by Mike “Mish” Shedlock

ZeroHedge.com

Deutsche Bank Admits Rigging, Will Expose Other Riggers

Deutsche Bank has admitted it rigged both the Gold market and the Silver market. ZeroHedge has the details in his report Deutsche Bank Agrees To Expose Other Manipulators.

Many asked me to comment. I am shocked?

No. In the wake of admissions of rigged LIBOR and rigged Euribor (bank to bank interest rates in dollars and euros respectively), one would really have to wonder “What isn’t rigged?”

To the Moon, Alice?

While some think gold would have “gone to the moon” without this rigging, I wonder if it got as high as $1900 an ounce because of rigging.

The same applies to silver when it topped over $40.

It’s logical to believe riggers don’t much care about the direction as long as they make money. Hopefully we get more details from Deutsche Bank soon.

This could get interesting.

What Isn’t Rigged?

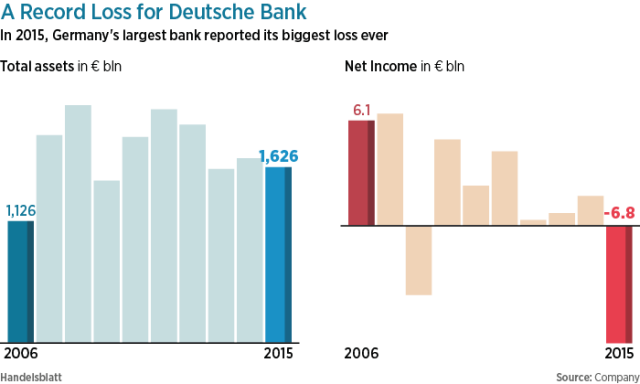

While pondering the above question, let’s dive into Deutsche Bank’s 2015 Annual Report to investigate other bid-rigging opportunities.

Consolidated Balance Sheet

Deutsche Bank has over €515 billion in “positive derivative values” in comparison to €496 billion in “negative derivative values”.

Hooray! Deutsche Bank is about €20 billion to the good. But how much was bet?

Deutsche Bank’s Derivatives Casino

The total size of Deutsche Bank’s derivatives casino is €21.39 trillion, notional.

Casino Breakdown

- Interest Rate: €15.41 trillion

- Currency Related: €4.78 trillion

- Equity Index: €0.90 trillion

- Credit Related: €0.27 trillion

- Commodity Related: €0.08 trillion

How Much Risk on €21.39 Trillion?

Inquiring minds may be asking: How much risk is there on €21.39 trillion?

Perhaps surprising little. After all, interest rate risk could easily be controlled with a few timely phone calls from the Fed and ECB.

What risk isn’t controlled that way can always be controlled other ways (as we have seen).

I am pleased to note Deutsche Bank uses “central counterparty clearing services for OTC clearing” and the bank “benefits from the credit risk mitigation achieved through the central counterparty’s settlement system.”

“Margin requirements for uncleared OTC derivative transactions are expected to be phased in from September 2016.”

Whew!

And we can all count on the obvious fact that Dodd-Frank reform has fixed everything.

So, nothing can possibly go wrong with €21.39 trillion in casino bets, just as €20 billion in profits (.0935%) shows.