Greece debt crisis: EU leaders hold critical summit

BBC

Greece faces a critical 24 hours as European leaders hold an emergency summit that could break the deadlock around the country’s debt crisis.

Greek PM Alexis Tsipras said he hoped Greece would “return to growth within the eurozone”.

But European ministers have said there is still no basis for making a decision for aid for Greece on Monday.

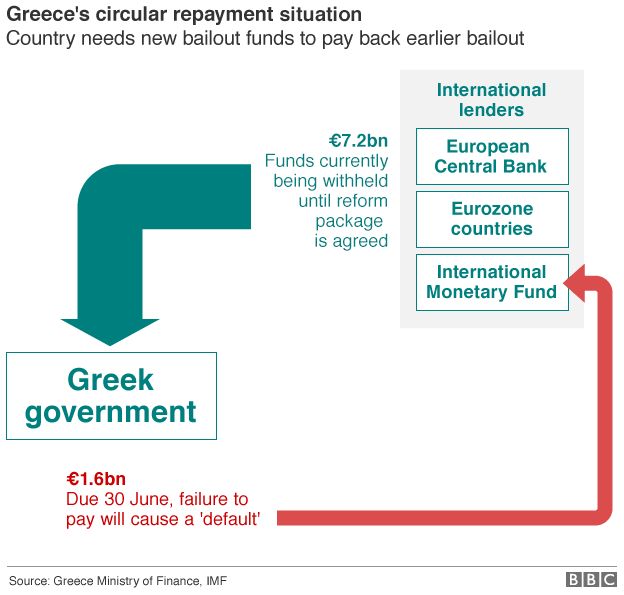

On Sunday, Mr Tsipras set out new proposals to try to prevent a default on a €1.6bn (£1.1bn) IMF loan.

But he has ruled out pension cuts, higher power rates, and an excessive budget surplus.

Greek debt talks: Main sticking points

- Greece will not accept cuts to pension payments or public sector wages, saying two-thirds of pensioners are either below or near the poverty line

- International creditors want pension spending cut by 1% of GDP – it accounts for 16% of Greek GDP. They say they want to target early retirement not lower-income pensioners

- EU officials say Greece has agreed to budget surplus targets of 1% of GDP this year, followed by 2% in 2016 and 3.5% by 2018. Greece says nothing is agreed until everything is agreed

- Creditors also want a wider VAT base; Greece says it will not allow extra VAT on medicines or electricity bills

- Greece complains creditors focus on increasing taxes instead of cracking down on tax evasion; IMF is concerned Athens is not offering credible reforms

But on Monday Germany’s Finance Minister Wolfgang Schaeuble said there were “no substantial proposals” from Greece.

Arriving for the summit, he told reporters he had nt seen anything new from Greece so far and “without anything new, there is nothing for the ministers to prepare for their leaders”.

The head of the group of eurozone finance ministers, Jeroen Dijsselbloem of the Netherlands, said it would be “impossible to have a final assessment” as the Greek proposals were very recent, but they would “hopefully [form] the basis for final talks”.

Finnish Foreign Minister Alexander Stubb said he did not see a deal being reached on Monday. “We have wasted a lot of air miles, both on the finance ministers’ side and on the prime ministers’ side,” he said.

Greece must repay the loan by the end of June or risk crashing out of the single currency and possibly the EU.

Talks have been in deadlock for five months. The European Commission, the IMF and the European Central Bank (ECB) are unwilling to unlock the final €7.2bn tranche of bailout funds until Greece agrees to economic reforms.

Business live: Latest from Greece

Stock markets rise on hopes of deal

Analysis – Robert Peston, BBC economics editor

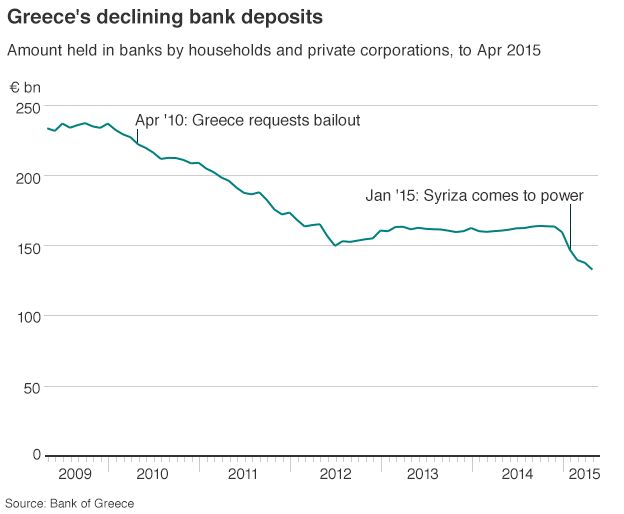

If deposit withdrawals continue at the current pace, Greek banks will soon exhaust eligible assets they can pledge to the Bank of Greece for cash under the Emergency Liquidity Assistance (ELA) scheme.

Even before that, the European Central Bank could turn off the ELA drip feed – because it is forbidden to allow the Bank of Greece to lend to insolvent banks.

If Greece’s bailout talks collapse, it would be hard for the ECB to maintain the fiction that the Greek banking system is solvent – given that the value of a big chunk of banks’ assets depends on the solvency of the Greek state.

So the ECB would have to take the banks off life support.

And the Greek authorities would have no realistic option but to impose capital controls, or restrictions on how much cash can be withdrawn by customers from the banks.

Prime Minister Tsipras is meeting the heads of Greece’s three international creditors in Brussels, ahead of his talks with the leaders of 18 other eurozone nations.

Mr Tsipras’ offer on Sunday of a reforms package to the leaders of Germany, France and the European Commission is seen by some as a sign the Greek government is willing to make concessions.

The proposals, which Mr Tsipras described as “mutually beneficial”, were adopted at an emergency meeting of the Greek cabinet – though details have yet to be revealed.

Why all the focus on Monday?

The deadline for Greece to pay back a slice of its loan is 30 June – so why the panic to get things resolved by 22 June?

The simple answer is time.

Just agreeing a deal and arranging how the money is transferred is a complicated affair – one that could not be finalised with hours to go.

A separate European Council summit is scheduled for Thursday and Friday, and its agenda is packed.

In theory, if no deal is struck on Monday, there is still a week to get things resolved.

On Monday, the ECB again increased the amount of emergency credit it allows Greek banks to draw on to remain afloat, and may renew the increase in coming days if necessary, banking officials said.

It approved an emergency loan on Friday.

Greek savers have withdrawn billions of euros in recent days, putting the banking system under intense pressure.

Withdrawals between last Monday and Friday reportedly reached about €4.2bn, representing about 3% of household and corporate deposits held by Greek banks at the end of April.

But Greek banks opened as normal on Monday following the ECB loan.

Greece – deal or no deal?

- Option 1 – No deal: Greece defaults on IMF and ECB repayments; ECB pulls plug on emergency bank assistance leading to run on Greek banks, capital controls and potential Grexit

- Option 2 – Greece agrees reform deal with creditors at last minute and avoids default, staying in euro

- Option 3 – No deal reached but both sides paper over cracks and Greece stays in euro for now

Cars and shoe boxes: Greeks cope with an economic crisis

Peston: Is there any way Greece can avoid default??